views

- Most landlords either use a first come, first served policy, or choose tenants based on the quality of their overall application.

- Look up your local state and city laws to ensure you’re using a fair and legal process to select tenants.

- So long as it’s legal, you are allowed to ask all applicants to submit a “best offer” on what they’d pay for rent.

- Use the same application and rental process for all of the applicants to avoid accidentally displaying bias.

How to Choose from Multiple Applicants

Option #1—first come, first served. This is the most popular option for landlords because it’s easy and legally defensible. With first come, first served, you accept the first fully qualified applicant. So, if you receive 4 great applicants after a day of showings, the apartment goes to whoever submitted their application first. Remember, there is no perfect tenant. If you keep holding out for the absolute best tenant, your rental unit may sit on the market for too long! This is probably the fairest way to go if all of the applicants are equally qualified. Whether a tenant is qualified or not is up to you, but you do have to maintain the same selection criteria for all tenants. In other words, it is illegal to deny one tenant because their credit isn’t high enough and then select a different applicant with similar credit.

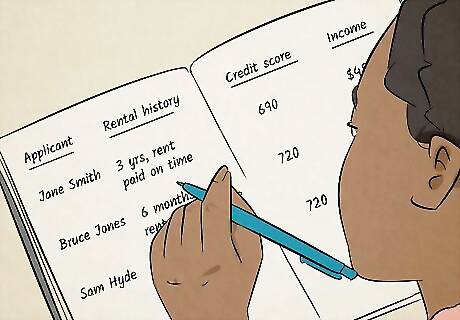

Option #2—overall strength of the application. All landlords care about a potential applicant’s credit score, income, criminal history, and rental history. If you have multiple applicants, you can weigh all of their applications to determine who is the strongest overall candidate. So long as you don’t discriminate or use custom requirements for different applicants, you can use whatever criteria you like. This is a slightly less popular option because it can be hard to weigh multiple factors against one another. Let’s say one applicant has a credit score of 720 but an income of $30,000. Is that better than another applicant with a 690 but an income of $60,000? Many landlords have specific exclusionary criteria. For example, you might choose to never rent to anyone who has been evicted in the past 3 years, or to never rent to anyone with a credit score under a certain threshold.

Can you have applicants bid on the unit?

It depends on where you live, but generally, yes. In some countries, counties, and cities, it is explicitly illegal to auction off a rental unit to prospective tenants. But if it’s allowed, you can certainly ask multiple tenants to submit a “best offer” for the unit. Send out an email or text letting the applicants know you have competing offers and wait to see what they’re willing to pay. If you plan on doing this, make a note of it in your classified ads for the unit that you’ll allow a bidding war if you receive multiple applications from qualified tenants. Do not lie about having a tenant willing to pay a certain amount if they don’t exist. This likely qualifies as fraud depending on where you live.

Legal Considerations

Follow the Fair Housing Act when you’re analyzing tenants. While landlords can set whatever rental criteria they’d like, nobody can violate the Fair Housing Act (that’s the name in the US, but most countries have a law like this). This law basically states that you cannot deny someone housing specifically because of: Race Skin color National origin Religion Sex, gender, or sexual orientation Family status Disability

Check your local laws regarding rental regulations. Read your state, county, and city regulations. Every jurisdiction has their own legal requirements, and you could end up in serious legal trouble if you accidentally violate a law. If possible, consult a local landlord-tenant attorney and have them look over your application process. That way, they’ll be able to point out any red flags or potential violations. For example, in New York, you can’t ask applicants if they’re a US citizen. In New York City, there’s a threshold for how much you can increase rent between tenants. Every state and city has their own little legal nuances, so learn your local laws thoroughly.

