views

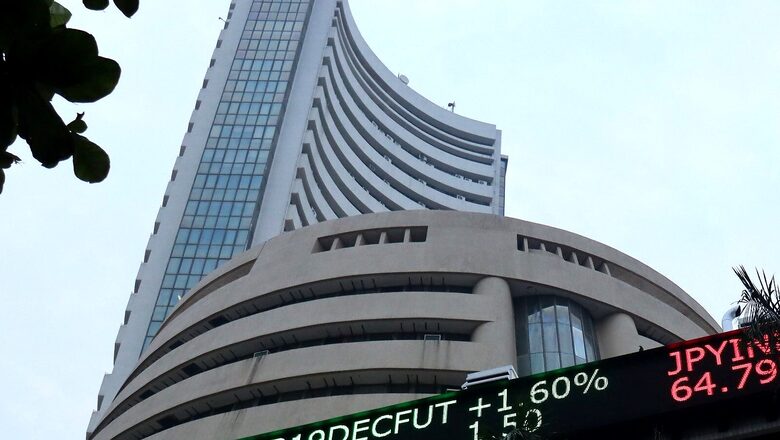

The Indian market opened with some gain, at 1130 IST hours, the BSE Sensex and broader Nifty were at an all-time high. The BSE Sensex was trading at 58,578, up 340 points while the nifty was trading at 17,402, up 22 points.

In early trade, the benchmark BSE Sensex opened at 58,311.33, up 64.24 points, or 0.11 per cent. However the broader Nifty was trading at 17,402.05, up 22.05, or 0.13 per cent. On NSE, ONGC, Shree Cement, Titan, Hero Motocorp were among the top gainers while BPCL, Axis Bank, Tata Steel, IndusInd Bank were among the laggards. In early trade 33 shares advances, 16 declined and 1 remained unchanged. Sectorally, Nifty Bank, Nifty Financial Services, Nifty Private Bank were trading in the red. Nifty Consumer Durables and Oil and Gas were the top gainers.

“The primary driver of this bull run has been liquidity and therefore a reversal of the trend is likely to happen only with decline in liquidity, particularly capital outflows triggered by FPI selling. Even though there were signs of this happening in July, there are no such signals now. In fact the reverse is happening with continuous FPI buying during the last few days. CPI inflation in US for August coming at below expectations at 5.3 % gives credence to the Fed’s view that inflation is transient. This can support further FPI inflows into India, which, in turn, can impart resilience to the market. But investors should remember that these positive developments are pushing valuations very high.The outperformance of the broader market continues this month with disproportionate rise in some mid-small-cap stocks. There is hyper speculative activity in the broader market. Investors should be cautious operating in this segment,”Dr. V K Vijayakumar, chief investment strategist at Geojit Financial Services said.

On BSE, Kotak Bank, Zee Entertainment, Force Motor, Jamna Auto, DishTV were the top performers while Hatsun Agro, GFL Limited were the top losers. BSE MidCap rose 0.69 per cent and BSE SmallCap rose 0.69 per cent, in early trade on Wednesday. The market took week global cues from Asian and US stock market.

Asian bourses like Hong Kong stocks fall at open of trade Wednesday morning, The Hang Seng Index fell 0.73 percent, or 186.27 points, to 25,315.96. The Shanghai Composite eased 0.33 percent, or 12.11 points, to 3,650.49, while the Shenzhen Composite Index on China’s second exchange gave up 0.47 percent, or 11.70 points, to 2,477.19. On the other hand, Tokyo stocks also opened lower on Wednesday as investors sought to lock in profits after recent rallies, with falls on Wall Street also weighing on the market. The benchmark Nikkei 225 index was down 0.65 percent, or 200.30 points, at 30,469.80 in early trade, while the broader Topix index slipped 0.81 percent, or 17.18 points, to 2,101.69.

“US stocks gave up early gains and finished lower as profit booking ahead of crucial FOMC meeting was visible. Notably, August CPI data stood at 5.3% on annualized basis, which was mostly in line with consensus estimates. In our view, recent downgrade in economic growth in the USA following rise in delta variant of Coronavirus and possible impact on corporate earnings weighed on investors’ sentiments in last couple of days. However, in-line CPI data should essentially offer comfort to investors that Federal Reserve might not announce Quantitative Easing programme in upcoming policy meeting next week. In our view, retail sales data for August will be in focus in ongoing week now and USA equities may trade sideways in next couple of days ahead of FOMC meeting.” Binod Modi, head strategy at Reliance Securities said.

Read all the Latest News , Breaking News and Ukraine-Russia War Live Updates here.

Comments

0 comment