views

X

Research source

Choosing a Tax Filing Option

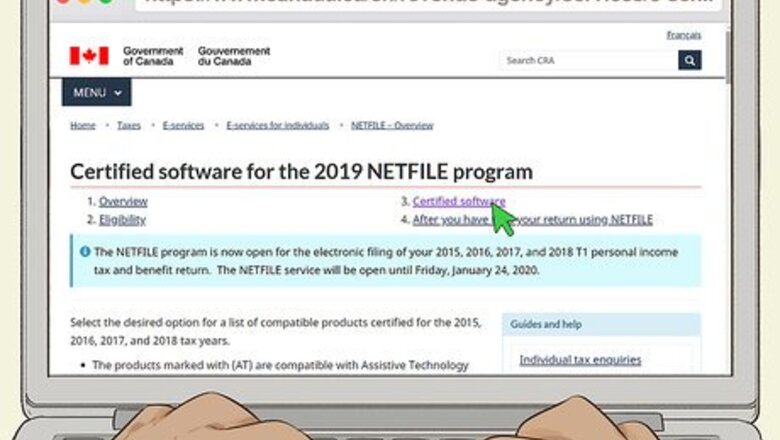

Use NETFILE to file your tax return online. For most taxpayers, filing online is the quickest and easiest option, especially if you're owed a refund. To use the NETFILE system, you must complete your tax return using certified software. Some of this software is free, while others charge you a fee. To choose from a list of certified NETFILE software, visit https://www.canada.ca/en/revenue-agency/services/e-services/e-services-individuals/netfile-overview/certified-software-netfile-program.html. You can't use NETFILE if you went bankrupt in the year for which you're filing taxes, or if you are a non-resident of Canada. You also can't use NETFILE if you need to change your name, such as if you were recently married or divorced.Tip: If it's your first time filing a tax return in Canada, you can only use NETFILE if the CRA already has your birthday on file. If you had taxes withheld from the paycheck, the CRA has your information.

Order a paper tax and benefit package if you want to mail in your return. You can get a paper tax and benefit package at a local post office or tax services office. You can also download one online from the CRA website. If you filed a paper return last year, the CRA will automatically mail the paper tax and benefit package to you at the address you reported on last year's return. If you want to order a package online, go to https://www.canada.ca/en/revenue-agency/services/forms-publications/tax-packages-years/general-income-tax-benefit-package.html and click on the name of the province or territory where you lived during the calendar year for which you're filing your return. To locate your nearest tax services office, visit https://www.canada.ca/en/revenue-agency/corporate/contact-information/tax-services-offices-tax-centres.html and scroll down until you see the name of your province or territory.

Visit a free tax clinic if you have a modest income. Free tax clinics are available to Canadian taxpayers who have a modest income and a relatively simple tax situation. Some are available year-round, but most are offered between February and April. To find a free tax clinic near you, visit https://apps.cra-arc.gc.ca/ebci/oecv/external/prot/cli_srch_01_ld.action and enter your province and city. You may not be able to use a free tax clinic if you're self-employed or own your own business, even if your income is relatively modest.Tip: Ask the volunteer tax preparer how your return will be submitted to the CRA. You may be responsible for mailing your return after it's completed.

File your return by phone if you received an invitation. If you're eligible to file your return over the phone, you'll receive an invitation in the mail in mid-February. The invitation includes instructions on how to file your return over the phone. You'll typically be deemed eligible for this service if you have an extremely low or fixed income and your tax situation doesn't change much from year to year. If you don't get an invitation, you cannot file your return over the phone. However, you may still be eligible for free assistance at a tax clinic.

Completing Your Tax Return

Gather the documents you'll need to calculate your income and deductions. If you were employed or had investment income for the year, you'll receive a tax statement, referred to as a "tax slip," for the year. You'll need these tax slips to do your taxes. You'll also need receipts or statements for any expenses you want to claim as deductions. If your employer or financial institution didn't give you a tax slip for the year, or if you misplaced it, contact them and ask for another one. You can also get copies of your slips from the CRA through its "My Account" service. If you don't have an account with this service, you can register for one at https://www.canada.ca/en/revenue-agency/services/e-services/e-services-individuals/account-individuals.html.

