views

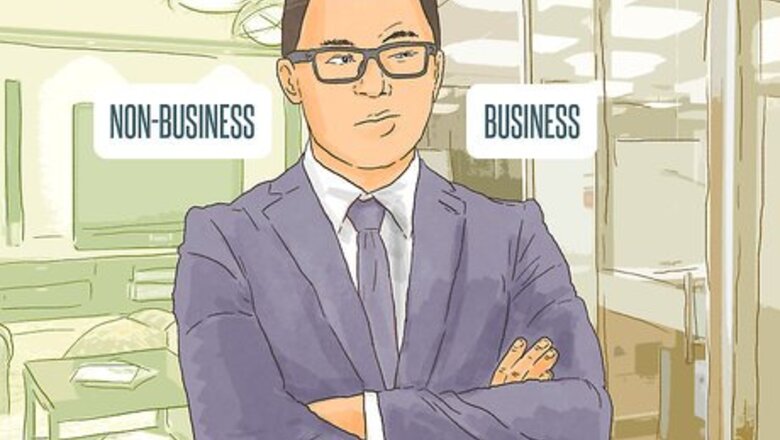

Categorize the Nature of the Debt

Determine whether it is business or non-business bad debt. The IRS distinguishes clearly between business and non-business types of bad debt. Business bad debt is a worthless (uncollectible) debt that was created or acquired during the course of business. This might includes loans or credit sales to customers or vendors, or business loan guarantees. Nonbusiness bad debts are defined more broadly as all other bad debts (not related to business). To be a bad debt, the debt must be considered "worthless." That is, reasonable efforts must have been made to collect the debt. A debt is considered a bad debt when, even after attempting collection, there is no expectation that the debt will be repaid. Business debt allows for partial deductions, whereas non-business debt requires a deduction of the entire debt amount.

Review the debt agreement to determine breaches of contract. The debt agreement should clearly lay out the terms of the debt and repayment. This might include a schedule, payment amount, interest rate, fees, and other details. Check the agreement again to be sure that the debtor is in violation of its terms. Debts without a signed agreement will be more difficult or impossible to collect, as it may seem that they are a gift.

Identify breach and contractual remedies. Specify the type of breach, whether it is low payment, no payment, or late payment. Then, identify the steps taken to remedy breach. These step may be laid out in a debt collection policy on the lender's side. For example, a lender might work with the debtor to accept a payment gap or create a payment plan.

Document collection efforts. Document any attempts to collect on the debt. Specifically, write down who was spoken to over the phone and what was discussed. In addition, keep copies of any letters sent or received between the lender and debtor. These "demand letters" can be used when proving collection efforts in court.

Accounting for Business Bad Debt Expense as a Lender

Determine which treatment method is used. As a lender, there are two major treatments that can be used when dealing with business bad debt. The first, the direct write-off method, accounts for bad debts only when they are confirmed to be uncollectible. This is the simpler of the two methods, but sometimes must be amended if the borrower eventually does pay the debt. The other method is the allowance for doubtful accounts. This method sets aside an amount to account for bad debts before the debts are deemed uncollectible. The amount is set using estimates from historical bad debt percentages. Use the method established in your bookkeeping procedures. If there is no existing method, use the direct write-off method to start. You can always use the allowance method once you know how much bad debt to expect.

Write off bad debt expenses. The direct write-off method requires the creation of an expense account that will record the bad debt expenses experienced throughout the period. When a bad debt is recorded, it is recorded as a debit to Bad Debt Expense and a credit to Account Receivable, both for the amount of the bad debt. For example, a $2,000 bad debt would be recorded as a debit to Bad Debt Expense for $2,000 and a credit to Account Receivable for $2,000.

Establish an allowance for doubtful accounts. The allowance for doubtful accounts operates as a contra-asset account to Accounts Receivable. This means that it is presented on the assets portion of the balance sheet. The account is used to hold money that will cover bad debts throughout the period. The amount of the allowance can be calculated in several different ways, including as a percentage of Accounts Receivable, a percentage of total sales, or through a more complex account aging schedule. For more information on estimating the allowance, see how to account for doubtful debts.

Make appropriate journal entries on books. For the allowance method, the journal entries will reflect a reduction in the Allowance for Doubtful Accounts account for each bad debt expense. This would be reflected as a credit to Accounts Receivable and a debit to Allowance for Doubtful Accounts, both in the amount of the bad debt. For example, a $1,000 unpaid account balance would be recorded as a debit to Allowance for Doubtful Accounts and a credit to Account Receivable, both for $1,000.

Present the debt on the balance sheet. Under the allowance method, the Allowance for Doubtful Accounts is presented as a contra-asset account under Account Receivable on the Balance Sheet. This means that under Accounts Receivable, the following line is used: "Less: Allowance for Doubtful Accounts." This line shows the allowance for doubtful accounts and is used to reduce Accounts Receivable to arrive at a third line, Accounts Receivable, net. As the allowance is drawn down, Accounts Receivable goes down as well, meaning that net Accounts Receivable remains the same.

Accounting for Business Debt Forgiveness as a Lender

Recognize which types of debt can be forgiven by direct write-off. "Debt forgiveness" is a term that is generally reserved for the write-off of long-term debts, and does not include accounts payable, commercial paper, or other short-term debts. Short-term debts should be handled using the bad debt allowance method, which predicts in advance that a portion of the debts will need to be forgiven.

