views

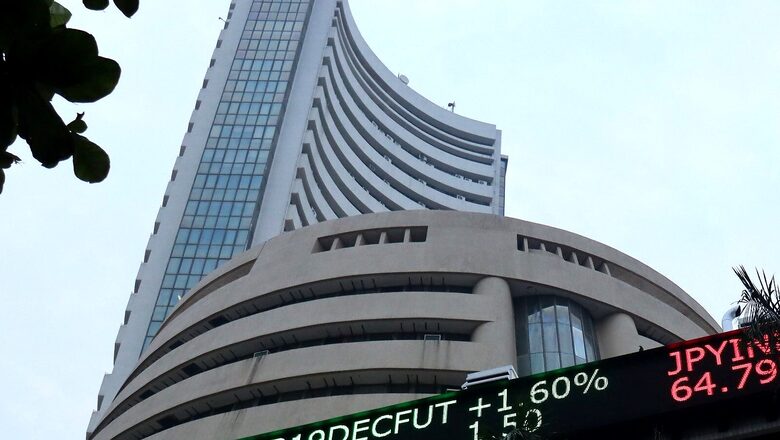

The benchmark Indian indices closed on a flat note on Tuesday, The BSE Sensex ended in the red at 58,129.95, down 17.43 points or down 0.03 per cent. However, the broader Nifty was also down 15.70 points or 0.09 per cent at 17,362 About 1296 shares have advanced, 1810 shares declined, and 137 shares are unchanged. India’s Volatility gauge India Vix eases by 1.2 per cent. BPCL, Sun Pharma, Tech Mahindra, Wipro and Axis Bank were the top Nifty losers. Bharti Airtel, HDFC, Grasim Industries, ITC and IndusInd Bank were among the top gainers. Sectorally, BSE Telecom was the top sectoral gainer, up 3.08 per cent while the BSE REALTY was the biggest sectoral loser, down 2.24 per cent, Among sectors, except FMCG, all other sectoral indices ended in the red with oil & gas, IT and Realty indices down 1-2 percent. The BSE midcap and smallcap indices ended in the red.

“The domestic market traded with high volatility as investors locked in gains from the recent rally & global factors. However, the broad market maintained its buoyancy in segments, which are bound to benefit from unlocking. European shares traded with cuts ahead of the European Central Bank’s policy meeting on Thursday, where talks regarding the tapering of asset purchase programs are likely to take place in the backdrop of rising eurozone inflation,” Vinod Nair, head of research at Geojit Financial Services said.

Indian markets taking mixed cues from the global markets opened flat. Other than Asian Bourses, Hong Kong’s The Hang Seng Index added 0.17 percent, or 43.59 points, to 26,207.22. The Shanghai Composite was flat, inching 0.15ints lower to 3,621.71, while the Shenzhen Composite Index on China’s second exchange was also hardly moved, ticking down 0.55 points to 2,462.81.

“ The benchmark index recovered its early losses and set an all-time high at 17436.50 levels on Tuesday’s session. The nifty50 settled at 17357.45 levels while the Banknifty ended at 36468.80 levels with 0.3% losses. All the sectoral indices closed on a mixed note wherein Nifty Realty was the top laggard with more than 2% fall. Stocks like HDFC, BHARTIAIRTEL & GRASIM were the top gainers while WIPRO, SUNPHARMA, TECHM, and BPCL were the top losers for the day. Technically, the Index has been trading in Higher High & Higher Low formation, which suggests strength in the counter. On an Hourly Chart, the Index has been finding resistance from the upper band of Bollinger crossing above the same can show further upside movement. All the key indicators like RSI, MACD & Stochastic are supporting the positive trend in the index. At present, the psychological level of 17500 could be a resistance while on the downside, 17200 may act as support for the index.” Sachin Gupta, AVP Research, Choice Broking said.

However, in the early trade, the Indian indices opened on a positive note on Tuesday, the benchmark BSE Sensex was up 111.94 points or 0.19 per cent at 58408.85, and the Nifty was up 28.90 points or 0.17 per cent at 17406.70. About 1224 shares have advanced, 510 shares declined, and 103 shares are unchanged. The Indian market opened on a flat note- thanks to the mixed global cues.

“On the technical front, the market is witnessing a continuous positive trend and it has sustained well above 17,300-350 levels and we believe this up move will extend till 17500 level in the short term. On the downside 17,100 is the immediate support in Nifty 50 followed by 16,900,” Mohit Nigam, head-PMS, Hem Securities said.

The Indian rupee slipped 7 paise to 73.17 against the US dollar in opening trade on Tuesday, tracking a strong American currency in the overseas market.

Read all the Latest News, Breaking News and Assembly Elections Live Updates here.

Comments

0 comment