views

Dard-e-sar ke vaaste

chandan lagaana hai mufeed,

Uss ka ghissna aur lagaana

dard-e-sar yeh bhi to hai

[Sandalwood paste is the ideal cure for a headache,

(But) its preparation and application is a headache in itself!]

That Urdu couplet best encapsulates Kannauj's long-standing love affair with sandalwood oil and attar (perfume). Situated along the mighty Ganga in Uttar Pradesh, Kannauj is one of the oldest cities in the country. In its heyday, it was regarded as the Grasse of the East, after the French town famous as the perfume capital of the world.

Given the huge demand for sandalwood oil for making attar, Kannauj became the hub for distilling it even though most of the wood actually grew in the southern states of Karnataka and Tamil Nadu. The city dominated the world market for sandalwood oil for a long time, exporting roughly 100 tonnes - half its production - at the peak during the late 1980s and early 1990s.

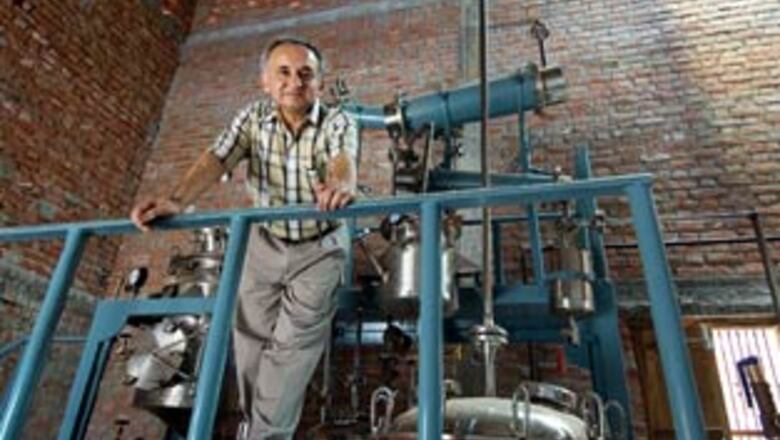

But mention chandan (sandalwood) to Krishna Narain Kapoor, whose family has been engaged in the art of making attar based on sandalwood oil for over a century, and he looks away with a grimace.

"Why do you ask? What good will come of it?" His bitterness is not without reason.

The 65-year-old Kapoor's ancestor set up the first and biggest modern distilling and perfumery company in Kannauj, Manaulal Ramnarain, in 1880.

Over time, the family broke into four separate firms. Kapoor's firm, Indian Fragrances & Chemicals, produced around 800 kilos of sandalwood oil every month and employed 80 people at its peak.

But now the shutters are down. His is not the only distillery to shut shop. India's total shipments have plummeted to a paltry 5 tonnes and processors are increasingly buying foreign varieties of sandalwood oil. As for Kannauj's attar industry, it is all but gone. So what went wrong?

A RAW DEAL

Insiders say things started going wrong in 1978-79 when Indonesia, then the biggest exporter of sandalwood in its raw form, banned the export of raw sandalwood. India stepped in to fill the supply void for the Far Eastern countries. They needed sandalwood for their incense industry and in religious ceremonies, and kept bidding the price higher.

PAGE_BREAK

Exporting raw sandalwood suddenly became more lucrative than making oil. The easy money involved in the supply of raw wood led to its widespread smuggling and mindless exploitation of sandalwood forests.

Ironically, it was a well-intentioned diktat for protecting sandalwood that delivered the knockout punch. In 1996, in an example of the road to hell being paved with good intentions, the central government decided to regulate the export of sandalwood and its oil by imposing export quotas. It set up a system of raw-sandalwood auctions. One could export the oil only if one bought the wood.

That move constricted supply and jacked up the price of Indian sandalwood oil. Today, it costs anywhere between Rs. 65,000 per kg (if it is extracted from smuggled wood) and Rs 1.5 lakh per kg. India has out priced itself from the market, while Australia has positioned itself as the dominant supplier of sandalwood and its oil. It has also started growing Indian varieties.

