views

Pakistan and the International Monetary Fund (IMF) have completed the first round of technical-level talks after which the Washington-based lender is supposed to share nine tables comprising macroeconomic and fiscal framework with the Pakistani authorities, paving way for the policy-level parleys next week.

Both Pakistan and IMF will sign a staff-level agreement if both the parties reach a consensus on how to fix the economy by February 9.

According to GeoTV, the Pakistani authorities have massively revised downward the macroeconomic framework and shared it with the IMF under which the real GDP growth is projected to go down from 5% to 1.5%-2% while inflation will escalate from 12.5% to 29% on average in the current fiscal year.

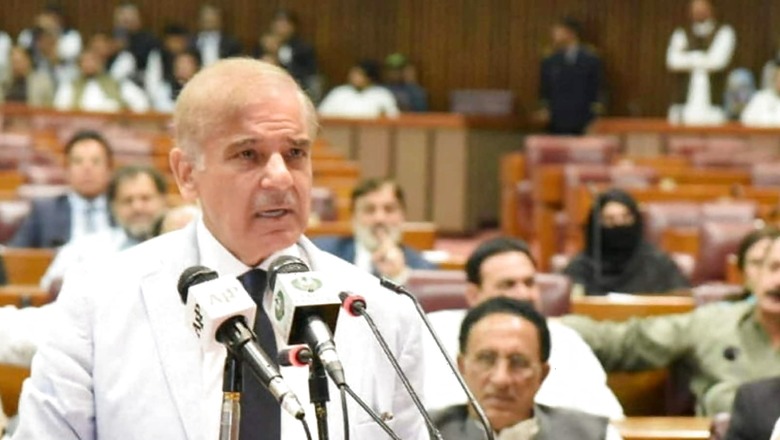

Pakistani Prime Minister Shehbaz Sharif had also warned of “tough time” as his government struggles to keep up with the IMF conditions to release the next instalment for the loan package.

Pakistan is seeking $1.1 billion from the IMF as part of its $6 billion bailout package to avoid default. Negotiations with the IMF on reviving the bailout started on January 31.

Now, IMF has asked Pakistan to meet these new demands:

-Cut in defence budget gradually

-Declare the assets of civil & military servants of Grade 17 to 22; FBR has issued SRO for assets declaration of Civil Military servants from BPS 17-22

– Increase excise duty to generate Rs 25-30 billion

-Tax on banks’ foreign exchange income to generate Rs 20 billion

-A 3% flood levy is expected to generate Rs 60 billion

-Raise the federal excise duty on sugary drinks to create Rs 60 billion

-Withhold tax on bank transactions of non-filers to generate Rs 45 billion

-Rs 20 to 30 billion advance tax on the sale/purchase of immovable property

-Capital value tax on imported and locally assembled vehicles to generate Rs 10 billion

-Jack up federal duty on Tier-I and Tier-II cigarettes by at least Rs 2 per stick to raise Rs 120 billion

-Raise petroleum levy by Rs 70-80 per litre

-Slap 17% GST on petroleum products

-Increase GST by 1% to 18% through a presidential ordinance

Besides the unprecedented economic crisis, Pakistan is also struggling with the aftermath of last summer’s devastating floods that caused up to $40 billion in damages.

Sharif has often blamed former premier Imran Khan and his government for the economic malaise. Khan was ousted in a no-confidence in Parliament in April last year, and has since been campaigning for early elections.

(with input from PTI)

Read all the Latest News here

Comments

0 comment