Update your personal information. The first part of your tax return requires you to provide your name, address, and marital status. You'll also need to list the number of children in your household. If you use NETFILE, this information may be automatically imported onto your return. However, you have to make sure the information from last year is correct. If it isn't, make sure you change it. If you are owed a refund and want it direct deposited into your bank account, you'll also have to provide the CRA with your banking information.

Report your income from all sources. Your income may be listed on your tax slip. However, some income, such as money you were paid in cash or tips you received, may not be included on a tax slip. You are still responsible for reporting this income to the CRA and paying taxes on it. Some benefits you receive may also be considered taxable income. You'll receive a tax slip from the department administering your benefits if this is the case.Tip: Complete a return even if you have no income. You may be able to claim refundable tax credits. Tax returns are also required to access various government benefits.

Claim any applicable deductions or credits. Depending on the amount of income you earned and your life circumstances, you may be able to claim deductions or credits that decrease the total taxes you're required to pay for the year. Deductions reduce your taxable income, while credits directly lower the amount of taxes you owe. Some credits are refundable, while others you can only claim to the extent that you owe taxes. Canadian deductions and credits fall into the following broad categories: Family, childcare, and caregivers Education Disability Pension and savings plans Employment expenses Provincial and territorial tax credits Climate action incentives

Submitting Your Tax Return

Transmit your return electronically if you prepared your return online. If you use one of the certified NETFILE tax return services, the software will automatically connect with the CRA servers to submit your return. You can also provide payment information if you need to pay a balance owed or want the CRA to direct deposit your refund of any overpayment. Soon after you transmit your return, you'll receive an email saying that your return was received by the CRA. Hold onto this email until you receive your refund, if a refund was owed to you.

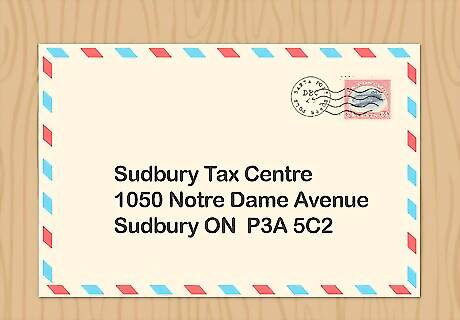

Mail your paper return to the tax centre for your area. Paper returns are processed by regional tax centres. To find the right tax centre address, go to https://www.canada.ca/en/revenue-agency/corporate/contact-information/where-mail-your-paper-t1-return.html. If you owe a balance, you don't have to send your payment along with your paper return. However, you do have to either pay the balance in full or make payment arrangements before the April 30 deadline.

Follow the instructions on your invitation to file over the phone. If you were invited to file your tax return over the phone, the written invitation you received in the mail will tell you how to do this. Do not lose your invitation until after you've filed your tax return or you'll have to use another method, such as going to a tax clinic. If you are owed a refund, you can choose to have it direct deposited into your bank account by entering your account details over the phone. If you choose to receive a written cheque, it will be mailed to you within a couple of weeks after you file.

Pay any balance you owe by April 30. Regardless of when you submit your tax return, any balance owed must be paid by the April 30 deadline or you will be charged interest and penalties. If you can't afford to pay the balance in full, you may be able to make a payment arrangement with the CRA. If you need to make a payment arrangement, call 1-866-256-1147. The system is available Monday through Friday from 7:00 a.m. through 10:00 p.m. Eastern time. If you want to speak to an agent, call 1-888-863-8657. You can also set up a pre-authorized debit arrangement by visiting https://www.canada.ca/en/revenue-agency/services/about-canada-revenue-agency-cra/pay-authorized-debit.html.Tip: The CRA accepts almost any payment method to pay your balance either online, by mail, or in person at a financial institution or Canada Post outlet. Even if you mail in a paper return, you can still pay online or in person if you choose.

Wait for your notice of assessment if you're expecting a refund. If you mail in a paper tax return, it may take up to 8 weeks for you to receive your notice of assessment and any refund you're owed. If you submit your return online, you may get your refund in as little as 8 days if you opted to receive it through direct deposit. If you filed online, you may get your notice of assessment shortly after you file your return. However, you'll likely still have to wait a few days for your refund to appear in your bank account.

Comments

0 comment