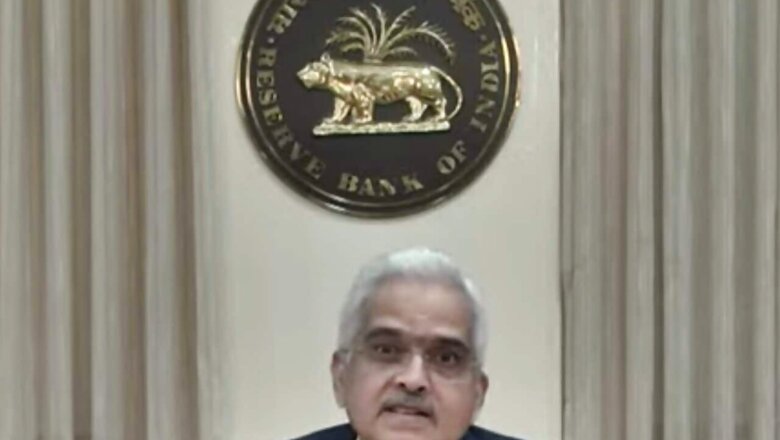

RBI, Govt In Discussions With South Asian Countries For Cross-Border Trade In Rupee: Shaktikanta Das

views

RBI Governor Shaktikanta Das on Friday said the government and the RBI are in discussions with South Asian countries to have a cross-border trade in the rupee. He added that the central bank digital currency (CBDC) is in a trial phase, and the central bank is moving carefully and cautiously on that front.

“Priority for South Asian region, including India, is taming inflation. Risks to growth, and investments may rise if inflation remains high. South Asian nations need to undertake deep reforms to raise productivity, Das said while addressing the IMF Conference on South Asia’s path to resilient growth.

The RBI governor also said South Asia needs to enhance cooperation when it comes to energy security given the region’s high dependence on fossil fuel imports. Taming inflation, containing external vulnerabilities, raising productivity, strengthening cooperation for energy security, green energy cooperation, and promoting tourism are key policy priorities for South Asian nations.

“At the central bank level, a key dimension for cooperation has been learning from each other on common goals and challenges… Rupee settlement of cross-border trade and CBDC, where the RBI has already started moving forward, can also be areas of greater cooperation in future,” Das said.

He said the key to facing the challenges of geo-fragmentation is to revive the efficacy of multilateralism. “I am not a believer of modern monetary theory. Any policy response can’t be unbridled and has to be calibrated,” Das.

Das also said the calibrated and measured response of the RBI during the pandemic has helped us to pull out the liquidity and not get caught in a ‘chakravyuh’.

The governor outlined six policy priorities before the South Asian region to deal with critical challenges arising due to Covid, inflation, financial market tightening and the Russia-Ukraine war.

“Multiple external shocks… have exerted price pressures on South Asian economies. For successful disinflation, credible monetary policy action, targeted supply-side interventions, fiscal trade policy and administrative measures have become key instruments,” Das said.

Das said while the recent softening of commodity prices and supply-side bottlenecks should help in lowering inflation going ahead, risks to growth and investment outlook may rise if inflation persists at high levels.

Prioritising price stability may be the optimal choice for the South Asian region, he added.

Read all the Latest Business News here

Comments

0 comment