views

Choosing Checks from Your Bank

Get checks from your bank. You can always order checks directly from your bank. While these checks will likely have your bank logo instead of personalized checks, they are relatively easy to order directly through your bank. You should get a limited quantity of checks when you first open a checking account at your bank. If you plan on writing a lot of checks, you may want to order checks immediately at your bank when you open your account. Bank checks are sometimes cheaper than personalized checks, but check with your bank to verify the prices. Additionally, there will never be any problems between a third-party check company and your bank, since you are ordering directly from the bank.

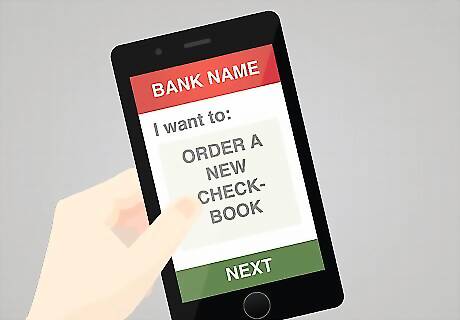

Use mobile ordering to get checks. At many banks, you can order checks directly from their mobile app. If you need checks quickly, this may be a good way to get checks while you’re on the go. You’ll need to sign into the mobile app. If you haven’t already set up an online account with your bank, you’ll likely need to do that first before you can access their mobile app. For many banks, there should be a section on their mobile app called “Order Checks” or “Check Orders”. You can also check out the “Help & Support” section on the app to find where you can order checks using the app.

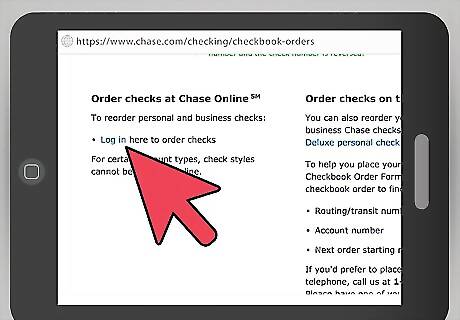

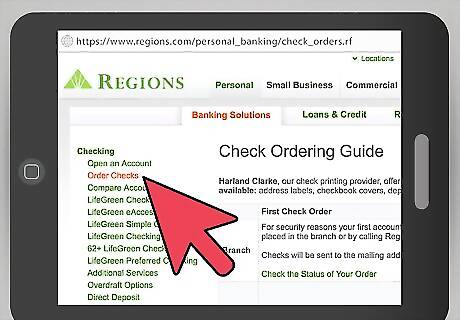

Order checks online. Many banks prefer that you order checks online, since it’s quick and easy for you to do. Checks through your bank will be either their standard check or a personalized version through a vendor the bank does business with. First, you should log into your online account with your username and password. Again, you’ll need to have set up your online account first so you can order checks. Once you log in, you should be able to order checks through your account. For some banks, they may have an approved vendor where you can order personalized checks for a fee.

Get checks by phone or in person. If you feel uncomfortable ordering checks online, you can also order by phone or at the bank. In both cases, make sure to have all your important account information available to give to the representative or bank teller. When ordering by phone, the representative should be able to pull up your bank account. You’ll likely need your account number, as well as your routing information to order check by phone. You can also go to the bank to order checks. Bringing the initial set of checks your bank gave you can help expedite the ordering process.

Finding Checks through a Third-Party Vendor

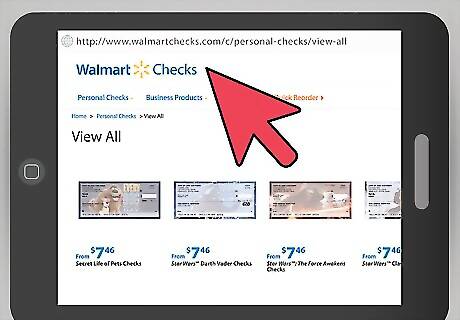

Find personalized checks through a third-party vendor. If you want unique personalized or themed checks, you may have to go through a third-party vendor. Some banks have preferred vendors, but you can also order from a variety of websites. Your bank may have a specific vendor that offers personalized or unique checks. It’s a good idea to check with the bank, either online or in-person, to see if they have a preferred vendor, since that may be cheaper in many cases. If you know you want specific themed checks, you’ll likely need to look elsewhere than your bank to get them. You can find websites online that can offer nearly every color, design, pattern, or theme you may want.

