views

Getting Your Name Cleared From ChexSystems

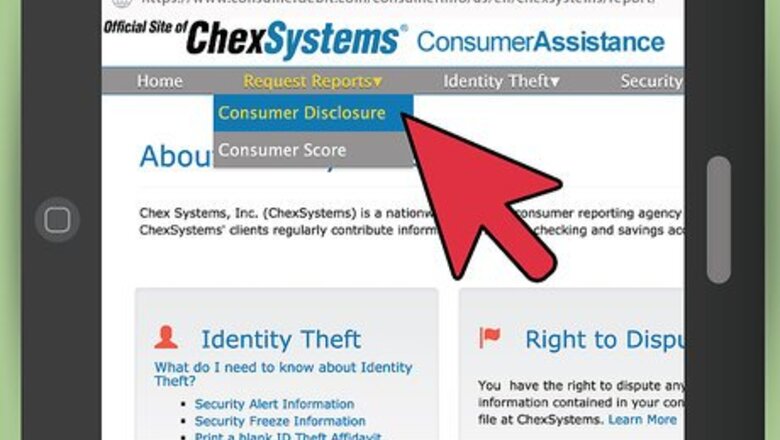

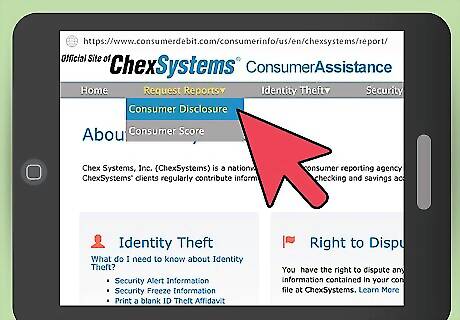

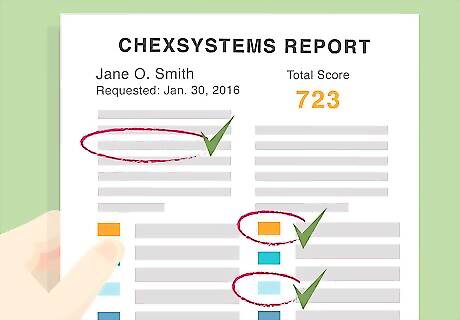

Get a copy of your ChexSystems report. Getting a copy of your ChexSystems report will allow you see precisely what your record says, and why you are being denied a bank account. To check your report, you must order the report online from the ChexSystems website. Ordering the report also allows you see if there are any errors or false information. Find out if you are on the list by reading How to See if You Are on ChexSystems List. To order the report, visit: https://www.consumerdebit.com/consumerinfo/us/en/chexsystems/report/index.htm You will need to provide personal information to obtain the report. Once you do, your report will be mailed to you within five business days.

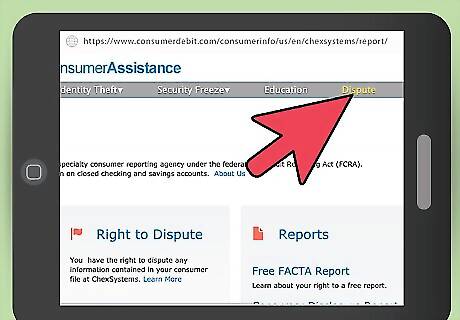

Assess the report for errors. Once you receive your report, it is time to check the report for any errors. It is not uncommon to find errors on a ChexSystems report. If there is anything unusual that you do not recognize, or any information that is incorrect, you can contact ChexSystems to dispute the error. Note that information remains on a ChexSystems report for five years, meaning that any information older than that would be an error. You will need to fill out the "Request for Consumer Reinvestigation Form" (which can be found on the website), and mail it to the address indicated. On this form you will indicate the account in question, the date, and a brief description indicating the nature of the problem. You will receive notice of the investigation results within 30 business days.

