views

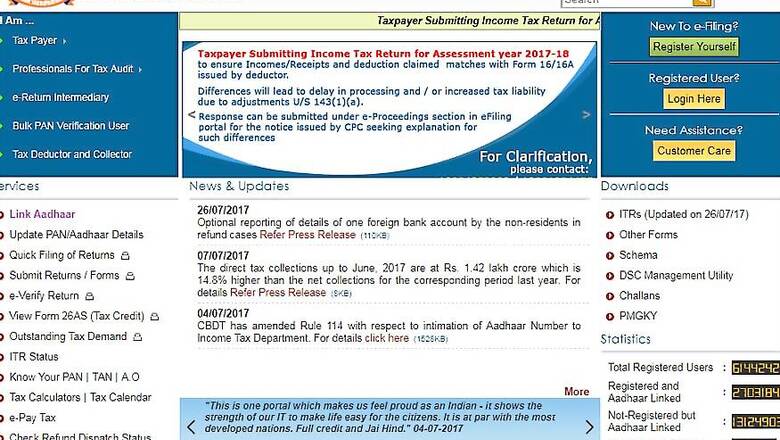

Although the government has extended the deadline for filing the Income Tax Return FY2016-17 to August 5th 2017, however, you must file it asap, today if possible. The biggest reason is that due to last minute rush millions of people use the official website of Income Tax Department - incometaxindiaefiling.gov.in at the same time. This may slow down the website speed and you may end up leaving the ITR e-filing process incomplete.

Secondly, it is important to get all your financial papers from your bank if you have a home loan, you need to get the interest certificate and loan account statement to claim exemption for pre-payment of principal. You need to get your children’s (upto 2 children only) fee receipts for the last year or get a tuition fee certificate from their school clearly demarcating the tuition fee from other payments like transport fee, medical fee, multimedia charges etc. You need to have all your investment proofs like copy of LIC premium, copy of Health Insurance premium, copy of all other investments in ULIPs, NPS, PPF, etc. You need to get the Donation certificates to get tax exemption for the same.

If you still procrastinate the whole process and wait for the next deadline August 5th 2017 then chances are that you will not be able to gather all the above documents in time on a single day. And you will end up attracting penalties and financial losses due to non-filing of Income Tax Return FY2016-17.

Read more about these penalties and financial losses here:http://www.news18.com/news/india/income-tax-returns-what-happens-if-you-dont-file-itr-by-august-5-1478487.html

From July 1st 2017, the Income Tax Department has made it mandatory to link your Aadhaar ID with PAN Card. Thereby you will not be able to file a return if you have not linked your Aadhaar ID with PAN card as yet. It is quite simple to link both the government IDs. You can do it yourself on the Income Tax department’s e-filing portal in less than 5 minutes.

Also you need to understand the various Income Tax Forms before filling any one as there has been a change introduced in the ITR Form names recently by the ministry of Finance and Central Board of Direct Taxes. The earlier form 2-2A-3 have been merged to make just ITR Form 2 now.

Read out the new Forms and the guidelines to pick the same according to your income or nature of entries in your financial statement for FY16-17 http://www.news18.com/news/india/understanding-types-of-itr-forms-for-filing-itr-online-1466851.html

Once you fill up a Form you need to upload your Digital Signature Certificate (DSC) to complete the e-filing process otherwise you will get an acknowledgement ITR Form-V which you need to download and print and sign it manually with blue ink pen and send it to the Income Tax Office at Bangalore. However if you are keen on making things less time consuming and online only then it is advisable to get a DSC.

Follow the below link to know why and how you can get a Digital Service Certificate (DSC) online and use the same for e-filing your ITR FY2016-17.http://www.news18.com/news/india/how-to-upload-digital-signature-certificate-dsc-for-e-filing-your-income-tax-return-itr-1467799.html

To Successfully file your Income Tax Return FY2016-17 before August 5th 2017 in 3 Steps read more here:http://www.news18.com/news/india/income-tax-returns-3-steps-to-e-file-your-returns-in-less-than-30-minutes-1478469.html

Comments

0 comment