views

Tracking Income and Expenses

Write down how much money you bring in each month. Your net monthly income is the total amount of money you actually get to take home every month, after all of the deductions (taxes, health care, etc.) have been subtracted. This includes your paychecks, child support, tips, monthly bonuses, Social Security payments, alimony, and any other payments you receive on a regular basis. Write everything down and total the items up. Gross income, which is the amount you made before taxes were taken out, will also be printed on your pay stubs. Don’t use your gross monthly income for this. Disregard overtime pay since that usually varies according to circumstances.

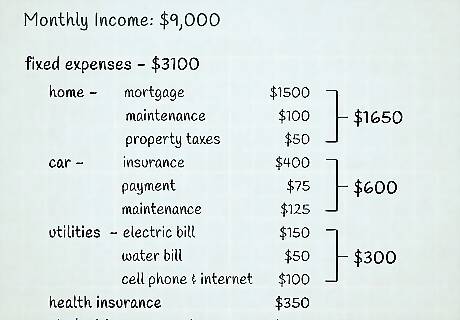

Make a list of your fixed expenses for each month. Fixed expenses are expenses that you have to pay every month no matter what. These expenses may fluctuate a little from month to month, but for the most part, they stay the same. An example of a fluctuating fixed expense is your electricity bill, since that varies by month. Common fixed expenses include: Mortgage, rent, and/or property taxes Utility bills (cable, internet, cell, electricity, water, gas, etc.) Car payment/vehicle insurance Health insurance Student loan payments To calculate the average for a fluctuating expense, look at your bills from the past year, add up the monthly amounts due, and divide that total by 12. Use that average to create your budget.

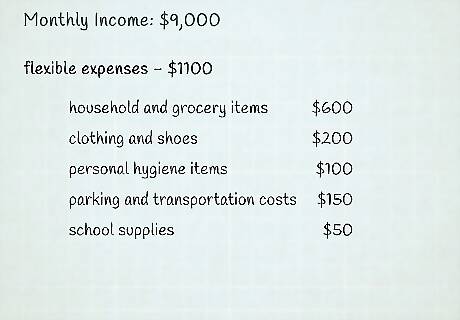

Use bank statements and receipts to add up flexible expenses. Flexible expenses are expenses that are necessary each month, but you have some control over how much you spend on them. Review your bank statements and receipts to figure out the average amount you spend on each flexible expense. Typical flexible expenses include: Household and grocery items Clothing and shoes Personal hygiene items Gasoline, parking, and transportation costs School supplies

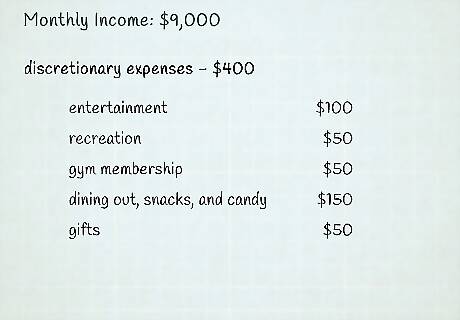

List all of your discretionary expenses and total them up. Discretionary expenses are non-essential expenses, like entertainment, that you have full control over. Generally, discretionary expenses are things that you want, but don't really need to survive. Non-essential expenses include things like: Entertainment like movies, concerts, books, magazines, and video/music streaming services Recreation like hobbies/hobby supplies, travel, video games, and amusement parks Gym membership Dining out, snacks, and candy Gifts

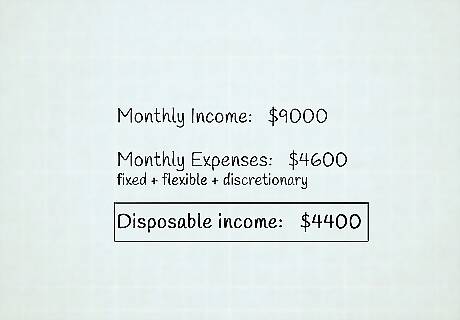

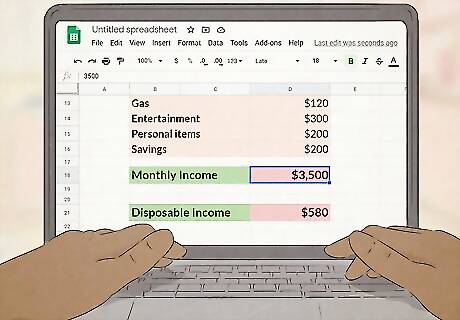

Subtract your monthly expenses from your monthly income. Use a calculator to make this math easier. If the expense total is less than the income total, you are more or less on track financially. If the expense total is more than the income total, you are off-track and need to prioritize your expenses before you can do any saving. For example, if your expense total is $200 less than your income total, that means you have an extra $200 each month to put into savings or towards a long-term goal like buying a car. If your expense total is $200 more than your income total each month, you may be struggling and unable to pay some of your bills. To get back on track, start by deciding which discretionary expenses you can get rid of.

Managing Your Money

Set aside money for monthly expenses to stay on top of things. Every time you get paid during the month, be sure to set aside the amount you budgeted for expenses, no exceptions. Once you’ve set that money aside, you can decide what to do with any that you have leftover each month. For example, if your monthly fixed expenses are $800 and you get paid twice a month, put aside $400 from each paycheck to cover the fixed expenses. Any money leftover can go towards groceries, gas, and clothes. If you get paid weekly, be sure to take a little out of each check to cover your monthly expenses.