Attempt to restructure the debt before writing it off. Debts should only be forgiven (written off) if the possibility of collection is impossibly low. Before proceeding with a write-off (which harms both the lender, who loses money, and the borrower, whose credit rating is damaged), reasonable efforts should be made to restructure the debt. For example, consider a company that has issued a long-term note to a customer with a face value of $10,000, an annual interest rate of 12 percent, and a length of 5 years. If the customer cannot pay the note, the company might consider allowing the customer to swap the note for one with a smaller interest rate or longer term. This would ease the burden on the customer. All actions taken to restructure debt should be recorded in the notes section of the financial statements.

Record the journal entry for the forgiveness of the debt. If the debt must be written off, an adjusting entry is required in the general journal. This entry shows a debit to Bad Debt expense and a credit to the associated receivable account. Continuing with the example above, assume the customer owes $10,120 upon the note's maturation (the face value plus the last year's interest). If the entire debt is forgiven, the lender should debit Bad Debt Expense for $10,120, credit Notes Receivable for $10,000, and credit Interest Receivable for $120. For notes issued to customers for the purchase of the lender's products, it is also appropriate to transfer the Notes Receivable balance to Accounts Receivable, where it can be handled using the allowance method. In this case, the lender would debit Accounts Receivable for $10,120, credit Notes Receivable for $10,000, and credit Interest Receivable for $120.

Recognize bad debts on financial statements. Bad debts are represented on three of the four financial statements (they are not present on the Statement of Shareholder's Equity). On the balance sheet, they are added to the Allowance for Doubtful Accounts, which is then subtracted from Accounts Receivable. On the income statement, they are recorded as an expense on the line item Bad Debt Expense. Finally, on the statement of cash flows, they are listed as Bad Debt Expense, which is a non-cash expense.

Accounting for Nonbusiness Debt Forgiveness as a Lender

Understand non business debt forgiveness reporting differences. Unlike business bad debt, non-business bad debt cannot be partially deducted. This means that only a completely worthless (uncollectible) debt may be deducted. The debt can only be considered worthless when you have taken reasonable steps to collect on it. You must be able to prove this so that the forgiven debt can be deducted.

Take the deduction in the right year. Deductions for non-business bad debt can only be taken in the year in which the debt becomes worthless. However, this does not require that the debt be actually due. An example might be if the borrower goes bankrupt or is otherwise judged unable to repay the debt before the debt comes due.

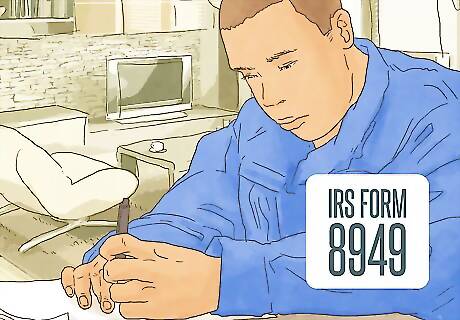

Report a short-term capital loss. Nonbusiness bad debts are recorded as short-term capital losses on IRS Form 8949. Specifically, they can be stated on part 1, line 1. Record the debtor's name and note that you have attached a statement explaining the bad debt. Other bad debts can be recorded on lower lines. You will have to complete a detailed bad debt statement and attach it to your return.

Offset capital gains. The capital loss resulting from non-business bad debt forgiveness can be used to offset capital gains. If there is still a net loss after accounting for capital gains, the remaining amount of the loss can be used to offset up to $3,000 (or $1,500 depending on your filing status) of other income. Any still-remaining losses can be carried over into following years' returns.

Accounting for Personal Debt Forgiveness

Determine whether your forgiven debt is taxable. For personal debt forgiveness, you will likely not need to make credit and debit entries into a ledger. However, as forgiven debts are typically taxable as income, you will need to figure out how much additional money you will owe on your taxes. Start by looking into exceptions to debt forgiveness taxation. You may not be required to pay taxes if your debts were forgiven through bankruptcy proceedings, if you are financial insolvent, or on certain farm or non-recourse loans. Examples of forgiven debt susceptible to taxation are credit card debts, mortgage debts, and student loan debts (unless your job qualifies you for an exemption). See IRS Publication 4681 for more details.

Calculate the forgiven amount. If you have a taxable forgiven debt, you will receive a Form 1099-C that details the taxable amount. This amount is typically the forgiven portion of your debt. So, if you had a $1,000 debt and only paid $500 of it, the forgiven, and taxable, portion would be $500. This amount is then added to your income for that tax year and taxed accordingly.

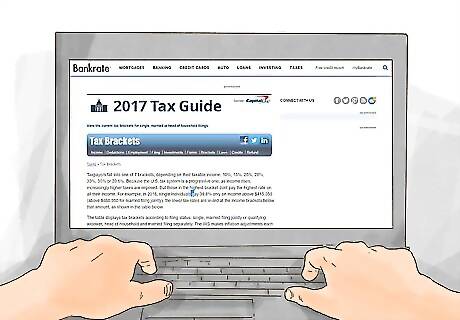

Find your tax burden. Your tax burden for these debts depends on your federal income tax bracket. Check the current year's tax brackets on the IRS's website or elsewhere online. For example, for 2016, a single taxpayer making $30,000 per year is in the 15 percent tax bracket. They would then calculate their tax burden for the forgiven debt using this number. So, for a $500 forgiven debt, they would owe $75 in federal taxes.

Structure your tax payments. If you had debt forgiven, odds are your financial situation is a bit rocky. Luckily, the IRS is willing to structure payments on your forgiven debt tax burden so that you can pay it off over time. For tax burdens under $10,000, you are automatically granted this option. For amounts up to $50,000, you will need to apply. Avoid scam artists and offer-in-compromise companies that will claim they can make your forgiven debt tax-free. These options are expensive and will likely not work.

Comments

0 comment