views

Budget 2024 Expectations: The union government is due to present the interim budget for 2024-25 on February 01, 2024. As with any pre-budget period, there are a lot of expectations and speculations surrounding potential changes in direct taxes.

Deloitte India recently unveiled a comprehensive taxation guide, presenting thorough analyses and suggestions on various taxation aspects such as direct taxation, indirect taxation, personal taxation, mergers & acquisitions, and transfer pricing.

Also Read: No ‘Spectacular Announcement’ Likely in February 1 Budget, Says Finance Minister

The aim is to provide perspectives for informed discussions on fiscal policies during the forthcoming 2024-25 Budget. Crafted with insights from experts, this booklet is custom-tailored to align with the nation’s economic landscape.

According to Rohinton Sidhwa, partner, Deloitte, the following themes are the top asks from the Budget 2024;

Expectation 1: Extending concessional corporate tax rate for new manufacturing companies

The existing concessional corporate tax rate, set at 15 percent, has been pivotal in attracting investments into India.

This rate is currently available to new domestic manufacturing companies under Section 115BAB. However, a crucial requirement for these companies is to commence manufacturing operations by March 31, 2024.

Introduced in 2019, this concessional rate yielded remarkable results, significantly boosting the influx of Foreign Direct Investment (FDI) into the Indian manufacturing sector. To put it in perspective, there was a substantial increase in FDI, from Rs 89,766 crore in FY 2020-21 to an impressive Rs 1,58,332 crore in FY 2021-22, showcasing a 76 percent surge.

According to Deloitte, recognising the substantial role this measure has played in advancing economic objectives and attracting foreign investments, the tax policy administration may extend the sunset clause of this regime for an additional two years. This extension will undoubtedly contribute to India’s economic growth, enhancing the country’s attractiveness to investors.

The new import policy that encourages domestic manufacture of Personal Digital Assistants (PDAs) and restricts import through its licensing model, has led to tech giants announcing plans for expansion of investment and manufacturing in India. These opportunities can be capitalised further.

Extending the concessional tax rate would provide an opportunity for such investors who are currently in the process of setting up or considering India as a potential investment destination, to use this opportunity.

Expectation 2: Settlement scheme to resolve past tax disputes arising from differential treaty interpretations

Foreign investors have often faced tax disputes arising from differences in treaty interpretation. Adding to this uncertainty is the recent decision by the Supreme Court in the case of Nestle SA. The decision had wide ramifications on treaty interpretation and various treaty benefits that taxpayers have historically availed.

A key takeaway from this ruling is the necessity for specific notifications from the tax policy administration under the Act, to implement treaty protocols, especially in the context of the “Most Favoured Nation” (MFN) clause.

The tax policy administration will soon release specific guidelines regarding the interpretation of protocols to treaties between India and various countries. These guidelines will be intended for implementation in future transactions, promoting clarity and consistency in treaty interpretation.

However, recognising the need to provide certainty and resolution for present cases where a lower rate has already been claimed, the tax policy administration should consider establishing guidelines under a settlement scheme, Deloitte said. Such schemes could provide a one-time window for taxpayers to make voluntary tax payments of differential taxes, without interest or penalty. This initiative would offer relief and certainty to taxpayers, while also facilitating efficient collection of taxes from the perspective of the tax administration.

Expectation 3: Incentivising exports through the tax holiday regime

The tax policy administration previously granted income tax exemptions to Indian companies engaged in exporting services, leading to substantial growth in the services sector. However, these income tax exemptions are no longer available due to the sunset provision under section 10 and section 80 of the Income Tax laws.

Reintroducing a tax holiday or exemption could stimulate exports. This approach would attract foreign exchange and align with the government’s “Make in India” campaign, encouraging Multinational Corporations (MNCs) to establish export hubs in India.

To foster exports, the tax policy administration may consider reinstating tax exemptions for income generated from the export of both goods and services. This would revitalise India’s export sector and strengthen its position in the global market.

Expectation 4: Promoting R&D through weighted deductions

Given the focus on promoting manufacturing, investing in R&D is crucial to facilitate development of advanced manufacturing processes and technologies. These advancements can spur innovation and strengthen the manufacturing sector’s capabilities.

Substantial investment in R&D, both in strengthening existing institutions and establishing new research institutions, is essential to reduce reliance on foreign technology and innovations.

The government has introduced several policy initiatives, such as the Atal Innovation Mission, and R&D policy in the pharma sector, to encourage R&D. Introduction of tax incentives, coupled with these policy measures, can effectively support the broader objective of the Make in India campaign.

The government may consider restoring weighted deductions for R&D expenditure and donations to scientific research institutions that were available in the past. By reinstating these tax incentives, India can further foster innovation and position itself as a hub for R&D activities especially for Global Capability Centres.

It is important to note that these are just some of the potential changes, and the actual budget proposals might differ significantly. As we get closer to February 1st, we can expect more details and analysis from various stakeholders.

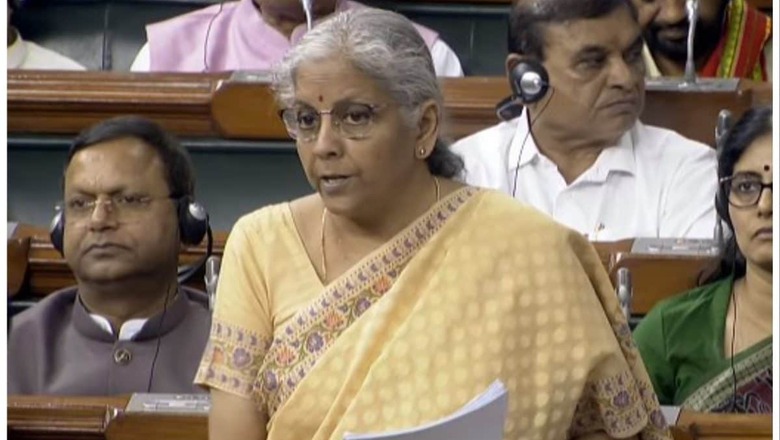

Finance Minister Nirmala Sitharaman recently said the budget to be presented on February 1, would not have any “spectacular announcement” as it would be a vote on account in the run-up to the general elections

Comments

0 comment