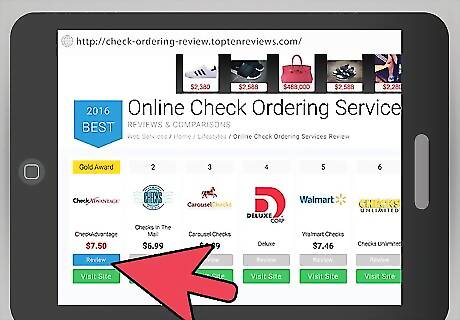

Research which companies are offering check printing services. Many are listed in magazines, Sunday newspaper inserts, or as a part of direct-mail marketing pieces. Probably the best way to find them is looking online. If you get the newspaper on a regular basis, there’s usually an insert form that you can use to order checks. You can also look online on the insert company’s website to see all the varieties of checks they offer. Online ordering is also very easy for ordering checks. You’ll just need to have your checking account, routing number, and bank information when ordering checks online.

Make sure you use a reputable company when ordering online. It’s important to avoid fraudulent businesses when ordering checks online. These companies will have your banking information, so you don’t want it to fall into the wrong hands. If you find a check style or personalization that you like, do some research on the company. You’ll want to make sure that it’s reputable and other people have used the check ordering service before. Your bank’s preferred vendor may be a good place to start, since you know it’s a reputable vendor per your bank. If they do not offer what you’re looking for, you can find websites linked through chain stores or reputable online vendors.

Ordering Your Checks

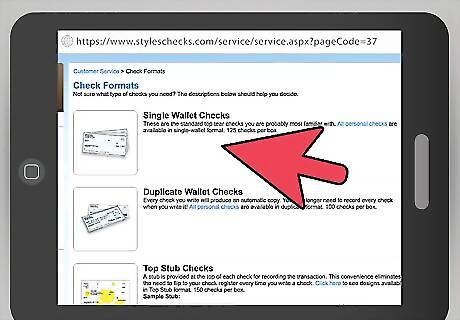

Choose the check style you want to use. You can get either single-page checks or duplicate checks. The duplicate checks give you a copy of the check you just wrote for your personal records, while the single-page checks offer only a single check without a copy for your records. Single page checks are usually best if you’re writing checks for most personal reasons, such as paying bills. Additionally, most banks offer a digital version of your check on their website, so you should be able to get an image of the check online if necessary. Duplicate checks may be a better option if you have a business account. Your bookkeeper may want copies of the check so a hard copy of each check is filed away.

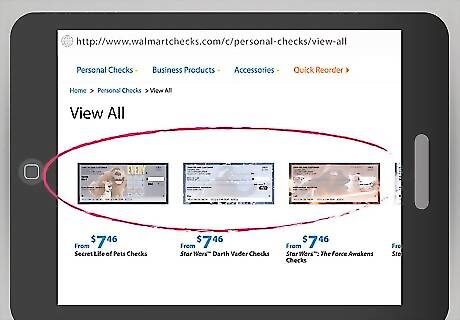

Decide on the check’s image. You can get a variety of images on your checks, including characters, pictures, or different fonts and styles. It’s important to choose a check image and style that matches your checking needs. If your checking account is mostly a personal account, you can have more fun with your check’s image. You may want to have images of your family members, logos of your favorite sports teams, or famous movie or television characters on your checks. When choosing checks for a more professional account, you’d want to choose something that is personalized, but a little more professional. An embellished, but polished font or style may be a better choice than a cartoon character in this case.

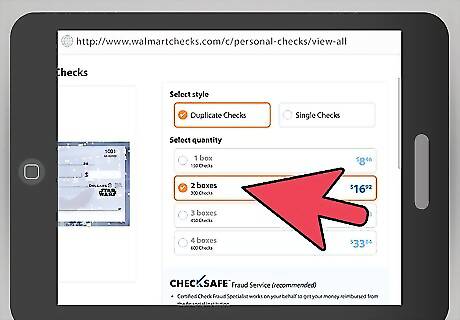

Decide how many checks you use in a given period. This way, you will be able to see how many boxes you should order. The final price is generally lower for larger quantities. If you write checks a lot, you may want to go ahead and order a large quantity of checks. They won’t go to waste and you will save money by ordering more. For people who don’t use checks often, it may be a better idea to use smaller quantities. You can order checks in quantities as low as 100 if you don’t think you’ll use them up quickly.

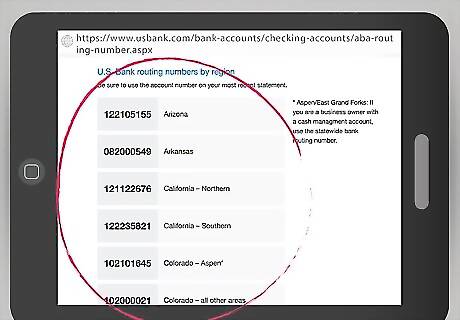

Have your routing number and bank account number at hand. Before completing the order form for your checks, you’ll need to have these numbers available. You cannot order checks without these key identifying numbers. Your routing number should be at the bottom left-hand corner of your check. It is a nine-digit code on any checks. If you don’t have any checks from your initial set, you can contact the bank to get your routing number. The account number should be to the right of the routing number. This account number should also be in your checkbook or written down somewhere else so you know what it is at all times.

