views

How to Write a Void Check

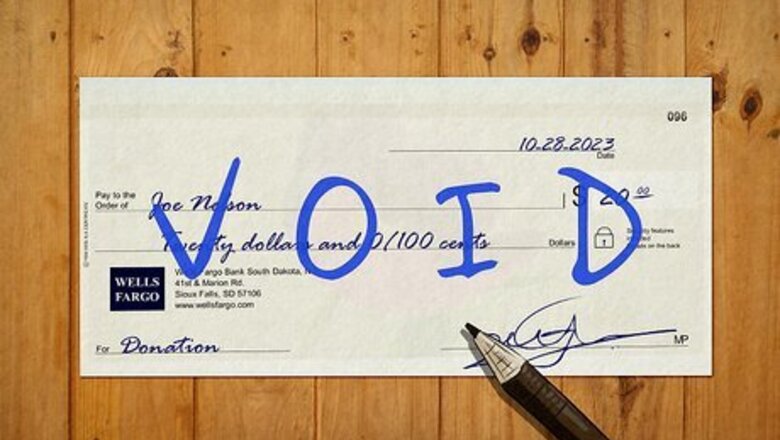

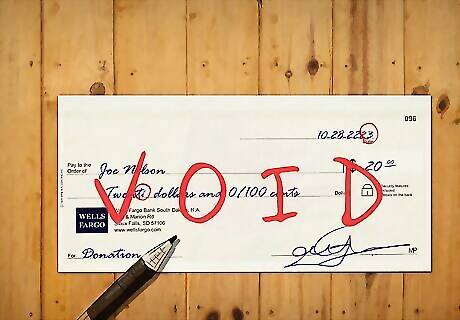

Use a blue or black pen to write VOID across the check. Use a permanent pen or marker to cover the majority of the front of the check with the word “void” in all caps. You don’t need to mark any specific area so long as most of the check is covered and people can’t write in the lines. A voided check cannot be deposited—the word “void” on the check prevents it from being deposited, cashed, or used for any financial transaction. Avoid writing on the account, routing, and check numbers that are listed at the bottom of the check (if you’re using the voided check to verify bank information or personal data). Don’t add your signature to the check, as this may cause confusion. You may want to make a photocopy of the check for future reference.

What is a voided check?

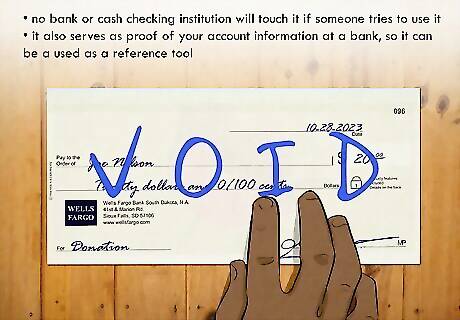

A voided check is an unusable check used mainly as a reference. If someone were to get their hands on a blank check of yours, they could theoretically fill it in themselves and use it to commit fraud. By writing “void” across the face of the check, no bank or cash checking institution will touch it if someone tries to use it. At the same time, a voided check serves as proof of your account information at a bank, so it can be a useful reference tool for certain financial transactions. The big takeaway here is twofold: voided checks are safe to hand over to anyone you want to have your bank account and routing number, and voided checks cannot be used to take money out of your account.

When to Use a Voided Check

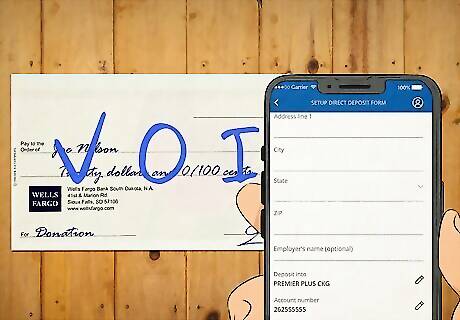

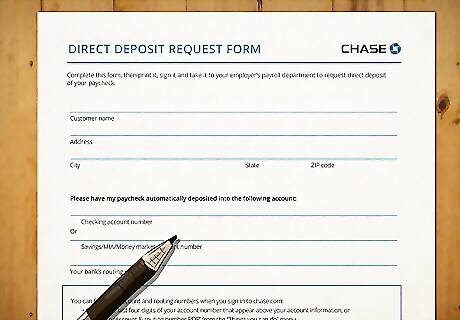

To set up direct deposit Employers will often ask for a voided check to help set up direct deposit. They’ll use the account number and routing number printed on the check to set up the direct deposit, and the check itself will confirm the account information matches the employee records you’ve provided.

To facilitate an ACH transfer Automatic clearing house (ACH) is the network that banks use to send and receive funds. A company or bank may ask for a voided check to help make ACH transfers easier for them since the check will have all of the information they need.

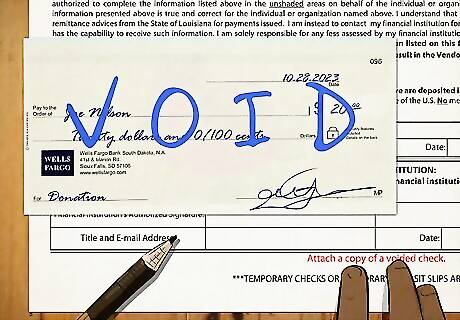

To set up automatic bill payments Some utilities, credit cards, and banks will require a voided check in order to set up automatic payments. The voided check not only contains all of the information they need to set up the transaction, but it will serve as proof that you intended to set the transaction up in the first place.

