views

Placing a Freeze

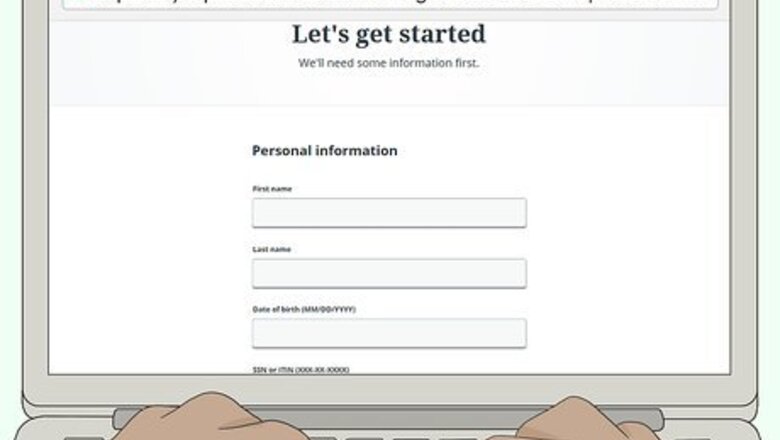

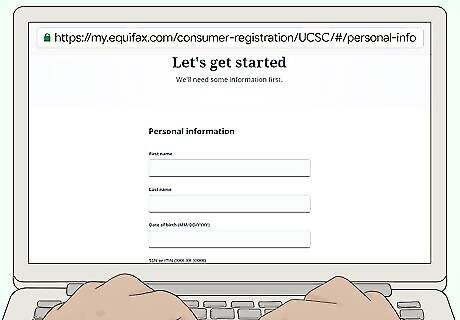

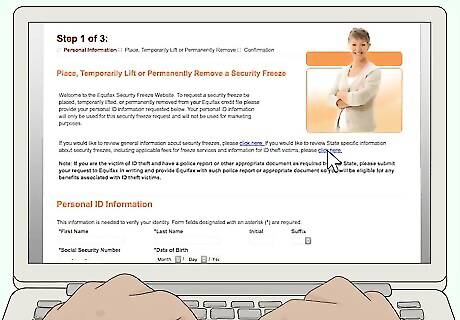

Create an online account to freeze your report online. The quickest and easiest way to freeze your Equifax credit report is to set up a free online account with Equifax. Go to https://my.equifax.com/membercenter/#/login and click the link to "Register Now." A basic account is free. However, you will have to answer a few questions to verify your identity. The questions are based on information provided in your Equifax credit report.

Call the automated number if you want to freeze your credit by phone. If you don't have secure internet access, you may not feel comfortable accessing Equifax online. In that case, you can place a freeze just as quickly by calling 888-298-0045. You'll have to enter your Social Security number on your phone and answer a few questions to verify your identity. Then you'll have the option to freeze your credit report.Tip: If you've recently moved or changed your name, you may have to mail documents to Equifax before your credit report can be frozen. The automated phone system will provide you with instructions if that is the case.

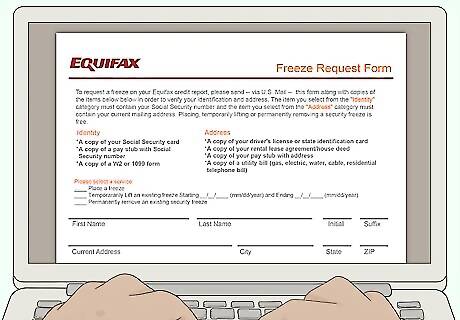

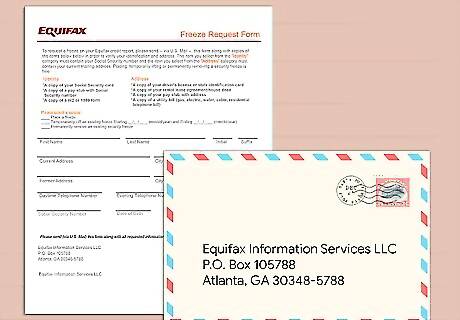

Fill out the form to place a freeze by mail. Equifax also gives you the option to print a paper form, fill it out, and mail it to Equifax. You can download the form at https://assets.equifax.com/assets/personal/Security_Freeze_Request_Form.pdf. The form must be accompanied by documents that verify both your identity and your place of residence. If you've recently moved or changed your name, you may need to provide additional documents to verify your identity. When you've completed the form, mail it to Equifax Information Services LLC, P.O. Box 105788, Atlanta GA 30348-5788. This address is also listed on the form.

