views

Understanding Tenant Improvements and Leasehold Improvements

Define tenant improvements. Tenant improvements are capital improvements made by the landlord. The landlord makes these improvements to prepare the space for the tenant. These improvements become permanent components of the property. They are owned by the landlord, and they remain capital assets of the landlord even when the tenant takes possession of the property. For example, suppose a landlord owns a commercial building that he wants to lease out as office space. In order to attract the right tenants, the landlord installs floor and wall coverings, ceilings, partitions, air conditioning, fire protection, and security. The landlord pays for these improvements.

Identify leasehold improvements. Leasehold improvements include customization of the property made by the tenant. Examples include shelving, cabinetry, and painting projects. Depending on how the tenant improvement section of the lease agreement was negotiated, either the tenant or landlord may pay for these improvements. For example, suppose a landlord owns a commercial space and the owners of a hair salon and spa want to rent it. The owners of the hair salon plan to install carpeting, lighting and walls and doors for private rooms. The tenant, or the owners of the hair salon, pay for the improvements. Sometimes, the landlord gives the tenant an allowance, called a tenant improvement allowance, to pay for the leasehold improvements. This allowance is usually a certain dollar amount per square foot of space. If the cost of the leasehold improvements exceeds the tenant improvement allowance, the tenant pays for those improvements out of pocket. Sometimes the tenant alone pays for the improvements. No matter the payment arrangement, in most cases the improvements become the property of the landlord at the end of the lease.

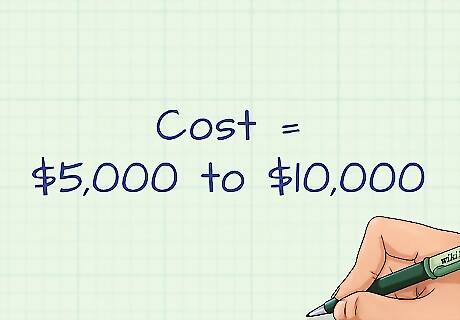

Account for tenant improvements and leasehold improvements. Tenant improvements and leasehold improvements typically qualify as capital expenditures. This means that the cost of the improvements exceeds a predetermined limit established by the company, known as the capitalization threshold (which is typically between $5,000 and $10,000). Capital expenses are recorded as an asset on a balance sheet, and then charged to expense over time on the income statements using depreciation or amortization. If the landlord makes tenant improvements, the capital expenditure is recorded as an asset on the landlord's balance sheet. Then the expense is recorded on the landlord's income statements using depreciation over the useful life of the asset. If the tenant pays for leasehold improvements, the capital expenditure is recorded as an asset on the tenant's balance sheet. Then the expense is recorded on income statements as amortization over either the life of the lease or the useful life of the asset, whichever is shorter. The tenant expenses the leasehold improvements with amortization instead of depreciation because the ownership of the improvements reverts to the landlord at the end of the lease. Therefore, the improvements are treated as intangible assets, for which amortization is used instead of depreciation.

Learn the difference between depreciation and amortization. Both depreciation and amortization are methods to record the expense of a capital expenditure on an income statement over time. Some people use the terms interchangeably, although this is not technically correct. The difference between depreciation and amortization has to do with tangible and intangible assets. Tangible assets are physical assets, such as land, buildings or equipment. These are recorded with depreciation. Depreciation is calculated using the useful life of the asset and the salvage value, or the amount for which the asset can be sold at the end of its useful life. Intangible assets are non-physical assets, such as licenses, copyrights, patents or trademark. These expenses are recorded with amortization.

Expense leasehold improvements with amortization. The tenant makes leasehold improvements and expenses them with amortization. Even though many leasehold improvements are actually tangible assets, such as carpeting or cabinetry, the tenant records the expense for these improvements with amortization. The reason has to do with ownership of the assets. Since the landlord retains ownership of the improvements at the end of the lease, there is no salvage value for the tenant. Therefore, the leasehold improvements are treated as intangible assets and accounted for with amortization.

Expense tenant improvements with depreciation. The landlord makes tenant improvements and expenses them with depreciation. These capital purchases are treated just like other ordinary capital purchases. They are tangible assets that the landlord owns. They have a useful life and a salvage value. The landlord records them as an asset on the balance sheet and then expenses them over time as depreciation on income statements.

