views

New Delhi: Come February 1 and Finance Minister Piyush Goyal will present the Union Budget to the Parliament one final time before the Lok Sabha elections in 2019. To expect a vanilla narration will be nothing short of ignorance.

Former Cabinet Secretary and member planning commission, BK Chaturvedi put it aptly when he told News18, “this government has the knack of doing everything differently.”The Budget exercise has been no exception. Jaitley changed norms when he presented the Budget on February 1 instead of the last day of the month; he merged the Railway Budget with the General Budget, ending a 92-year-old tradition of a separate budget for Indian Railways.TRACING BACK TO THE BRITS

Budget is the most extensive account of government finances. It is the annual statement of government’s revenues from all sources and expenses of all activities undertaken during the financial year. It also comprises estimates for the next fiscal year called budget estimates. The Ministry of Finance, National Institution for Transforming India (NITI) Aayog, administrative ministries and the Comptroller & Auditor General (CAG) of India are the main players in the preparation of the Budget document.

The first Indian Budget was presented by James Wilson on February 18, 1860. Wilson was the finance member of the India Council that advised the Indian Viceroy. He was a Scottish businessman, economist and a Liberal politician. He was the founder of The Economist weekly and the Standard Chartered Bank.

Since then, the Budget has come a long way and finance ministers over the years have added their unique touch and style to this annual ritual. India has seen 35 finance ministers, including the likes of Indira Gandhi, Rajiv Gandhi, Manmohan Singh, Yashwant Sinha and Jaswant Singh.

Independent India’s first finance minister RK Shanmukham Chetty, an industrialist, erstwhile Diwan of Cochin state and Constitutional Adviser to the Chamber of Princes presented his first Budget on November 26, 1947.

Until 1999, the Union Budget was announced at 5 pm on the last working day of February. This practice was inherited from the colonial era when the British Parliament would pass the budget at noon and India would follow by presenting the Budget in the evening, the same day. It was Yashwant Sinha, the then finance minister in the Bharatiya Janata Party-led National Democratic Alliance (NDA) government, who changed the ritual by announcing the 2001 Union Budget at 11 am.WATCH OUT FOR THE BAG

The word ‘budget’ was derived from the Middle English word ‘bowgette’, which came from Middle French ‘bougette’ — meaning a leather bag. The story of the budget box goes back to the time when Queen Victoria’s Chancellor of the Exchequer (Britspeak for finance minister) William Ewart Gladstone carried his papers in a little red suitcase. Since then, the little red box has featured in every single British budget till 2010.

Our finance ministers simply continued with this colonial legacy of over 150 years. The Indian version of the bag, though, has gone through some changes over the years.

Independent India’s first Budget was presented by RK Shanmukham Chetty on November 26, 1947. He was seen carrying what looks like a leather portfolio bag. A decade later, TT Krishnamachari posed with a slender file instead of the usual Budget box.

By 1970s the box underwent a makeover. A classic hardtop, aluminium-rimmed attache case was used to carry the Budget documents. This was used by both Yashwantrao Chavan and Indira Gandhi.

FMs continued to experiment with the form, if not the idea of the Budget bag. Yashwant Sinha’s 1998-99 version had straps and buckles down the front while Manmohan Singh’s epochal 1991 version looked more or less like its Gladstone granddad but in black. P Chidambaram used a reddish-brown one in the Gladstone mould while Pranab Mukherjee held up a reddish box which looked almost like a repeat of its British counterpart.