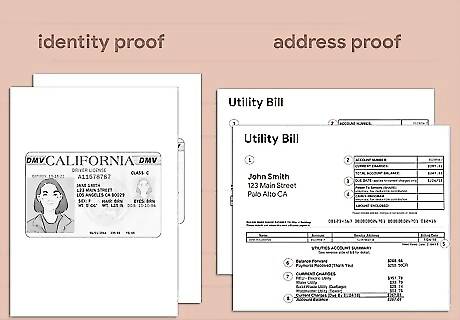

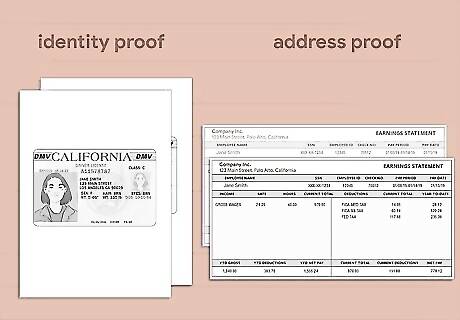

Make copies of documents to verify your identity. If you request a credit freeze in writing, your request form must also include 1 copy of a document that verifies your identity and 1 copy of a document that verifies your address. You may also be required to submit these documents if you are unable to verify your identity online or over the phone. Acceptable documents include: For identity: a valid driver's license, Social Security card, court order for name change, birth certificate, passport, marriage certificate, divorce decree For address: valid driver's license, recent utility bill, pay stub, lease or mortgage statement, bank statement

Lifting a Freeze Temporarily

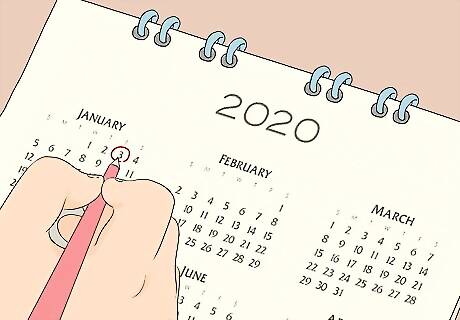

Choose the dates you want the freeze temporarily lifted. If you want to apply for credit or need to submit an application for other services, such as insurance, that might require a credit check, you can lift the freeze. This allows for that company to check your credit. You can specify a beginning and end date when the freeze will be lifted. For example, if you're applying to rent a new apartment, you might have the freeze lifted for a week after you submit your application to give the landlord time to run a credit check. Let the landlord know that your credit is frozen and the dates you're lifting the freeze. Depending on how you request the freeze, the beginning date should be far enough in advance that the lift will actually be effective during the dates you need.Tip: If you're not sure about the dates you want to unfreeze your credit, you can use the name of the creditor instead. Your freeze would still be in effect except for that company.

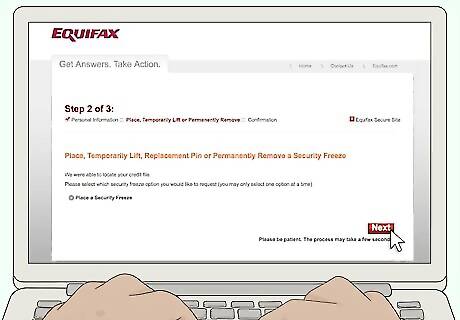

Manage your freeze through your online account. If you set up an online account for your credit freeze, go to https://my.equifax.com/membercenter/#/login and enter your login credentials. From your homepage, click through the link to manage your credit freeze. Enter the dates or name of the company you want to lift the freeze for. Make sure you click through to confirm that the freeze was lifted. You'll receive an email confirming the details you submitted.