To correct a mistake you made If you ever fill out a check and you misspell someone’s name, write the wrong amount, or you just end up not wanting the check to be cashed, write VOID on the check. This way, nobody can actually use the check. You can also tear the messed-up check to shreds, but you may want to keep the check for your records (in which case, “void” is the way to go). If you want to destroy a voided check, you can also shred it or tear it into pieces yourself.

Alternatives to a Voided Check

Direct deposit form If you don’t want to give your employer a voided check (or you just don’t have a checkbook), ask if they have any direct deposit forms instead. You’ll have to fill out the form with all of your personal information, but it’ll functionally be the same thing as a void check. HR departments will often ask for a void check to fill out the direct deposit form on their own. Void checks save them time when onboarding a new employee. If you don’t have a checkbook but need a single voided check for something, your bank will usually give you 1-5 checks for free if you stop in at a branch and ask politely. If your bank doesn’t provide checks, they’ll likely have an alternative option for you.

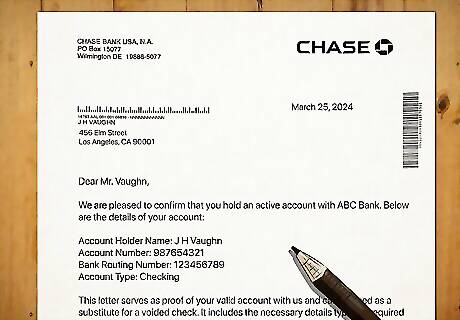

Letter from your bank For things like utility payments or tuition costs, large institutions will often require a voided check. In lieu of a voided check, you can probably use a letter from your bank that contains your account number and the bank’s routing number. Any statement should work, but you can also stop by your local bank branch and ask for a letter proving you have a valid account. Check ahead of time with the utility company or institution to ensure that your bank letter will be an acceptable substitute.

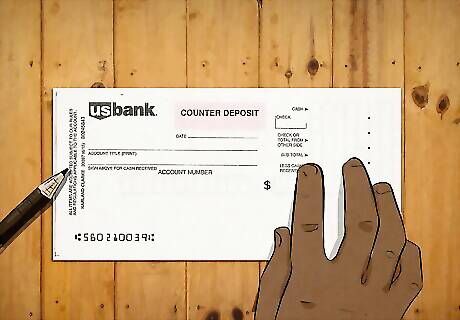

A deposit slip Flip to the back of your checkbook to see if your bank included any deposit slips. These deposit slips normally have your account number and routing number pre-printed on them. If your slips do have your account info on them, you can probably use one of those instead of a voided check. The info on the slip is identical to the info on your checks. You don’t need to void a deposit slip because they’re only used to put money in your account. If someone wants to commit fraud by throwing funds in your account, there’s no reason to stop them!

Digital bank linking programs The purpose of a voided check is to connect a bank account to another institution. These days, many companies use digital bank linking programs to connect accounts without wasting any paper checks. Plaid is the most popular program for this service, but there are a few others out there.

Canceling a Check After You Have Sent It

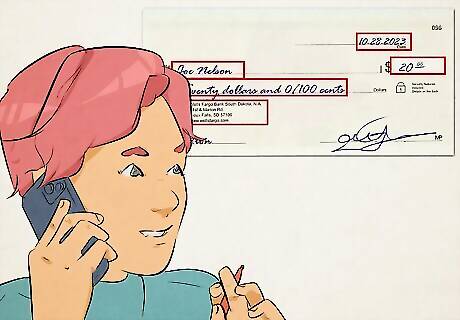

Ensure you have all the required information. If you want to stop a check payment after you have sent it, you must act quickly. Canceling a check is different than voiding a check and generally incurs a fee. In order to save time with the bank, make sure you have all the necessary information on the check you want to cancel. The information required may vary by bank, but you should make sure you have the following details: The check number, the amount the check was for, and the date of the check. The payee, or the person or organization to whom you wrote the check. The reason for stopping the payment, such as writing the wrong amount on the check.

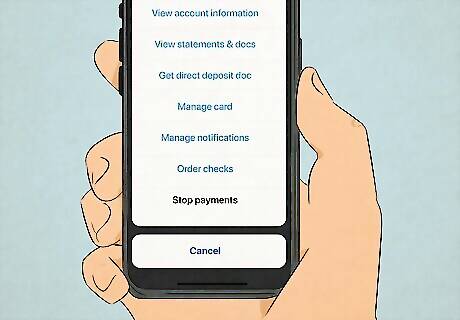

Void the check online. Depending on your bank, you will probably be able to cancel a check through your online banking account. It's essential that you do this quickly. If the payment has been processed, the only way to stop it is by contacting your bank directly and getting a "Stop Payment Order." A stop payment order is an order not to pay a check that has been issued but has yet to be cashed. If requested soon enough, the check will not be debited from the payer's account. Most banks charge a fee for this service Log into your account and seek out the customer services and options provided by your bank. If you have the option to stop a check payment or void a check, select this and cancel the appropriate check number. Make sure you copy the number across correctly, or you might cancel the wrong payment.

Phone your bank. If you don't have access to online banking or just want to deal with a real person, phone up your bank directly. You will be asking them for a "Stop Payment Order." Speed is important, so using the phone is a good option if you get through to somebody in customer service without spending too long on hold. A stop payment order is an order not to pay a check that has been issued but not yet cashed. If requested soon enough, the check will not be debited from the payer's account. Most banks charge a fee for this service. Before you call, make sure you have all the same information about the check you want to cancel that you would need in order to cancel it online: the check number, amount, and date, the payee, and the reason you need to stop the payment.

Comments

0 comment