Accounting for Leasehold Improvements

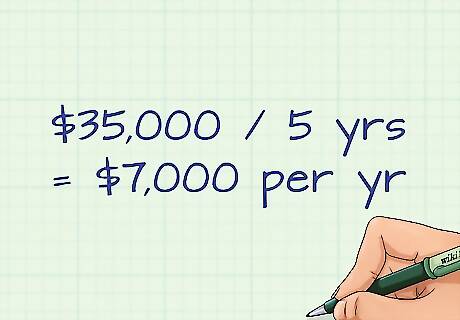

Know who accounts for leasehold improvements. Since the tenant pays for them, it is the tenant who makes the entries for leasehold improvements. The tenant records the capital expenditure as an asset on their own balance sheet. Then the cost of the improvements is recorded as amortization on the tenant's income statements over time. For example, suppose the hair salon and spa who is leasing commercial space from the landlord spends $35,000 on the necessary improvements. It is the hair salon who will record those assets and expenses on their balance sheet and income statements.

Define the amortization period. The IRS requires leasehold improvements to be amortized over either the length of the lease or the useful life of the improvements, whichever is shorter. So, suppose the hair salon has signed a five-year lease with the landlord, and the useful life of the leasehold improvements is estimated to be seven years. Since the lease period is shorter than the useful life of the improvements, the expenses will be amortized over a five-year period. The hair salon will record $7,000 of amortization each year for a period of five years on their own accounting documentation ($35,000 / 5 years = $7,000 per year).

Extend the amortization period. The amortization period can be extended beyond the expiration date of the lease. Certain conditions must be met that guarantee that the tenant will renew the lease. For example, the landlord can provide a bargain-price renewal option. Or, the landlord might charge a penalty for failure to renew the lease. Either of these conditions would strongly incentivize the tenant to renew the lease, so the amortization period can be extended, resulting in smaller amortization expenses. For example, suppose the hair salon could commit to renewing the lease for an additional five years after the expiration because the landlord is offering a discount on rent if they renew. In this case, the period of the lease would be 10 years, and the useful life of the equipment is still seven years. Now, the shorter period is the useful life of the improvements. So the hair salon will amortize these expenses over the course of seven years. The annual amortization expense will be $5,000 ($35,000 / 7 years = $5,000 per year).

Record the amortization. The journal entry for amortization includes a debit to the Amortization Expense line on the tenant's income statement and a credit to the Accumulated Amortization account on the tenant's balance sheet. The journal entry is made in this way in order to achieve the matching principle. The matching principle in accounting says that expenses are reported by a company in the same period as the related revenues. According to the matching principle, it would be incorrect for the hair salon to record the entire cost of the leasehold improvements, $35,000, in the first year because revenue related to those improvements will be generated over the next several years. With amortization, part of the cost of the leasehold improvements gets moved from the tenant's balance sheet to the tenant's income statement so it can be matched with the revenue obtained from the use of these items.

Accounting for Tenant Improvement Allowances

Understand who accounts for tenant improvement allowances. The tenant improvement allowance is the amount of money the landlord agrees to contribute towards leasehold improvements. The way the allowance is recorded in financial statements depends on the nature of the agreement between the landlord and the tenant. The landlord may have agreed to reimburse the tenant for the expenses. Alternatively, the tenant might receive free or discounted rent for a number of months.

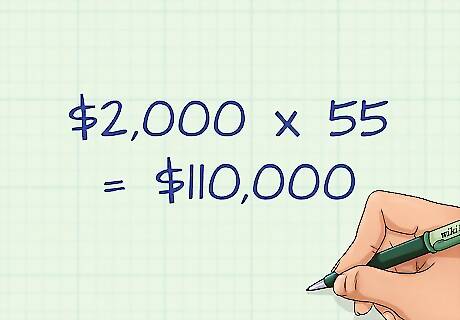

Record rent-free or reduced rent periods. Both the tenant and the landlord are required to recognize the rent on a straight-line basis over the term of the lease. This means that the total amount of rent over the entire term of the lease should be divided by the number of months in the lease so that the same amount of rent is recorded each month, even in rent-free or reduced rent months. For example, suppose the lease for the hair salon stated that the monthly rent would be $2,000 for a term of 60 months and that the landlord agreed to contribute $10,000 to the leasehold improvements in the form of free rent for five months. In this example, the hair salon is paying $2,000 per month for 55 months, or $110,000 total ($2,000 x 55 = $110,000). The term of the lease is 60 months, so the monthly rent that must be recorded as an expense for the tenant and as revenue for the landlord must be $1,833.33 ($110,000 / 60 = $1,833.33).

