views

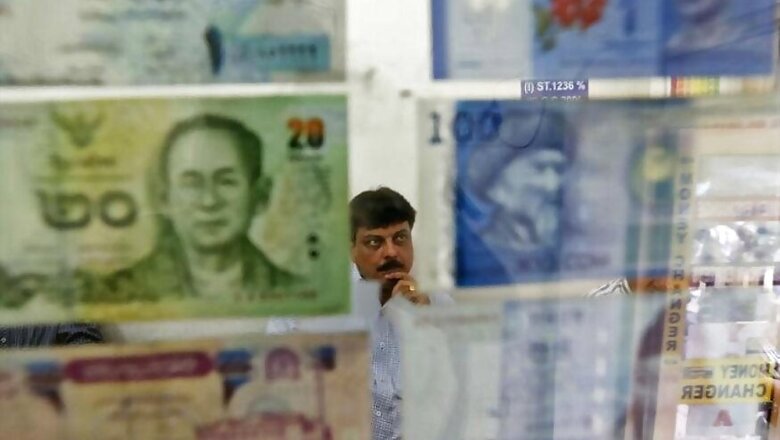

New Delhi: Foreign investors have pulled out over Rs 3,800 crore from the country's equity markets so far this month over concerns regarding "lower prospects" of economic growth as compared to other emerging markets.

However, Foreign Portfolio Investors (FPIs) have invested a net sum of Rs 243 crore in the debt markets during the period under review.

The latest FPI outflow took place following a withdrawal of close to Rs 31,000 crore on net basis from the equities in last three months (October-December). Prior to that, FPIs had put in Rs 10,443 crore in the stock markets.

"FPI outflow for this month (January) may be attributed to relative lower prospects of growth in the Indian economy as compared to other emerging markets as well as developed countries," Bajaj Capital Group CEO and Director Anil Chopra said.

"Though the demonetisation decision is being praised by all economic experts, however, it is also being mentioned in the same breadth that benefits will accrue in medium to long term. In the near term, growth may be compromised due to limited liquidity in the hands of consumers and the slump in the key sectors like automobile and real estate etc," he added.

Net withdrawal by FPIs from equities stood at Rs 3,809 crore this month (till January 13), while they invested a net Rs 243 crore in the debt markets, translating into a total outflow of Rs 3,566 crore (USD 523 million), depositories' data showed.

Pankaj Pandey, Head of Retail Research at ICICI Direct, believes that FPIs' allocation may remain tepid in the coming months.

"We do not see a major turnaround for the next two quarters and so, the first half of 2017 will remain subdued in terms of foreign capital flow. The uncertainties are expected to settle down and reforms will start counting in for the economy in the second half of 2017, accelerating the growth momentum," 5nance.com CEO Dinesh Rohira said.

Comments

0 comment