Call the automated number if you don't have an online account. If you didn't set up an online account with Equifax when you placed your freeze, you can still do a temporary lift. Simply call 888-298-0045 and follow the prompts. You will have to enter personal information to verify your identity. You will then be given the option to receive a personal identification number (PIN) for one-time use or answer questions based on information in your credit report. After your identity has been verified, follow the prompts to enter the beginning and ending date of the freeze or the name of the company you want the freeze lifted for. Make sure you confirm that the information you entered was correct.

Mail in the paper form if you're not in any rush. Typically, if you want to lift the freeze temporarily, you have an immediate need for doing so. However, you can still request a temporary lift of your freeze by mailing in a paper form if you don't need to lift the freeze right away. For example, if you're going to be looking for a new place to live in a few months, you might send in the form and specify that you want the freeze lifted for a month while you're shopping for a home. You can download the paper form at https://assets.equifax.com/assets/personal/Security_Freeze_Request_Form.pdf. Print the form and fill it out, then mail it to the address listed on the form.

Submit copies of documents to verify your identity. If you request a temporary lift of your credit freeze in writing, you must also provide 2 documents that verify your identity and place of residence. Even if you attempt to lift the freeze over the phone, you may need to submit documents if you are unable to verify your identity over the phone. To verify your identity, make a photocopy of the front and back of a government-issued photo ID, such as a military ID or driver's license. You can also use a copy of your birth certificate or the bio page of your passport. The document you use must be valid. To verify your address, make a photocopy of a recent utility bill, lease, mortgage statement, or other document with your name and address, such as a bank statement or pay stub.

Removing a Freeze Permanently

Evaluate your reasons for removing the freeze. If you placed a freeze on your credit report because you were worried about identity theft, it typically isn't advisable to permanently remove it. Even if you think you're in the clear, it's likely that your information is still out there. There may still be times when you decide you no longer need a credit freeze. For example, if you thought your information was compromised in a data breach but later learn it wasn't, you might decide that you don't need to continue to have a credit freeze. Permanently removing the credit freeze can also give you more flexibility if you're doing something that will require multiple credit checks, such as if you're shopping for a new car or buying a house.Tip: Even though it may seem like a hassle to lift the freeze temporarily, it's worth it for the protection it provides. It also ensures that you consciously think before applying for credit.

Follow the prompts to remove your freeze online. If you have an online account with Equifax, log in at https://my.equifax.com/membercenter/#/login and click the link to manage your freeze. From there, you'll be able to permanently remove the freeze. Even if you don't have an online account with Equifax, you can set one up if you want to remove your freeze online. You'll just have to answer a few questions to verify your identity. The questions relate to information found in your Equifax credit report.

Remove the freeze by phone if you don't have online access. Even if you have an online account, you can also remove your credit freeze by calling 888-298-0045. The line is automated, so it's available 24/7. Simply provide some information, such as your name, date of birth, and Social Security number. Then, you'll be prompted to answer a few more questions to verify your identity. These questions are based on information contained in your Equifax credit report. Instead of answering questions, you can opt to have the system send you a PIN to enter through text or email. That PIN will verify your ID. After you've verified your identity, follow the prompts to remove the freeze from your credit report.

Fill out the paper form to remove the freeze by mail. If you're not comfortable removing the freeze online or over the phone, you can also download the form at https://assets.equifax.com/assets/personal/Security_Freeze_Request_Form.pdf and mail it to Equifax. Simply place a checkmark before the phrase "Permanently remove an existing security freeze." Make sure you fill out the form completely so Equifax takes action on the correct account. Then mail the form to the address listed on the form.

Provide copies of documents to verify your identity. When you mail a paper form to remove the credit freeze, include photocopies of documents that establish your identity and your address. If you try to remove a freeze over the phone, you might also be asked to mail in documents to verify your identity. Acceptable identity documents include a driver's license, state ID, military ID, or passport (bio page with photo). Acceptable residence documents include a utility bill, lease, mortgage statement, bank statement, or pay stub.

Comments

0 comment