views

- Use your bank’s mobile app to deposit the check without an ID. Or, cash the check at an ATM in your bank’s network.

- As an alternative, get a prepaid debit card and deposit the check using the card’s mobile app. Or, sign the check over to a trusted friend or family member to cash.

- If you don’t have a bank account, bring the check and your ID to the bank that issued it. Or, cash the check at a store like Walmart.

Ways to Cash a Check without an ID

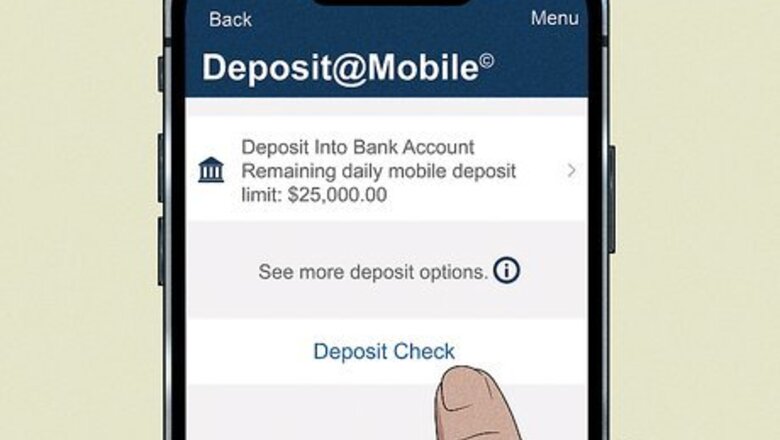

Deposit the check using your bank’s mobile app. If you have a bank account, most banks have a mobile app that allows you to deposit a check without an ID. Simply download your bank’s app and sign in using your account information. To deposit the check, endorse the back and then snap pictures of the front and back of the check. Follow your bank’s requirements for endorsing the check. Some banks ask you to write your bank account number or add other restrictions. Alternatively, cash the check online through your bank’s website.

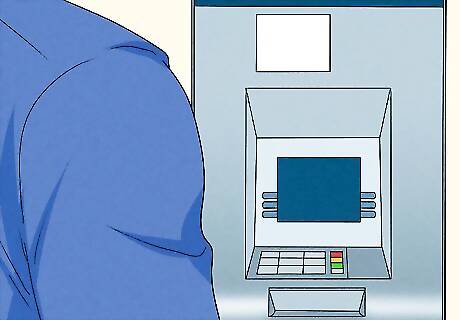

Cash the check using your bank’s ATM. Many ATMs deposit checks and don’t require an ID if you have a bank account. Simply go to an ATM that’s in your bank’s network, insert your debit card, and enter your PIN. Select the “Deposit” option, insert the check, and confirm the check amount. The funds from your check are typically available within 2 days.

Use a prepaid debit card to cash the check. Most prepaid debit cards, like Visa Prepaid Cards, have accompanying mobile apps to manage your money, which includes depositing checks. Just purchase a prepaid debit card, download the mobile app, and register your card. Then, take pictures of your check to deposit it onto the card. Some prepaid cards charge a fee for depositing checks.

Deposit the check using a mobile payment service like PayPal. Many mobile payment services like PayPal, Venmo, and Cash App have a check depositing feature that adds the funds to your online account, without requiring an ID. Simply download the app of your choice, create an account, and link your bank account to the app. Then, navigate to the app’s check deposit feature and take pictures of the front and back of the check. Most apps charge a fee for depositing your check. There are also typically limits on the amount you can deposit. Other mobile payment service apps like Current, Ingo Money, and GO2bank deposit checks.

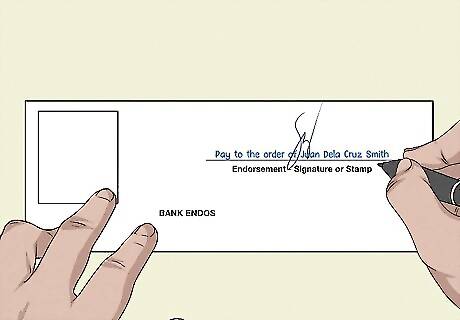

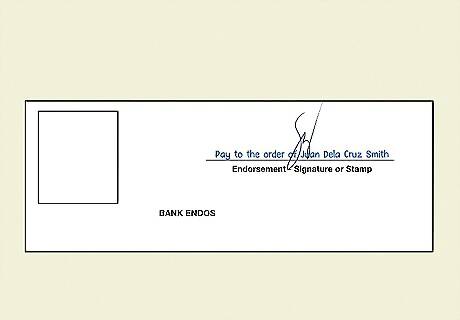

Sign the check over to a trusted friend or family member with an ID. Some banks allow you to sign your check over to someone else, meaning that the check is now theirs to cash. To sign over a check, verify that your bank allows third-party checks and then endorse the check. Below your signature, write “Pay to the order of” and the friend or family member’s name. Then, give the check to them so they can cash it and give you your money. Note: Some banks require you to be present and show your ID when your friend or family member deposits a signed over check. Ask your bank what their requirements are for third-party checks before you sign over your check.

