views

X

Research source

Assessing Your Eligibility

Find out if your spouse has claimed their benefits. If you're currently married, you can't claim spousal benefits unless your spouse has already started receiving their retirement benefits. If you're older than your spouse, you can collect your own retirement benefits until your spouse reaches retirement age, then claim the spousal benefits on top of your own retirement benefits. The amount of your spousal benefit isn't affected by the age at which your spouse started receiving their retirement benefits. It is always based on your spouse's primary insurance amount, which is the amount they would receive if they started claiming benefits at their normal retirement age (NRA). This age is based on the year you were born. You can find out your NRA, and the NRA of your spouse, at https://www.ssa.gov/oact/ProgData/nra.html. If you and your spouse are divorced, it doesn't matter if they're receiving their benefits yet or not. You can still collect your spousal benefit if you are otherwise eligible.

Compare your spousal benefit to your own retirement benefits. The Social Security Administration (SSA) always pays out your own retirement benefits first. However, if your spouse worked for more years, or made more money than you did, it's possible that your spousal benefit will be greater than your retirement benefits. The SSA looks at the amount of retirement benefits you're eligible for, then the amount of spousal benefits you're eligible for. If the spousal benefits are greater than your retirement benefits, you would be paid your retirement benefits first, then spousal benefits would be used to make up the difference. You always get the larger of the two amounts. If your retirement benefits are greater than your spousal benefits, you technically wouldn't be eligible for spousal benefits, because you would be paid your retirement benefits since they would give you more. For example, suppose you are eligible for $200 a month in retirement benefits. Your spouse's primary insurance amount is $500 a month, and they started receiving benefits at their NRA. This means you're entitled to 50 percent of their primary insurance amount, or $250 a month. Technically, you would be paid your $200 a month in retirement benefits, plus another $50 a month in spousal benefits, to bring you up to the full $250 a month.

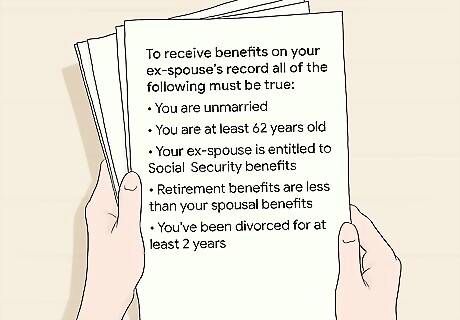

Determine whether you can receive benefits on your ex-spouse's record. If you are divorced but were married to your spouse for at least 10 years, you may be able to get spousal benefits off of their account. To be eligible for divorced spouse benefits, all of the following must be true: You are unmarried You are at least 62 years old Your ex-spouse is entitled to Social Security benefits (either retirement or disability) Your retirement benefits are less than your spousal benefits based on their work would be You've been divorced for at least 2 years (if your ex-spouse has not yet claimed their benefits)Tip: You cannot claim spousal benefits from an ex-spouse if you are married. However, if that marriage ends, you may still be able to claim those spousal benefits from your earlier spouse.

Decide when you want to start receiving benefits. Your full spousal benefit is 50% of your spouse's primary insurance amount. However, if you decide to start receiving those benefits before you reach your normal retirement age, your benefit amount will be permanently reduced. If you are between the age of 62 and your normal retirement age, the amount of spousal benefits you receive is reduced by a percentage that is based on the number of months until you reach normal retirement age. The lowest percentage you could possibly get is 32.5% of your spouse's primary insurance amount. In some situations, it might make sense for you to claim your spousal benefits early. However, if you can afford to do so, you'll get more money if you wait until you reach your normal retirement age.Exception: Even if you haven't yet reached your normal retirement age, you can still receive the full 50% spousal benefit if you are caring for a child who is younger than 16 or disabled and entitled to receive benefits on your spouse's record.

