views

Keeping Track of Your Bills

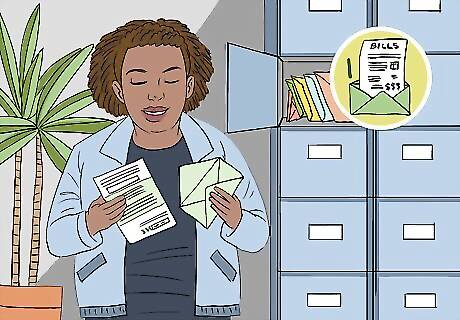

Open your bills immediately. If you get paper copies of your bills in the mail, open them immediately. When you're behind on bills, it can be tempting not to open them. Resist the urge. There is nothing to be gained by keeping yourself in the dark. Even people who have paperless billing set up will put off opening bills. For a lot of people, it can be easier to postpone looking at their bills if they can't see them hanging around the house. If this sounds like you, switch from paperless billing to conventional billing.

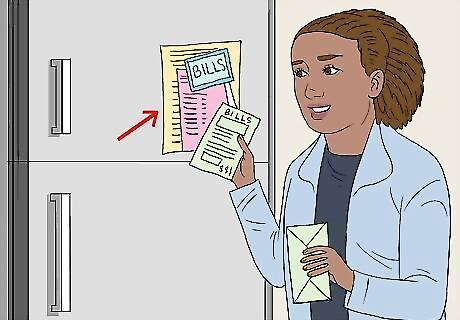

Put your bills in the same place. This might seem like a no-brainer, but that doesn't mean that everyone does it. Even people who know they should do this sometimes don't. Make a commitment to keep all of your bills in the same place, so that you go straight there from the mailbox. Try a home office, the refrigerator door, or a coffee table — just make sure that it's a place where you see them often enough that you don't forget.

Pay bills as you go. The easiest way to keep track of bills is to pay them as they arrive. That way, you never need to worry about paying bills late, and you never have to worry about overspending on non-essentials. The money you can't afford to spend is already spent where it is most necessary.

Divide your bills into two categories. Even if you pay each bill as it comes, every now and then, there will be a bill you can't afford to pay right away. When this happens, put the bill in one of two categories: bills that are due at the beginning of the month, and bills that are due mid-month. Pay the bills that are due at the beginning of the month first, and pay the mid-month bills second.

Negotiate more convenient due dates. Your goal is to owe roughly the same amount at the beginning of the month and in the middle of the month. Almost all companies will negotiate a more convenient due date if you ask. So if one segment of your bills is much larger than the other, call customer service for the respective companies and ask them to change your billing date.

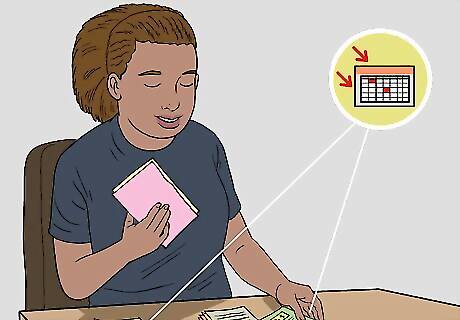

Mark your calendar. For the technologically averse, mark two dates on your calendar for bill payment. Each bill payment date should come a little bit before the bills are actually due. For example, on the 1st and 15th of each month, set aside an hour or so to both review and settle your bills. Make sure to keep this appointment with yourself.

Check out reminder apps or sites. If you find yourself needing a more noticeable reminder than a calendar, try an app or website that tracks spending and payments. Some common features include automatically linking to debit and credit cards, reminders when a bill is about to be late, and alerts when your bank account gets low. There are a lot of great apps and sites out there, but check out Quicken, Mint, and PocketGuard for a start.

Sign up for online bill pay. Online bill pay will automatically draft your bill payments from your checking account. You won't have to worry about keeping your bills organized or remembering to write and mail a check. You can set up an online bill pay through one of the secondary sites or apps available online, or you can set it up automatically with the companies who are billing you.

Budgeting to Pay Your Bills

Create separate accounts for bills and for discretionary funds. This is one of the easiest ways to make a budget that you stick to. Simply compute how much you pay each month for your regular bills. Divide that amount by the number of times you get paid each month to determine how much you should deposit in your bill-paying account from each paycheck. After each pay period, make sure to make the deposits in the proper accounts.

Budget for bills that you don't regularly pay. Certain items, like car registration, taxes, and insurance payments are often billed once or twice a year, instead of being billed each month. Budget for these too. Simply write down the total of your non-regular bills and divide that number by 12 to determine how much to set aside each month. So that you won't be tempted to skimp on irregular expenses, it's best to put this money in the same account as you use for your regular bills. That way, the money is there when you need it. Budget for items that you may not buy monthly, such as clothing, so that you always have some money tucked away when you need new items.

Keep an emergency savings account in case of disaster. This is very important, and most financial experts strongly recommend building emergency savings equal to three to six months of take-home income. As soon as you are caught up on bills, this should be your first savings goal. The amount you need to put in will depend on your needs. For example, if your car insurance policy has a $1,000 deductible, then always keep at least $1,000 in your emergency account just in case you have a car accident.

Paying Your Bills When You're Short on Cash

Start by paying your most important bills. It sounds easier said than done, but the way to start is by separating your bills into three categories: necessities, secured debts, and unsecured debts. Necessities are the types of bills you need to pay in order to survive. Thing like mortgage or rent, your utility bills, your grocery bills, and any bills that allow you to work, such as child care or car payments. A secured debt is a debt that is secured by some type of collateral. That means that if the debt goes unpaid, then the creditor can repossess whatever you have as collateral without first taking you to court. This includes mortgage and car payments (which are also necessities), as well as child support (which uses your wages as collateral) and back taxes. After you've paid off your necessities, pay these. Lastly, pay your unsecured debts. In order for a creditor to seize your property in order to satisfy an unsecured debt, they first have to take you to court. Since it takes a long time for a court case to come to bar, even if you get behind on these debts, you will have more time make things right with your creditors than you do with secured debts and necessities. Try to pay big, irregular bills over several monthly if you can't pay all at once. You may be able to negotiate with your creditor to space out your payments. Either way, it's better to pay what you can rather than nothing at all.

Cut the non-essentials. Of course, this is the last thing you want to do. But if you are coming up short every month, you may need to make some cuts in recurring expenses. You may have to cut off your cable or smartphone (get a flip-phone instead), or liquidate assets until you get back on your feet.

Talk to your creditors early. Many lenders or utility companies, for instance, will work with you to negotiate lower bill payments if you're in a bind.

Find ways to lower your rates. For example, you can opt for a higher deductible on your auto insurance or shop around for cheaper insurance that fits into your budget.

Get financial counseling. Contact a nonprofit credit counseling or financial planning organization. Counselors can help you set up a budget and can negotiate with creditors on your behalf. The Justice Department keeps a list of approved credit counseling agencies here: http://www.justice.gov/ust/list-credit-counseling-agencies-approved-pursuant-11-usc-111, but others are available. There are a fair amount of charlatans hawking credit counseling advice, so be cautious when choosing one. Make sure they are non-profit, ask about the qualifications of their counselors, fees, contract terms, and how their counselors get paid.

Comments

0 comment