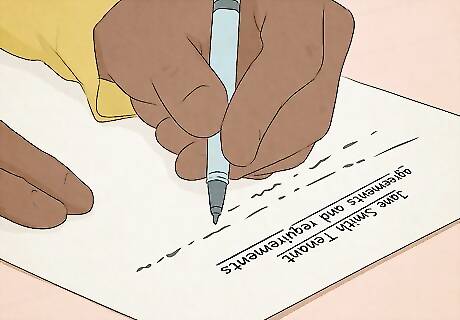

Consistency is essential when it comes to your screening process. Once you’ve chosen a selection criteria for your tenants, don’t deviate from it. Changing how you select your tenants might create the impression that you’re engaging in some kind of discrimination (even if you aren’t). If you’re going to revise the way you do things, do it in between available units. Include all of your requirements, rules, and selection criteria when you create your rental application and agreement.

Document everything in writing in case it comes up in court. It’s totally fine to interview potential tenants and ask questions over the phone, but be sure to document all agreements and requirements in writing. This is as easy as creating a copy of a rental application and filing it away, or providing your selection criteria in an email. You never know when someone is going to accuse you of breaking the law, so documentation is key.

Let tenants know if they didn’t get the place right away. Once you’ve selected a tenant, let the other applicants know you’ve gone with another applicant and the apartment is rented. If you take too long, you might create the impression that you’re up to something fishy. Whether you’re required to explain why a tenant didn’t get the place or not depends on where you live. As a rule of thumb, keep it vague unless there’s a concrete reason (like a credit score or problem with their rental history). If you run a credit check, you’re legally required to provide a copy to applicants.

How to Screen Tenants

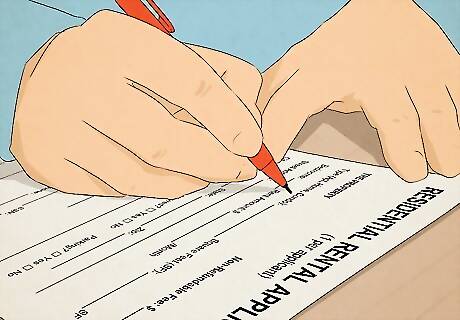

Use a standardized application to have tenants apply. Give every applicant the same exact form when you ask them to apply. Include a section for personal information, like name, current address, and phone number. Then, add a section for employment and monthly income. Finally, include a Q&A section to collect rental history info, references, and other relevant info you require. If you’ve never rented an apartment before and you don’t want to craft an application from scratch, look online for a template that works in your state or city. Alternatively, you can ask a real estate attorney if they’ve got a legally-sound copy you can use.

Verify each applicant’s ID, proof of income, and credit score. Confirm that your applicants are who they say they are. Run a background check to confirm that their ID and personal info are legitimate. Contact their employer to confirm that their income is accurate, check their paystubs, and run a credit check to see if they pay their bills on time. A lot of landlords use the apartments.com background check system, since it pulls credit scores at the same time. Credit and background checks cost money. Most landlords pass this cost on to applicants in the form of an application fee (usually $25-50).

Take their rental history into account. If an applicant has ever been evicted or sued a landlord, it may be a sign that they aren’t going to be a pleasure to deal with. You can absolutely turn tenants away on such grounds. Contact each applicant’s old landlords to see if they have a history of paying on time, taking care of the unit, and not breaking building rules. Note that in some states and cities, it’s illegal to deny housing on the basis of a criminal record. In some jurisdictions, it’s okay to deny an applicant for certain types of felonies. Look up your local laws to be sure. If you do end up turning an applicant away because of what a former landlord said, you may want to be vague about it and not bring up the previous landlord’s name, just to be safe.

Act promptly and try to respect your applicants’ time. Looking for an apartment can be stressful, so don’t take too long to make your decision. Once you’ve selected a tenant, let them know they got the unit right away. Also, reach out to the other applicants to let them know they didn’t get the unit. Be polite and answer any questions they have. In general, it’s best to not be too specific when letting people know why they didn’t get a unit. You could just say, “I’m sorry, we rent based on credit and another applicant had a higher score,” or something along those lines. If you aren’t giving someone a unit because of their credit report, you should consider giving them a copy of the report and explaining the issue.

Comments

0 comment