views

- You can add your credit card to Venmo via the website (in a desktop or mobile browser) or the mobile app.

- Credit cards are subject to a 3% fee when sending money to other users, and your credit card issuer may also charge a cash advance fee.

- Unlike a debit card or bank account, you cannot move funds from your Venmo balance to your credit card.

Adding a Credit Card

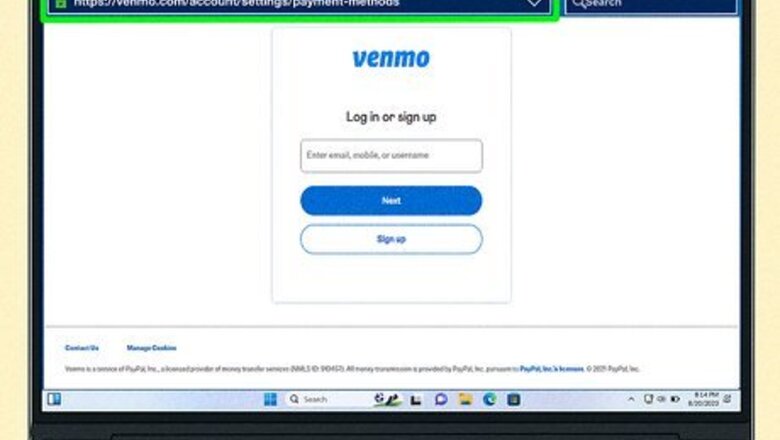

Navigate to your payment methods on your account. You can access this page on Venmo's website here.

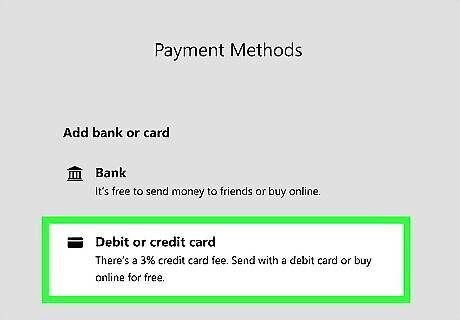

Click Add bank or card then Debit or credit card. Make sure you have your credit card handy to enter the information.

Enter the card information. Ensure the information is accurate, and click through to add your credit card to your account.

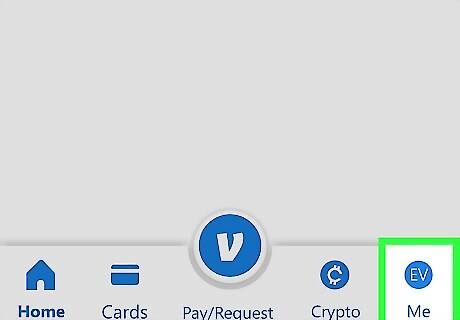

Tap the Me tab in the Venmo app. This will either be your profile picture or your initials, if you didn't set a picture.

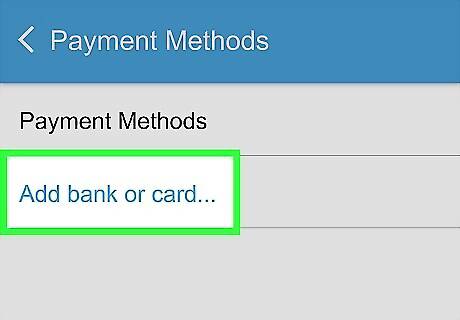

Go to Wallet > Add bank or card…. When given the option, select Card.

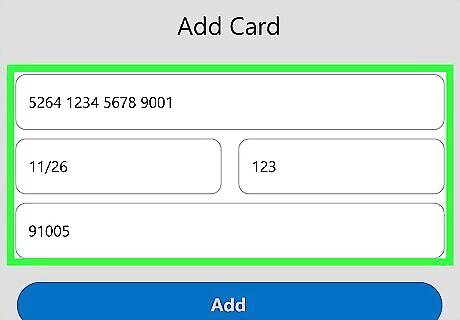

Enter your card information. You can do this manually, or use your camera to capture the card information so you don't have to type it in.

Troubleshooting

Check your card's billing address. You must enter the correct ZIP code when adding a credit card to Venmo, and if your billing address has changed, you will likely encounter an error when adding the card if you're using an old ZIP.

Check the card information. Ensure you entered your credit card's number, expiration date, and security code correctly. Incorrect info will lead to an error when trying to add your card.

Contact your card issuer. If all of your information is being entered correctly, you should reach out to your credit card issuer to ensure there are no problems with your credit card or account that could be causing an issue with Venmo.

Pros and Cons

Adding a credit card to your Venmo has some pros and cons. You will want to consider these pros and cons before adding a credit card to your Venmo account. Pros: If you're using Venmo to make purchases and not send money, adding a credit card may be most convenient for you. Credit card companies are required to abide by more guidelines when it comes to online purchases, including those made through Venmo. Venmo's encryption and multi-level authentication helps secure your credit card information. You will not incur any extra fees when paying authorized merchants directly with your credit card via Venmo. Cons: Venmo charges a 3% fee if you use your credit card to send money to other people, and your credit card issuer may also charge an extra cash advance fee as well. You also cannot move funds from your Venmo account to your credit card; you can only move your Venmo balance to an eligible debit card or bank account. If you need to update your card's expiration date, you must delete the credit card from your account and re-add it, as there's no way to update otherwise.

Comments

0 comment