views

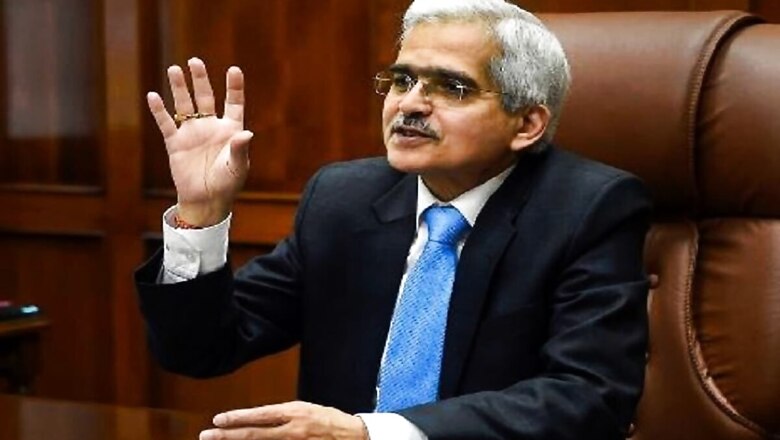

Reserve Bank of India (RBI) Governor Shaktikanta Das said the central bank and the government have managed the situation reasonably well during the entire Covid-19 period. In an exclusive interview with CNBC-TV18, Das said that the RBI has several instruments on the table to manage liquidity and will not prematurely pull out liquidity to stifle growth.

He said that the central Bank has many known and unknown tools to deal with liquidity situations and that the market should take the signal from the RBI and must trust it.

“Our forward guidance has been much more explicit than ever before. There are some subtle messages on liquidity that markets should read. The signal was sufficiently clear in the February policy,” stated the Governor.

The governor added that at the moment, he is okay with the level of liquidity. “The messages from central banks are always a mix of words and subtle signals. At the moment, we are okay with the level of liquidity. All the instruments are on the table; if required we will use new instruments,” added the RBI governor.

Das also said that the situation is never easy and they cannot have a straight-line evolution of the economy. The economy across the world has gone through a tough phase in the last year due to the COVID-19 pandemic and lockdowns followed by it.

Das said that the market should take the signal from the RBI and must trust it. The RBI also gave some subtle messages on the liquidity that the markets should read, said Das, adding that the signal was clear in the February policy. The RBI Monetary Policy Committee (MPC) had kept the repo rate unchanged in the sixth and last bi-monthly monetary policy meeting for the financial year 2020-21. The repo rate stands at 4 percent and the reverse repo rate has at 3.35 percent.

Read all the Latest News, Breaking News and Coronavirus News here

Comments

0 comment