Save leftover funds after expenses for future purchases or emergencies. Look at how much money you now have left from your income after the expenses have been covered for the month. If you know you need to make a big purchase in a few months, like a car down payment or college tuition, take all or some of your leftover money and put it towards that particular goal. Once you save up the amount you need, you can spend that money and remain debt-free. Try to save at least 10% of your income each month so that you have a financial cushion for unexpected expenses, retirement, or emergencies. Open a savings account to keep this money separate from your spending money.

Identify expenses that you can get rid of if your budget is off-track. Start writing down what you spend money on each day or use a budget app to help you keep track of day-to-day spending. Once you identify unnecessary expenses, you can cut those things out to get your finances back on track. The amount you spend on eating out, your morning Starbucks fix, and cinema trips can really add up. For example, spending $2.50 every morning on a cup of coffee might not seem like a big deal, but that comes out to $900 per year! Think about what you could do with $900.

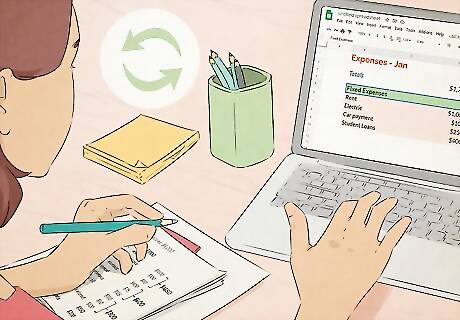

Review your budget each month and make any necessary adjustments. At the end of the month, compare how much you spent against what you budgeted for those expenses. If the amount you budgeted isn't lining up with the amount you actually spent for certain expenses, you may need to adjustment or get rid of some of your discretionary expenses to prepare for the coming month. For example, if you set aside $100 for groceries each month but routinely spend a little more than that, up your monthly grocery budget to $150 or $200. Then, see which non-essential expenses you can remove or reduce to balance out the grocery expenses. Be sure to account for income changes, too. For example, if you get a promotion at work, you can increase discretionary spending or up your savings goals. If your work hours are reduced, you may need to cut some discretionary expenses, like your gym membership, until you get back on your feet.

Using Budget Tools

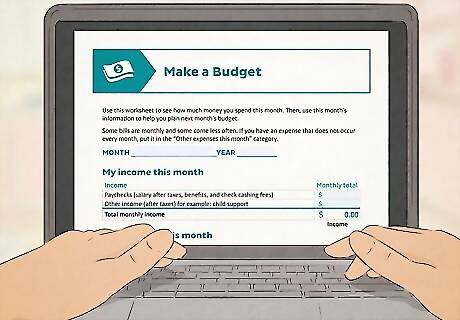

Use a premade budget worksheet to help you get organized. If this is your first time creating a budget, the process can be a little overwhelming. A premade budget worksheet can help you get started because it itemizes most of the common expenses for you and walks you through the process of adding them up with a calculator. All you need to to is print out the worksheet and fill in the blanks with your monthly totals. There are many free options online that you can download and print out. Check out this free budget worksheet: https://www.consumer.gov/sites/www.consumer.gov/files/pdf-1020-make-budget-worksheet_form.pdf Another free option: https://media.gcflearnfree.org/ctassets/topics/27/mb_budget_worksheet.pdf

Download a secure budget app for an easy way to track spending. There are many apps out there that can make budgeting a lot easier. For example, apps allow you to track spending in real time and you can set up alerts for bill payments. They also make it easier to catch suspicious account activity. Check with your bank to see if they offer an app that you can use. If you want to use a third-party budget app, make sure it offers safety features like: 128-bit SSL encryption Secure connection using SSL certificates Security scanning with VeriSign Firewall protection Multi-factor authentication Quicken, My Budget App, and YNAB all offer easy to use budgeting services.

Use a spreadsheet to get organized and prevent errors. If you don’t want to use an app or prefer a more hands-on approach, a budget spreadsheet can help you stay organized and do the math for you so you don't have to spend time adding and subtracting totals with a calculator. You can create your own using a spreadsheet program like Microsoft Excel, or you can download and use a free spreadsheet template. If you want to create your own spreadsheet from scratch, you may want to look at a budget worksheet template to help you build your spreadsheet. Check out this free template to help you track expenses: https://fyi.extension.wisc.edu/toughtimes/files/2011/02/Personal_Spending_Plan1.xls Another option: https://fyi.extension.wisc.edu/toughtimes/files/2011/02/Monthly_Budget-ppay1.xls

Buy budgeting software if you want a lot of tools at your disposal. You usually have to pay for budgeting software, but it’s generally pretty affordable. Companies often charge a small monthly fee rather than 1 lump sum to use it and they provide a wealth of tools to help you with every aspect of budgeting. If you prefer doing your budget on your computer rather than using your mobile phone, software is your best bet. Most software does comes with an app, though, so you are able to manage your budget from your tablet or smartphone. Popular budgeting software companies you can check out: Quicken Money Guard

Track spending during the month and review at the end of the month. No matter what tool you're using, it's best to write down your expenses as you pay them rather than sitting down at the end of the month with a big pile of receipts. Apps track much of this for you, but you'll still need to manually input anything you pay cash for. At the end of the month, use your worksheet, spreadsheet, app, or software to review expenses and spending habits to see if you're meeting your goals. Use the information to make budget adjustments for the next month. Don't forget to look for errors, especially if you're budgeting with paper and a pen. Consider using a budget app or software to automate your budget and reduce errors.

Comments

0 comment