Ironically, India will soon begin buying sandalwood oil of the indigenous variety grown in Australia.

"Indian sandalwood oil is priced at Rs 65,000 per kilo which is easily twice the price of sandalwood oil from Australia and three times the price of African sandalwood oil. Selling such a product at a global level is impossible," rues Kapoor. On top of that, it takes inordinately long to get an export licence. The first set of export licenses were issued in 1998, almost two years after the first auction.

"How could you wait for two years before delivering an export order? No international client will wait that long," says Moraddhwaj Saini, another erstwhile distiller. The bigger problem as a distiller and exporter is the lack of surety about obtaining the next license and thus guaranteeing regular supplies to one's clients overseas.

Kapoor finally brought down the curtains on his distillation plant last year. Now he has a plant worth Rs 1 crore gathering dust. Kapoor's distillery, one of 22 such distilleries in Kannauj, was the last to be closed down. "It was not easy for me to give up on my family business," he says.

"My heart skips a beat when I think of chandan," says 80-year-old Saini, wistfully gazing at the twin smokestacks of his idle distillation plant worth Rs 40 lakh. His factory was one of the first few to shut down in 1998.

PAGE_BREAK

A FADING FRAGRANCE

One obvious fallout of the unabated increase in sandalwood prices is that it has totally distorted the character of Kannuaj's USP - its traditional attar industry.

In the 1970s, attar made from top-quality sandalwood oil sold as a personal fragrance; that from inferior quality oil went into making incense and flavouring pan masala.

When oil prices shot up, attar as a personal fragrance became prohibitively expensive. Already, preferences were changing towards modern perfumes; this hastened the process.

By the start of the 1980s, attar manufacturers turned to the other domestic industry which was coming up in a big way - the pan masala and tobacco industry. But attar producers had to meet the price compulsions of pan masala and tobacco industry, so they began substituting sandalwood oil with liquid paraffin and other similar compounds as the base ‘note' or layer. "How can a gutkha (a mix of pan masala and tobacco) sachet continue to be priced at just Re. 1 all these years when sandalwood oil prices are shooting through the roof?" asks Saini. "Attar manufacturers had to find some way to substitute sandalwood oil."

Today, 90-95 per cent of all attar manufactured in Kannauj is used for flavouring pan masala and tobacco. Only around 10-15 per cent of all attars use sandalwood oil primarily because the main consumers of attars (the pan masala industry) do not want to increase the retail prices of their products.

Of the 5 per cent attar produced as personal fragrance, almost all is exported to West Asian countries like Saudi Arabia.

"Perhaps it may not be wrong to say that a whole generation has gone by without really knowing what true sandalwood oil-based attar really smells like," say Pradeep Kapoor with a wry smile. He also belongs to the same family which started the first distillation and perfume factory in Kannauj. His family firm, Jagat Aroma, moved out of the sandalwood distillation business and now exports fragrance components to foreign perfume manufacturers like Lancome, Tom Ford and G' Issey.

PAGE_BREAK

DOUBLE WHAMMY

The story of India's loss doesn't end here. In the late 1990s, around the time that India's grip on the sandalwood oil trade had begun to loosen, Australia spotted an opportunity and started working on a unique project: It started developing plantations of the Indian variety of sandalwood.

Australia's indigenous variety of sandalwood, Santalum Spicatum, is decidedly inferior to the Indian variety, Santalum Album, in terms of oil content. For that reason, Australia was till then a bit player in the sandalwood export market.

This however did not deter the Australian government to put in place the Sandalwood Act of 1929 to ensure the regeneration and sustainability of the most valuable commercial wood in the world. The Act mandates that only a percentage of sandalwood is available for harvest each year and for every tree cut down, a dozen seeds must be planted.