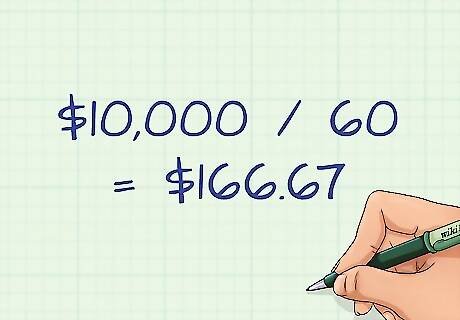

Record reimbursements for leasehold improvements to the tenant. If the landlord reimburses the tenant for leasehold improvements, this is considered a lease incentive. Both the tenant and the landlord must record the entire amount of the incentive on their balance sheets. Then the incentive is recorded as deferred rent over the life of the lease. The landlord records the gross value of the incentive as an asset on the balance sheet. Then the asset is expensed over the term of the lease as a reduction of rental income. The tenant records the gross value of the incentive as a liability on the balance sheet. Then the liability is recorded as a reduction of rental expense over the term of the lease. Suppose in the above example, the landlord gave the tenant $10,000 to use for leasehold improvements. The landlord would record $10,000 as an asset on the balance sheet. If the lease were for 60 months, then the monthly reduction to rental income to be recorded on the income statement would be $166.67 ($10,000 / 60 = $166.67). In the same example, the tenant would record a $10,000 liability under fixed assets on their own balance sheet. This would be offset by a $166.67 reduction in rental expense each month over the term of the lease.

Accounting for Tenant Improvements

Understand who accounts for tenant improvements. Since the landlord pays for tenant improvements, all expenses for these improvements are recorded by the landlord. Tenant improvements are treated as ordinary capital expenditures on the landlord's financial statements. The total amount of the expenditures are recorded as an asset on the landlord's balance sheet. Then, each month, the depreciation expense is recorded on the landlord's income statements.

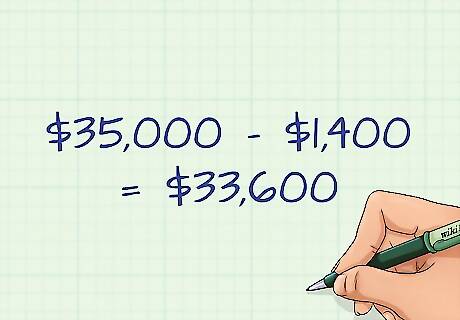

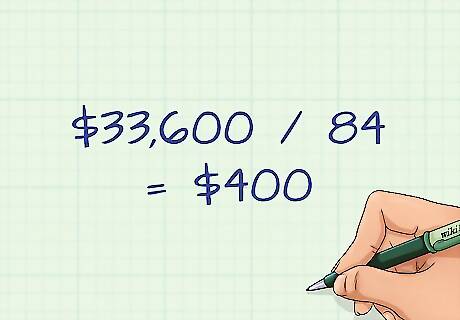

Calculate the depreciable amount of the improvements. In order to accurately record capital expenditures, know the total cost of the tenant improvements. You also need to know the useful life of the improvements. Finally, know the salvage value of any of the assets. Subtract the salvage amount from the total expenditure. This is the amount that will be depreciated each month on the landlord's accounts. For example, suppose the landlord paid $35,000 for capital improvements. The useful life is 7 years (or 84 months). The salvage value is $1,400. So the depreciable amount is $33,600 ($35,000 - $1,400 = $33,600).

Calculate monthly depreciation. Divide the depreciable amount by the number of months in the useful life of the assets. Each month, make a journal entry for the monthly depreciation. Record a debit to depreciation expenses on the landlord's income statement. Record a credit to accumulated depreciation on the landlord's balance sheet. For example, if the depreciable amount is $33,600 and the useful life is 84 months, then calculate the depreciation with the equation $33,600 / 84 = $400. This is the amount of depreciation to be recorded each month.

Comments

0 comment