Submitting Your Application

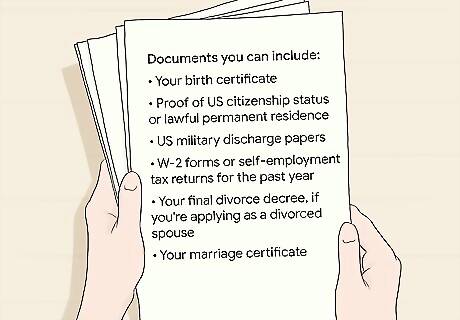

Gather documents that demonstrate your eligibility. You will be asked questions on the application to assess your eligibility. You may also need to provide original documents to the SSA so it's a good idea to get them together before you start filling out the application. Documents you may need include: Your birth certificate Proof of US citizenship status or lawful permanent residence US military discharge papers W-2 forms or self-employment tax returns for the past year Your final divorce decree, if you're applying as a divorced spouse Your marriage certificate

Complete the application online. The easiest way to apply for spousal Social Security benefits is through your "My Social Security" account at https://www.ssa.gov/myaccount/. If you don't have an account, you can create one and apply from there. To apply online, you must be at least 61 years and 9 months old. If you can't apply online or don't want to use the online form, you can also call 1-800-772-1213 (TTY 1-800-325-0778). You can also complete an application in person at your local Social Security office. If you don't know where the nearest Social Security office is located, go to https://secure.ssa.gov/ICON/main.jsp and enter your ZIP code.Tip: If you decide to go to the local Social Security office in person, you might want to call ahead and schedule an appointment. Although it isn't required, it will decrease your wait time.

Provide any additional documents requested. After you submit your application, you may be contacted by the SSA for further information. You may also get a letter in the mail with a list of documents you need to send to the SSA. With the exception of photocopies of W-2 forms, tax returns, or medical documents, the SSA needs original documents. Any original documents will be returned to you. If you don't feel comfortable mailing these documents, you can take them in person to your local SSA office. If you mail documents, you may want to send them using certified mail with return receipt requested, particularly if you're sending original documents.Tip: If you don't have all the documents requested by the SSA, call them and let you know. They can help you get them.

Collecting Your Benefits

Set up an online account if you haven't already. From your "My Social Security" account at https://www.ssa.gov/myaccount/, you can check the status of your application and manage your benefits. If you didn't apply for your benefits online, you can still set up a free account to manage your benefits. You must have a valid email address to set up an online account. The SSA will use that email address to send you notices about your account and your benefits, so make sure it's one you have regular access to.

Sign up for direct deposit. Direct deposit is the quickest and easiest way to get your Social Security benefits. With rare exceptions, federal law now requires all federal benefit payments to be made electronically. You can set up direct deposit through your "My Social Security" account or by visiting https://fiscal.treasury.gov/GoDirect/. To set up your direct deposit, you will need the following information: Your Social Security number or claim number Your financial institution's routing transit number Your account number and account type (checking or savings)Tip: You can also sign up for direct deposit at a local branch of your bank or credit union.

Apply for a debit card if you don't have a US bank account. If you don't have a US bank account, your benefits will be delivered to you on a Direct Express debit MasterCard. You can sign up for the debit card online at https://fiscal.treasury.gov/GoDirect/ or by calling 1-800-333-1795. Even if you have a bank account, you can still sign up for a Direct Express card if you prefer to get your benefits that way. You'll get your card in the mail within 2 to 4 weeks. Your benefits will be deposited onto the card account on your payment date each month. You can use the card anywhere that MasterCard is accepted or withdraw cash from an ATM.

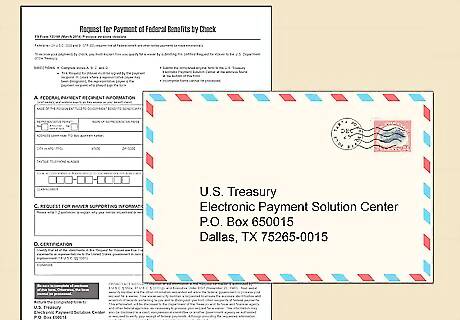

Submit an application for a waiver if you can't use direct deposit. If you live in a remote area without access to banking services, or if electronic payments would cause you a significant hardship (for example, because of a physical or mental impairment), you can apply for a waiver and continue to get a paper check. Waivers are rarely granted and only in extreme circumstances. If you would like to request a waiver, call 1-855-290-1545. You can also print the waiver form at https://fiscal.treasury.gov/GoDirect/about-faq/FMS_Form_1201W_March_2014.pdf. Fill it out and mail it to the address listed on the form.

Comments

0 comment