At present there are about 20,000 hectares of sandalwood plantations of different ages and species in Australia. Most of these plantations are in Western Australia. The Forest Products Commission (FPC), which governs the state-owned sandalwood resources of Western Australia, claims to be the largest supplier of sandalwood resources in the world.

"To the best of my knowledge, there is about 15 to 17 tonne of sandalwood oil produced a year in Australia, with expectations of this increasing as the plantations mature. The majority of the oil goes overseas, with little consumption in Australia…I would think in a round about way, India might end up with about 20 per cent of the exports," says Executive Chairman of the Wescorp Group of Companies, Tim Coakley.

Wescorp Sandalwood Pvt Ltd is the sole processor, marketer and exporter of Santalum Spicatum for FPC. It is expected that Australia would start exporting the Indian variety of sandalwood oil to India in the course of the next three to seven years.

"It's really a shame how we have managed to ruin a sector where we enjoyed undisputed dominance. It is the result of over regulation," sighs Pradeep Kapoor.

PAGE_BREAK

Western Australia claims to be the only region in the world that can guarantee harvest of approximately 2,000 tonnes of sandalwood each year on a sustainable basis. In India exporters like KN Kapoor have to shut shop because they are not sure about the availability of sandalwood or the availability of export license.

THE END OF THE ROAD?

But not all is lost. If the government wants, it can still work towards developing India's sandalwood forests, especially by roping in the private sector, and we can regain our lost dominance," says Saini.

"Look at how the paper industry thrives in the US, Canada or the Scandinavian countries," points out Pradeep Kapoor. "They have a proper re-forestation policy. Here the government never involved the private sector who stood to gain the most from sustainable exploitation of the sandalwood forests."

In Canada it is a pretty straightforward deal. The forests remain the government's property but are given to private players on a long-term lease (100 years or more). This allows private players to plan better. For each tree that is cut, the company must plant two new ones. The state monitors the way the forests are being managed. Apart from the lease money, the government earns through local taxes.

Bangalore-based environmentalist Leo Saldanha says, "If we allowed sandalwood to be farmed and there was an excess of supply then automatically it can intervene against thefts taking place. Today it is very easy to steal it."

But he feels leasing forests to companies is not a solution for India because human densities in our forests are much higher. You can travel for days in the Canadian and North American forests "and you won't find anyone," he says.

"When you bring in industry just to make sure sandalwood farming takes place, the natural result would be that local people are denied their natural and rightful access to those lands," he adds.

Saldanha's solution is to allow tribal and forest dwelling communities to farm these valuable trees. "In reality, it is the local forest dwellers who catch the poachers, not necessarily the forest department officials…. By and large protection to sandalwood comes from the local forest communities since it has cultural and religious sanctity for them."

A very senior Indian Forest Service official, who requested anonymity, says India would have to ban all use of sandalwood for 20 years before we can regenerate the sandal wealth. Pradeep Kapoor says "Waiting would be both good and bad. Bad because no oil distiller can wait for such a long time and good because the move will get us back on track."

Protect the forest by involving the communities, the birds will carry the seeds and do the job of planting and sandalwood's regeneration potential will take care of the rest, says Saldanha. "It's a very healthy tree, you don't have to do anything."

AN EVERGREEN AROMA

Traditionally, all attars were sandalwood-oil based because of the unique ability of sandalwood oil to lose its own mild fragrance and absorb another. The other reason for its use is the remarkable stability it provides to the perfume. It is generally held that well-made attar based on sandalwood oil would smell just the same even after 100 years.

However, paraffin-based attar should not be expected to hold the fragrance for even a full year. Moreover, it lacks the medicinal qualities of sandalwood oil. "Sandalwood oil was the best fixating agent. That's why it was valued. It was the base note over which the pyramid of an attar or perfume is structured," explains Pradeep Kapoor, a former attar maker.

Find this article in Forbes India Magazine of 14 August, 2009

Comments

0 comment