Do you need an ID to cash a check?

Most banks require you to present an ID when you cash a check. Banks require an ID when depositing a check and making other transactions to protect the institution and their other members from fraud. Your ID also verifies your identity with the bank and protects your account from fraud.

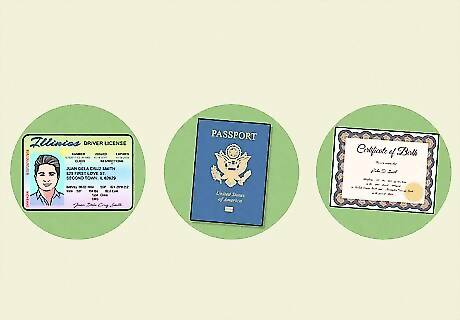

What are accepted forms of ID to cash a check?

Most banks accept driver’s licenses, passports, and state ID cards. To verify your identity, most banks need to see a primary ID with your photo that is issued by the government. Primary IDs include: Driver’s license Passport State-issued ID card Birth certificate (if a minor) Social Security card (if a minor or senior) US Military or Veteran ID Permanent Resident Card (Green Card or Resident Alien Card) US Employment Authorization Card Matrícula Consular Card

Some banks accept secondary forms of ID, like an employer ID. If you don’t have one of the primary IDs listed above, some banks are willing to confirm your identity with a secondary ID, especially if you are a known customer of the bank. Accepted secondary IDs include: A bank statement A bank-issued credit, debit, or ATM card Employer ID Card Employer pay stub Social Security Card Student ID A utility bill Foreign National ID Call your bank to see what ID they need for you to cash a check.

Cashing a Check as a Minor without an ID

Bring your parent or guardian to your bank to cash the check. If you have a check to deposit but you aren’t old enough to have your own ID, ask your parent or guardian to endorse your check for you. Then, go with them to cash the check at the bank and remind them to bring their ID, as the teller will ask for it. To endorse the check, ask your parent or guardian to write your name followed by “Minor.” Then, have them sign their name and write how they’re related to you (e.g., Mother, Guardian, etc.).

Deposit the check in a joint or minor bank account. If you share a joint account with your parent or guardian, you can easily deposit your check into your account online or by going to the bank with your parents. If you don’t have a joint account, ask your parent or guardian if they will set an account up for you. Some banks offer special accounts for children and teens that are monitored by your parent or guardian.

Use a prepaid debit card to cash the check. Most prepaid debit cards allow you to deposit a check using their mobile app without an ID. Ask your parent or guardian before buying a prepaid card. Then, download the app for the card, verify the card’s information, and deposit your check. If you’re having trouble depositing your check, ask your parent or guardian for help. Some prepaid cards charge a fee for depositing checks.

Ways to Cash a Check without a Bank Account

Visit the bank issuing the check. Most banks cash checks that are issued by them, even if you don’t have an account with the bank. Just look for a bank name on the check to find out which institution issued it. Then, endorse the check, go to the bank, and bring your ID to cash it. Some banks charge a fee to cash your check.

Cash the check at a retail or grocery store like Walmart. Some stores, like Walmart, Kroger, Safeway, and Harris Teeter, offer a check depositing service. Simply bring your check and an ID to the store to receive your cash. Most stores charge a fee to deposit your check. There is typically a limit to how much you can deposit.

Cash the check using a prepaid debit card. If you don’t have a bank account, buy a prepaid debit card (which does not require a bank account) and download the card’s mobile app. Sign in to the app using your card’s information, find the app’s mobile deposit feature, and then take pictures of the front and back of your check. There may be a fee for depositing your check.

Sign your check over to a trusted friend or family member. If a friend or family member has a bank account, ask them if they will cash your check for you. Simply endorse your check and write “Pay to the order of” and the friend or family member’s name under your signature. After they cash the check, they can give you your money. Call your bank to ensure they accept third-party checks. Your bank might require you to come with your friend when they cash the check and present your ID to verify the third-party check.

Deposit the check at a check-cashing store. Most check-cashing stores do not require a bank account to deposit your check, but they typically require an ID. Simply look up cash-checking stores near you and choose one that has good reviews and a low fee. Check-cashing stores tend to charge higher fees for depositing your check, with some charging fees more than 12%.

Comments

0 comment