views

New Delhi: In a major relief for the salaried class, Union Finance Minister Arun Jaitley rolled back the Budget proposal to tax 60% of Employees Provident Fund withdrawal on retirement. Making the announcement in the Lok Sabha on Tuesday following Prime Minister Narendra Modi's intervention and a huge hue and cry by the opposition parties as well as trade unions, Jaitley said that the proposal intended to encourage private sector employees to join the Nation Pension Scheme (NPS).

He, however, retained the tax proposal for the NPS.

Jaitley announced in Lok Sabha that paragraphs 138 and 139 of budget speech related to tax on EPF have been withdrawn.

What paragraphs 138 and 139 of budget speech says:

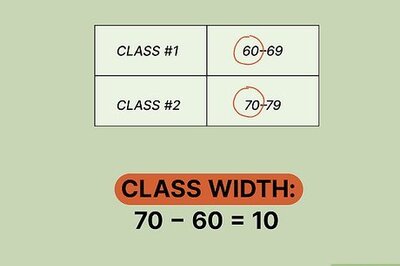

138. In case of superannuation funds and recognized provident funds, including EPF, the same norm of 40% of corpus to be tax free will apply in respect of corpus created out of contributions made after 1.4.2016.

139. Further, the annuity fund which goes to the legal heir after the death of pensioner will not be taxable in all three cases. Also, we are proposing a monetary limit for contribution of employer in recognized Provident and Superannuation Fund of Rs 1.5 lakh per annum for taking tax benefit.

CNN-IBN had reported that PM Modi had asked the Finance Minister to reconsider the budgetary proposal.

Sources had said that an official level meeting was held in PMO on the EPF tax issue on March 3, 2016, adding that the Finance Minister was likely to make an announcement on the exemptions on the floor of House when he replies to budget.

Jaitley had justified the move to bring in the taxation proposal in the Union Budget 2016-17 while claiming that the proposal would encourage pension savings.

The Finance Minister had claimed that the Narendra Modi government's aim was to create an insured India and presumptive taxes would benefit the small and medium taxpayers.

In his post-Budget 2016-17 interaction with industry chambers, the Finance Minister pointed that the revenue department was doing an important job to make sure that people comply.

Comments

0 comment