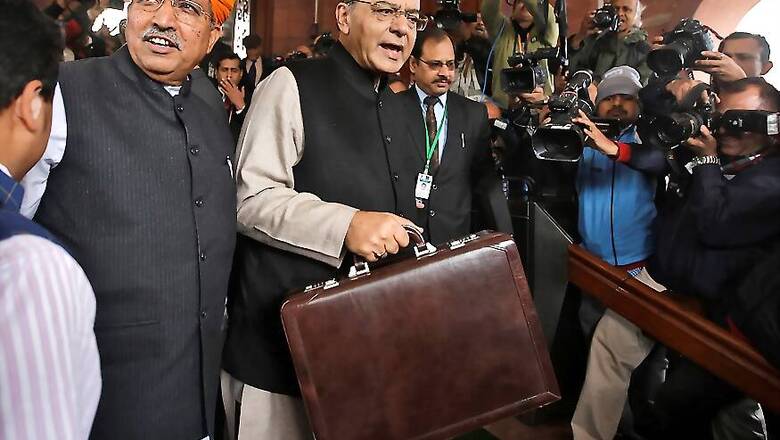

Arun Jaitley picked a similar box for the first two years that he presented the Budget, though in different colours — one black and the other tan. The budget bag is procured by the finance ministry. The ministry offers the FM a choice of three or four bags out of which the FM picks one.

The bag is definitely an intrinsic part of the Union Budget tradition and an intrinsic part of the FM’s ‘budget look’.WHY THE EMBARGO?

On the day of the UK Budget in 1947, Hugh Dalton, the British Chancellor of the Exchequer, met a journalist as he walked into parliament and casually spewed a few details on tax changes. The journalist went on to break the story before the speech.

Dalton, as a result, had to resign. This is when India’s Budget became a secret document as well. Also, when Parliament is in session, it became necessary for it to be informed first of any government matter to be discussed.HALWA, THE GREEN FLAG

Indian Budget process has another tradition — the halwa ceremony. Cooking of this traditional sweet dish marks the beginning of the printing of the Budget document. The ceremony is held about a fortnight before the Budget day. The halwa ceremony is followed by a lock-in, which means that all the 100-odd officials directly involved in printing of the budget papers cannot leave the premises and remain incommunicado till the Budget is presented. These officials cannot even contact their family or friends. The Budget Press is in the North Block, where finance ministry is housed.THE CADRE OF FMs

The first set of taxes were introduced by CD Deshmukh, finance minister from 1950-57 because the biggest challenge he faced was finding more money to implement the Five Year Plans. TT Krishnamachari, who replaced Deshmukh, had a lot of enthusiasm for taxation. In 1957, he invented two new levies, a wealth tax and an expenditure tax.

In 1987-88, Rajiv Gandhi presented the Budget and introduced corporate tax. In the Budget of 1994-95, Manmohan Singh introduced Service Tax at the rate of 5%.

The interim and final budgets of 1991-92 were presented by two ministers of two different political parties. Yashwant Sinha presented the interim budget while Manmohan Singh presented the final Budget. Yashwant Sinha presented the 1991 Budget in the backdrop of the forex crisis. His 1999 Budget was in the backdrop of Pokhran nuclear tests. The 2000 Budget was presented by Sinha in the backdrop of the Kargil war, while the 2001 Budget was presented in the backdrop of the devastating Gujarat earthquake.

From 1955-56, Budget papers began to be printed in Hindi as well. The budget for 1965-66 announced the first disclosure scheme for black money.

The Budget of 1973-74 is known as the ‘Black Budget’. The budget deficit was Rs 550 crore.

In his 1986 budget, VP Singh proposed concessions for the poor –subsidised bank loans, setting up of a small industries development bank and an accident insurance scheme for municipal sweepers.RIGHT AFTER THE BUDGET

Immediately after the Budget is presented in Lok Sabha, three statements — the medium-term fiscal policy statement, the fiscal policy strategy statement and the macro-economic framework statement under the fiscal responsibility and budget management act, 2003 are presented in Parliament. In an election year, the Budgets may be presented twice — first to secure a Vote on Account for a few months and later in full.

No discussion on Budget takes place on the day it is presented to the House. Budgets are discussed in two stages — the General Discussion, followed by detailed discussion and voting on the demands for grants.

Comments

0 comment