views

A greater shift towards the work-from-home culture by information technology (IT) companies and other businesses will not necessarily result in shrinking of office spaces, according to experts.

IT firms, including major players like Tata Consultancy Services, have indicated that very soon a majority of their employees will be working from home. TCS has in fact said 75 per cent of its 4.48 lakh global workforce could work from home permanently by 2025.

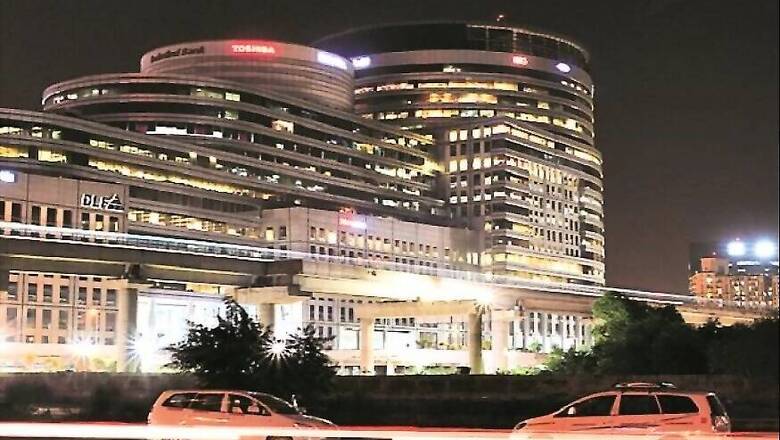

What then will happen to those big buildings, especially in IT hubs like Bengaluru, Chennai and Hyderabad? In short, they're there to stay.

"Working from home still has plenty of challenges," explains Juggy Marwaha, executive managing director of Jones Lang LaSalle (JLL) India, a global real estate services firm specialising in commercial property and investment management.

"India still does not have completely seamless data connectivity. Given our small homes and big families, we don't have dedicated study rooms. As Indians, we don't have the basic cultural change of having a discipline when working from home. Acoustic quality at homes, firewalls are not enough, data confidentiality becomes a huge issue. 80 per cent of our total office strength comes from markets in the USA and Europe, and they are very strict about data confidentiality. Companies will also have challenges in implementing performance management. Plus the psychological aspects, loneliness, depression and anxiety. We always talk about collaborating in work spaces. There are also regulatory issues."

Ashutosh Limaye, the director and head of consulting at Anarock Property Consultants, echoes Marwaha's opinion, saying the work-from-home system will not be feasible for all businesses.

"There will be more working from home for sure, but it's not like it will replace in a big way," he says. "The culture is not going to be completely replaced. Today we are overestimating the benefits and underestimating the challenges."

The need for more space due to potential social distancing norms in the near and distant future, expert say, is likely to offset the space gained by people working from home.

"In the last four-five years, they have been densifying offices," explains Limaye. "Earlier, offices used to be spacious. Now there are open offices without cabins. You want people together because you want them to interact more. Per person space in offices has come down from 100 square foot per person four years back to about 60-65. Now there will be new norms on social distancing, isolation areas. Basically you have to space out your offices. So even if a section works from home, you'll require more space for the remaining employees. So there won't be a sea change."

"Also, there could be de-densification of location," points out Marwaha. "Suddenly you'll see that a million-square-feet campus where everybody works together is not the norm. They could split workforces across different parts of the city or even across cities. Residential real estate could see a huge fallback as people will not have disposable income to buy. Lack of job security will not allow them to buy homes. Residential real estate market is in for a longer pain. But commercial (real estate) might not be (affected) that much. There will be pain before things improve. Things will get worse before they get better."

One section of commercial real estate that could get a boost is co-working spaces, where several employees from different organisations share an office. Co-working spaces can be rented on a monthly, day-to-day and even hourly basis, say experts.

"If few employees can work in shared spaces near their homes, they get the benefits and infrastructures of a workplace. From an employer perspective, they don't have to block large capitals for rent because co-working spaces are highly flexible," says Limaye.

Marwaha, though, believes co-work spaces won't be in demand.

"I think there will be major consolidation because co-working companies work on wafer thin margins. It won't allow them to operate without cash," he explains. "Landlords also need to be paid rent. Retail landlords have accepted that they won't take rent, but co-working is like office, they are stuck in between and have to pay rent. Social distancing norms don't go in accordance with co-work culture."

While there's plenty of pessimism surrounding the economy in the times of coronavirus, there could be a ray of hope for Indian businesses with reports that some companies could shift away from China in the future. This, experts say, could boost commercial real estate, provided India grabs the opportunity.

"It's a real possibility, but you need push-and-pull factor to work together. The push factor from China is there, now it's up to the Indian government to make inviting policies, make permissions fast, give them land/space for manufacturing as well as offices. There is a real opportunity to benefit from this push out from China. Overall, offices will grow," says Limaye.

"India has to get its act together in terms of ease of business. Regulation is a big problem today. To open one manufacturing unit you need 25 licenses which will take 25 months. It's a huge opportunity for the government to make it attractive for businesses to move in," says Marwaha.

"The new reality is now going to be the VUCA world: volatility, uncertainty, complexity and ambiguity. On the positive side, public memory is also short. Every crisis has always pushed us towards an attitudinal shift in the way people work. After World War 2, women's participation in the workforce increased because men died. After 9/11, people accepted higher level of screening and security. After 26/11, hotels here had a new business in terms of security drills. While many industries will suffer, many will also have new beginnings."

Comments

0 comment