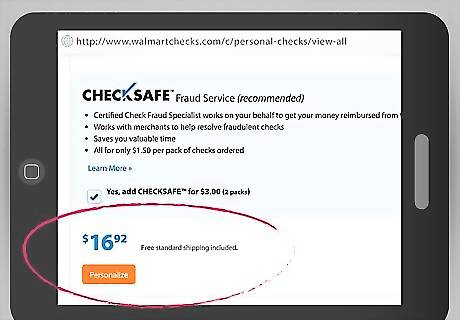

Add in the shipping and handling charges. If you’re ordering checks online, they’ll need to be shipped to you. Most of the time, the shipping and handling charges should be relatively minimal or even free. Some online retailers will offer free shipping and handling. However, you want to verify that your check ordering company is reputable even if they offer an especially great deal. If you are ordering checks through the third-party vendor from your bank, you can occasionally get the vendor to deliver directly to your bank. You may be able to pay less or even nothing in shipping and handling charges this way.

Be prepared to pay for your order online. Most likely, you will need to pay for your order online using a credit or debit card. This is especially true if you are out of checks and do not have a check available from a different account. If you’re purchasing checks from your bank, you can usually pay for your checks out of your account. Check costs vary, but are usually not very expensive. When buying from a vendor, you’ll have to pay for the checks directly, usually with a credit or debit card. Additionally, many first-time orders are given a discount. A few banks refuse to honor checks printed by outside print houses. Inquire with your bank before ordering from someone else to verify whether this is the case.

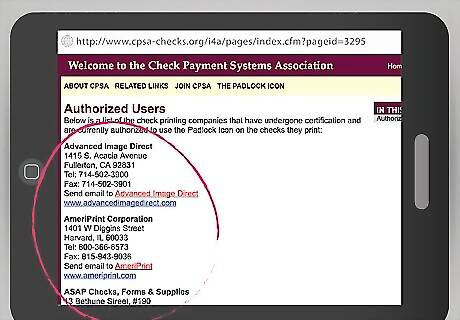

Make your privacy preferences known when ordering checks. Some check and stationery printing firms will share your information with the direct mailers that send junk mail. You want to make sure that your information is not shared outside of the check company. Many outside check companies have a small padlock icon on the check or on their website. This tells you that your personal information, as well as your checking account information, is usually secured. The Check Payment Systems Association (CSPA) also has a list of authorized check printing companies that are secured. Make sure your company is on this list before ordering checks from them.

Being Prepared to Order Checks in the Future

Wait for your checks in the mail. Checks should arrive anywhere from one to two weeks. If you need the checks immediately, you can usually pay more for expedited shipping. Whether ordering from your bank or a separate company, your checks usually will take 10-14 business days to arrive. You should get them all at once in a small package. If you're out of checks and need them immediately, it may be a good idea to pay for faster shipping. You may also be able to to go your bank to get a few checks to get you through until your new checks arrive.

Save a check to use to reorder checks. You also want to write "void" across the check so it can't be used in case you lose it. If you have a check from your previous order, you will have fewer steps to go through next time you need checks. If you write "void" across your check, it will not be accepted by banks and businesses. You don't want to have a loose check floating around that someone could use in case you lose it. Saving a check will make the ordering process easier and faster. You'll have your routing and account number ready when reordering checks.

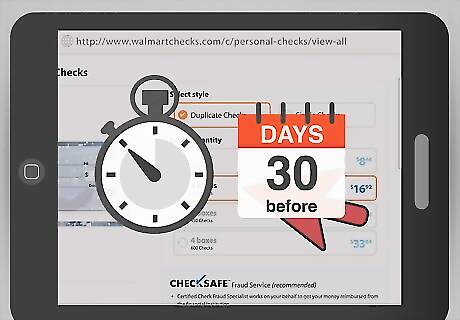

Reorder checks before you expect to run out. This is especially important so there will not be a time when you don't have them available. When you're down to your last few checks, it's probably a good time to order them. If you write a lot of checks, you probably should order plenty at first, since it'll be cheaper. About a month before you need new checks, place your order so you will have them when you run out. Buying checks before you run out will also mean you can shop around. If you want a different style or image on your new checks, you'll have plenty of time to choose one.

Comments

0 comment