views

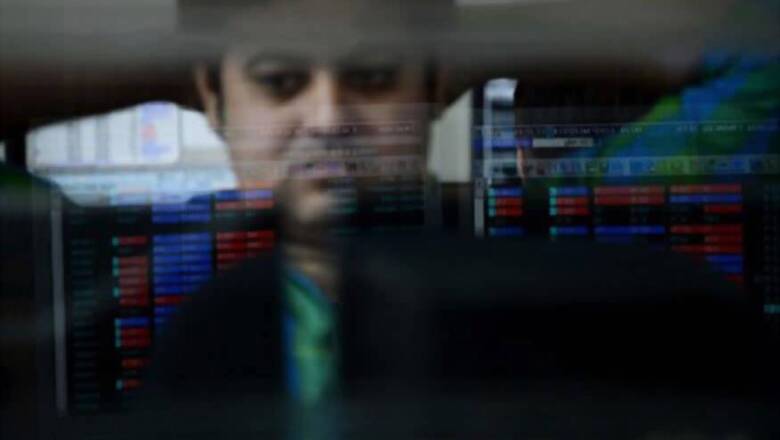

Mumbai: The markets made a powerful comeback on Monday as the Sensex rallied almost 216 points and reclaimed the 29,000-mark to close at a 2-year high, cashing in on solid gains in index heavyweight RIL amid mixed global cues.

The all-powerful GST Council approved the final draft of central GST (C-GST) and integrated GST (I-GST) and will take up for approval the state-GST and Union Territory-GST (UT-GST) laws at its next meeting due March 16, which instilled a sense of confidence in investors.

The 30-share barometer remained up throughout and hit a high of 29,070.20, powered by a rally in RIL and other blue-chips. The index ended 215.74 points up, or 0.75 per cent, at 29,048.19 -- its highest closing since March 5, 2015, when it had closed at 29,448.95.

The index has lost 152.04 points over the past two days.

The optimism led to the NSE Nifty gaining 65.90 points, or 0.74 per cent, to end at 8,963.45, a level last seen on March 3, 2015, too when it settled at 8,996.25.

The rupee notched up gains against the dollar, which added to the sunny side.

Reliance Industries came out top on the heap, surging 3.69 per cent and settling at a fresh 9-year high of Rs 1,304.90, after the company announced that the promoters will be reshuffling their shareholding.

RIL has gone up by over 21 per cent after its telecom venture Jio said last month that it will begin charging for data services from April.

Dredging Corporation rallied 12.68 per cent to close at Rs 502, largely on reports of possible stake sale.

Capital inflows continued, which ensured both the Sensex and the Nifty were back at their crucial levels. Foreign portfolio investors (FPIs) net bought shares worth Rs 1,528.48 crore on last Friday, according to provisional data.

Globally, major Asian indices closed mixed. China's Shanghai Composite and Hong Kong's Hang Seng rose. Japan's Nikkei, however, fell as the yen jumped after North Korea fired four ballistic missiles, three of which landed in Japanese waters.

European shares sank at the start of trade after Germany's troubled Deutsche Bank unveiled plans over the weekend to raise 8 billion euros (USD 8.5 billion) in fresh capital.

Other major gainers that fed the rally were Adani Ports (2.48 per cent), Tata Motors (2.30 per cent), Bharti Airtel (1.81 per cent) and SBI (1.79 per cent).

As many as 23 stocks finished higher while 7, including TCS, Hindustan Unilever and Dr Reddy's, ended lower.

On the sectoral front, oil & gas zoomed 1.32 per cent, followed by infrastructure, auto and power.

Broader markets such as the BSE mid-cap and small-cap went up.

"Barring the IT index, all other sectoral indices on the National Stock Exchange (NSE) traded with gains," said Karthikraj Lakshmanan, Senior Fund Manager, Equities, BNP Paribas Mutual Fund.

The breadth of the market stayed positive. On the BSE, 1,511 shares advanced and 1,371 declined. A total of 213 shares were unchanged.

The total turnover at BSE eased to Rs 2,988.44 crore, from Rs 3,001.53 crore last Friday.

Comments

0 comment