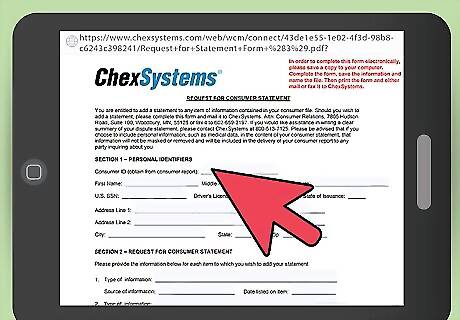

Write a Consumer Statement to ChexSystems. If your report finds no errors, or if there is information on your report you need to clarify, you have the option to write a 100 word statement to ChexSystems (200 if you live in Maine) that allows you to explain your situation. You can find the Consumer Statement Form on the same page as the Request for Consumer Reinvestigation Form.. For example, if you noticed a bounced check on your form, but that check bounce was an accident, or if there is an overdraft that was accidental or a one-time occurrence, you can explain this to ChexSystems. Also, if you owe money to the bank and it listed on your ChexSystems report, but you have paid it, you can indicate this to ChexSystems in your statement and have it removed. Remember to be professional and businesslike in your statement. This statement will likely be seen by banks in the future, and you need calmly and factually state why you believe the information on the report is unfair and poorly represents you as a banking user. Do not include profanity, or the names of other businesses or people.

Address the debts on your report. This step can be done before or after you contact ChexSystems to dispute, and is one of the most important things you can do to clear your record. If your ChexSystems report indicates you owe money to a bank, try your best to pay the owed balance off. Sometimes, the balance you owe may be a very manageable amount you forgot about, or that is within your ability to pay. If the owed amount is large and is outside of your current means to pay, contact your creditor. Creditors are extremely negotiable, and are often willing to accept a smaller amount back, rather than no amount at all. If you owe $1,000 and are only able to pay $700, contact your creditors and say you would like to make yourself right with the bank, and are able to pay $700.

Get the debt removed from your report. After you have paid the amount, be sure that your bank notifies ChexSystems to have the balance removed from your report. Once the balance is removed, your ChexSystems report will be cleared (unless you had other issues on it), and you should be able to get a bank account at another institution.

Getting an Account While on ChexSystems

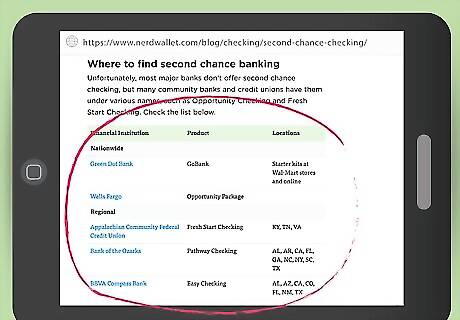

Try to find a “second chance” bank. If you are unable to get your record on ChexSystems cleared, there are other options available. One of these options is to get a second chance checking account, which allows individuals to rebuild their financial history. Second chance accounts sometimes have additional requirements (like taking a money management class) but they will allow you to have a bank account and after a year or two possibly move to a regular account. Many major banks do not have second chance checking accounts (although some do), but there are plenty of credit unions and community banks that do. If you are looking for institutions in your region that offer second chance checking accounts, NerdWallet.com offers an exhaustive list of providers by state. You can locate the list at: http://www.nerdwallet.com/blog/checking/second-chance-checking/

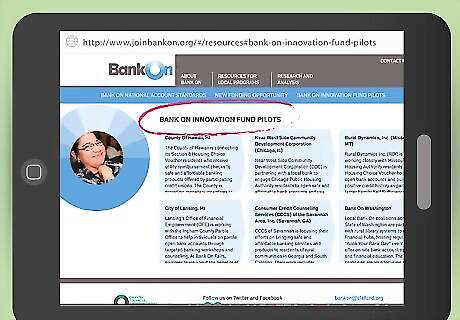

Use Bank On to find second chance bank accounts. A possible resource is Bank On, a nationwide program designed to help un-banked and under-banked Americans find low-cost, no-cost, and second-chance bank accounts. It is a collaborative effort between state governments, financial institutions, and community organizations. Visit the Bank-On website to see if there is a Bank On program in your region. If there is, contact them and inquire about what banking products and resources are available in your region to help you get a checking account. A local BankOn program will likely have innovative and local solutions to help you regain access to an account.

