views

Updating an Address When You Move

Notify your creditors first of your move. Two of the three major credit reporting agencies, Equifax and Experian, both say that when you move, you need to notify your creditors, not the credit reporting agency. The agencies will get notice of any address change through the records of the individual creditors. It is important that you notify all your creditors and all companies you do business with. If you move, but neglect to notify creditors, then bills and notices may be delayed, and your payments may be late as a result. If you want to be abundantly cautious and send a notice of address change to Equifax or Experian, you may do so, even though they do not require such a notice. You do not need to be concerned with any particular “proof” of the new address.

Notify TransUnion directly of your move. To change your address with TransUnion, the third major credit reporting agency, TransUnion asks that you notify them directly. You will need to send a written request to update your address, along with two forms of proof of the new address. The proof may be in the form of a photocopy of: Drivers license State ID card Bank or credit union statement Cancelled check Government-issued ID card Signed letter from homeless shelter Stamped post office box receipt Utility bills (water, gas, electric, or telephone)

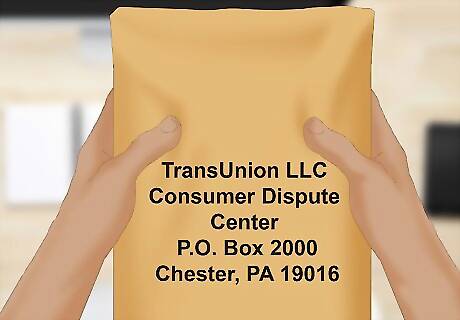

Mail documentation to the appropriate office. If you are notifying TransUnion of your address change, or if you wish to send a notice to Equifax or Experian, send your letter, with any supporting documentation, to the appropriate address. Your letter can be very simple. You may say something like, “I am writing to notify you that as of July 1, 2016, I have moved to a new address. The new address is _____. I am enclosing a copy of my new driver’s license and a utility bill that show this new address.” Send correspondence for TransUnion to TransUnion, LLC, Consumer Disclosure Center, P.O. Box 1000, Chester, PA 19016. Send correspondence for Equifax to Equifax Information Services, LLC, P.O. Box 740256, Atlanta, GA 30374. Send correspondence for Experian to Experian, P.O. Box 2002, Allen, TX 75013.

Disputing an Incorrect Address

Determine that a valid reason for dispute exists. A change of address due to a move is not a matter for disputing your credit report. A dispute is the means for correcting something that is blatantly incorrect. This may include either an address that you never used, or something as simple as a typographical error. For example, if your correct address is 123 Main Street, but it appears on your credit report as “124 Main Street,” you should treat this as disputing an error.

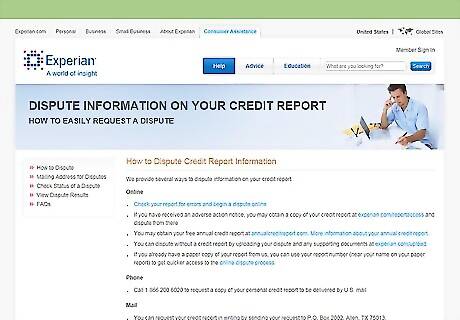

Dispute your address with Experian either online or by mail. If you wish to notify Experian of an error in your address, you can do so either by mail or online. Making the report online will usually lead to faster service. You can make online corrections at http://www.experian.com/disputes/how-to-dispute.html. You will see a link to “Start a New Dispute Online,” and then follow the steps from there to report the correct address. You can notify Experian by mail of any disputed information by writing to Experian’s National Consumer Assistance Center, P.O. Box 4500, Allen, TX 75013. In your letter, include a clear statement that your address on your credit report is incorrect. Provide the information that currently appears, and then state what you believe the correct information should show. If you have supporting documentation, like a utility bill or driver’s license, you should include copies.

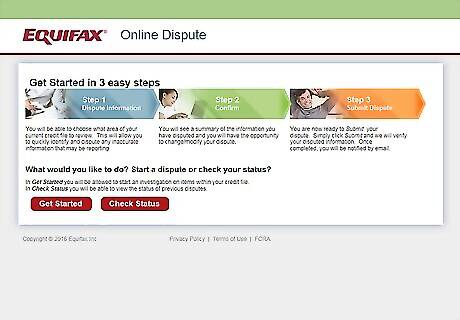

Notify Equifax of an incorrect address through its dispute process. For Equifax, you can begin the dispute process online, or you may submit a report by mail. Reporting incorrect information online is usually going to produce faster results. To report corrections online, begin at the Equifax Online Dispute page at https://www.equifax.com/personal/credit-report-services/credit-dispute/. To report incorrect information by mail, you may write to Equifax Information Services, LLC, P.O. Box 740256, Atlanta, GA 30374.

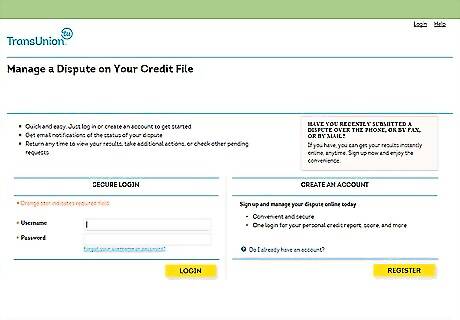

Report to TransUnion for incorrect address information. You may dispute incorrect information to TransUnion either by mail or through its online process. The online reporting will lead to faster results. To report online, visit the screen to dispute an error online, at https://service.transunion.com/dss/login.page?dest=dispute. This screen will prompt you for a userid and password. If you have not used this system before, you will need to create an account. After that, you will be able to enter the details of your dispute. Tell them about the incorrect address, and then provide the new information. You can use the same account to check on the status of your dispute later on. To report an incorrect address by mail, for TransUnion you will treat it just the same as an address change. Send a letter requesting the correction, along with two forms of proof, such as an ID or utility bill, to to TransUnion, LLC, Consumer Disclosure Center, P.O. Box 1000, Chester, PA 19016.

Reporting an Unusual Address as Possible Fraud

Recognize a possibly fraudulent address. Something as simple as an incorrect address is not likely to rise to the level of fraud. But if you notice an incorrect address, that never has been connected to you, together with accounts that you do not recognize, that could be an indication that someone has been trying to steal your credit identity.

Begin by contacting any one of the three major credit reporting companies. If you are concerned that you may be the victim of credit fraud, you only need to contact one of the three credit reporting companies, Experian, TransUnion or Equifax. That company will accept your report and will notify the other two companies. You can contact TransUnion at 800-680-7289. You can contact Experian at 888-397-3742. You can contact Equifax at 888-766-0008.

Submit an “Initial Fraud Alert” regarding your address. Notify whichever company you choose to contact that you wish to place an “Initial Fraud Alert” on your account. This is a note that will be attached to your credit report. Any lending agencies or potential creditors who may be asked to lend you credit in the future will see that note and will be warned to verify your identification before extending credit. This is designed for your protection. An initial fraud alert does not have any effect on your credit score. Creditors may not, by law, refuse to lend to you because you have reported an initial fraud alert. There is no charge to you for placing a fraud alert on your account.

Mark your calendar for 90 days. The initial fraud alert stays in place for 90 days. During that time, if you see no other activity that leads you to believe anything fraudulent was occurring, then you may just let it drop. If you wish, you may renew the alert by calling one of the companies again and asking to renew it.

Comments

0 comment