Enroll in CheckWi$e. This is a personal finance course developed by the American Center for Credit Education that can help you get a break from your bank. Once you complete it, you will be permanently registered in a national database, demonstrating to banks and credit unions that you are serious about managing your finances. Not all states offer this program. Search on Google for “CheckWi$e” plus the name of your state to see what’s available. If you don’t have any luck, contact your local municipality, BankOn program, or even financial institution to learn if there are similar programs available.

Make a list of bank branches in your area. You'll do better if you stick with the smaller, local banks and avoid the big banks. You may also have better luck if you check local credit unions as well. Credit unions act essentially as banks, except they don't have to pay stockholders and are generally much more lenient. Many credit unions will open an account for you if you can reasonably explain why you haven't paid a ChexSystems debt, and some credit unions will not pull a report on you even if you do have poor history.

Call and ask to speak to the branch manager or other bank official. Sometimes there's nothing like a face-to-face conversation to get things working in your favor. Most businesses want your business, but if you don't look good on paper, they'll be wary. If you present yourself, in person, as someone who is decent, with an honest reason for your past performance and evidence that you're not liable to be a problem in the future, they'll be much more receptive to working with you. Make sure to clearly explain why you have had financial issues with previous checking accounts, what steps you have taken to rectify those issues, and why those issues are unlikely to happen in the future. If you went through a bout of unemployment for example, indicate this. Also indicate if you have taken any actions to pay back previously owed bank debt.

Avoiding Issues With Chexsystems in the Future

Avoid overdraft at all costs. Going into overdraft -- or withdrawing more than you have in your account -- can lead to being listed in Chexsystems. There are a few helpful tips that can reduce your odds of going into overdraft in the future. Monitor your accounts frequently. If you see your account balance approaching zero it is important to reduce spending you can easily control. If you have essential bills coming due, consider using your credit card or line of credit so your account does not go into overdraft. It is very important to note that using credit to pay bills should only be done in emergency situations. If you regularly are running out of money in your checking account and needing to rely on credit, it means that your expenses are exceeding your income. If this is the case, it is absolutely essential that you look at options to increase your income (if possible), and if not, that you reduce your expenses so they are equal to or less than your income.

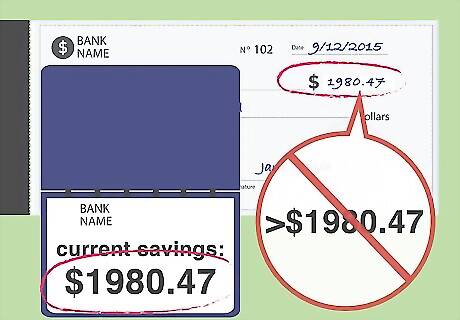

Practice caution with check writing. If you need to write a check, always confirm two things. Firstly, confirm that you have adequate money in your account to cover the check. Secondly, confirm that the money will remain in your account indefinitely until the check is cashed. Writing bad checks can easily get you listed in Chexsystems. Consider opening two checking accounts. One for your day-today transactions,and another specifically for check writing. When you need to write a check, transfer the amount into the checking-only account, and do not touch the money at all costs until the recipient cashes the check. Only write checks for amounts that you either currently have, or that you are 100% certain you will have. If you are writing a $100 check, and know you are getting paid $500 in the next week, do not write the check unless you are absolutely certain you can afford to use $100 of that $500 to cover the check.

Create a Budget. Learning budgeting skills is an excellent way to ensure your expenses are within your income every month. There are plenty of resources available online to teach you how to make a budget. In addition, there is also software available that can be useful. Look for budgeting software like Mint. Mint, as just one example, allows you to sync your bank accounts with the software, and can closely track your expenses each month to ensure you stay within your income. When you create a budget, you will often need to reduce your expenses. When doing this, it is helpful to think of what you want versus what you need. Reducing wants can be an excellent way to find savings. For example, a cable package may be a want, but it is likely not a need especially if you already have internet. As another example, eating is certainly a need, but eating out once a week is a want and can likely be reduced to once a month (or even less frequently depending on your particular situation).

Comments

0 comment