views

X

Trustworthy Source

Internal Revenue Service

U.S. government agency in charge of managing the Federal Tax Code

Go to source

Calculating Capital Gains or Losses

Talk to the executor of the estate. Before you can figure out if your sale of inherited property is taxable you need to know your basis in the property. Generally, this is the value of the property on the date the person died who previously owned the property. The executor of that person's estate should be able to give you this information. If the executor filed an estate tax return, you'll use the value listed on that return as your basis. If an estate tax return was filed, a different valuation date may have been used other than the date of death. You'll need to use the same date to make sure your information matches the information on the estate tax return.Tip: You can only use an alternate valuation date if the executor filed an estate tax return. Otherwise, you must use the value of the property on the date of death.

Determine the fair market value (FMV) of the property on the date of death. If the executor didn't file an estate tax return, your basis in the property is the FMV of that property the date the previous owner died. This amount should be included in the estate records. If the executor can't provide you with the FMV of the property on the date of death, talk to an attorney who specializes in inherited property. They'll give you advice on how to determine the FMV of the property.

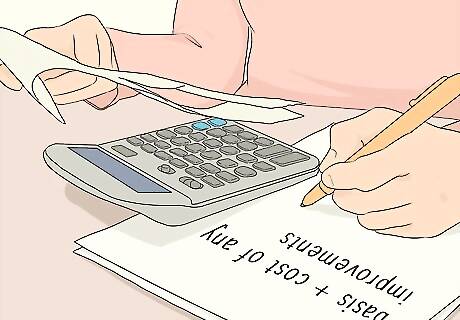

Add the cost of any improvements you made to the basis. If you made any improvements on the property before you sold it, those costs also become part of the basis. Any fees or other expenses involved in the sale of the property, such as realtor commissions, also become part of your basis in the property. For example, if you inherited a house and repainted it and put in new flooring before you sold it, you could add the cost of the painting and flooring to your inherited basis in the property.

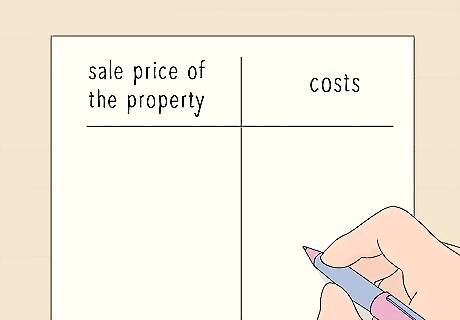

Compare the sale price of the property to your costs. Generally, if you sold the property for more than your basis in the property, you have capital gains. If you sold the property for less than your basis in the property, you have capital losses. Capital losses are only deductible to the extent of any capital gains you have, such as from the sale of investments, real estate, or other investment property. If you don't have any capital gains, you don't have to report capital losses on your taxes. Capital gains do have to be reported and are potentially taxable depending on your filing status and other income or losses throughout the year.

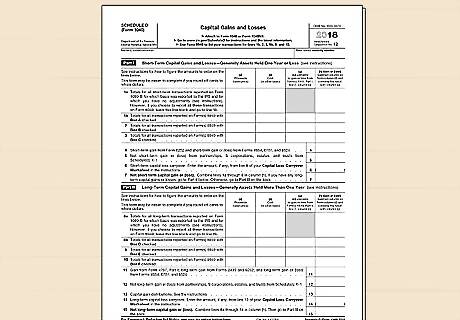

Using Form 8949

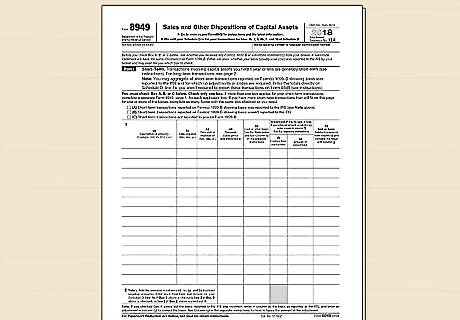

Download Form 8949 for the correct tax year. If you're doing your taxes by hand, get a copy of Form 8949 from the IRS website at https://www.irs.gov/forms-pubs/about-form-8949. You may also want to access the instructions for filling out the form. Check the upper right-hand corner of the form before you use it to make sure you've got the right form for the right year. Although the forms typically don't change much from year to year, you still want to make sure you've got the most up-to-date version.

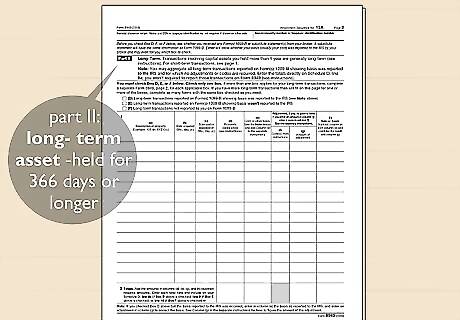

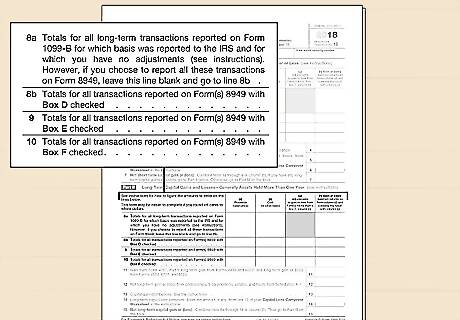

Categorize the property as a long-term asset. Form 8949 separates short-term assets, which you've held from 365 days or less, from long-term assets, which you've held for 366 days or longer. However, inherited property is generally treated as a long-term asset, regardless of how long you actually held the property before you sold it. Part II of Form 8949 deals with long-term assets. Skip Part I (unless you have short-term capital gains or losses from other assets that you need to report). Check Box (F) to indicate that you're reporting a long-term transaction not reported on a Form 1099-B. Form 1099-B reports gains or losses from the sale of stocks, bonds, and other investments.Tip: If you have to report the sale of other long-term assets, use a separate Form 8949 if those transactions were reported to you on a Form 1099-B.

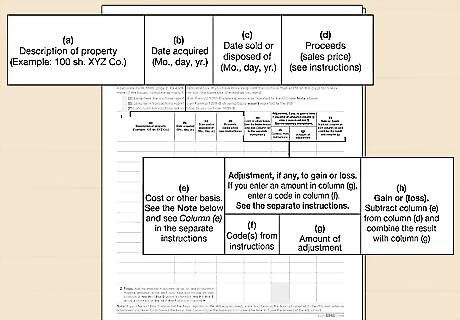

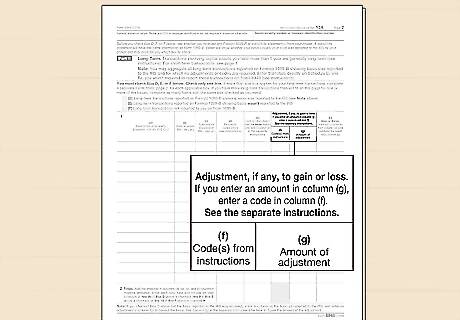

Enter the correct figures for your inherited property. The table for Part II is divided into 8 lettered columns. You'll put information about your inherited property on one line in each of these columns. Typically, you'll only need to worry about 6 of these: In column (a), write a description of the property. Typically, this is the street address. In column (b), write the date you acquired the property in month-day-year format. This will be the date the estate legally transferred the property to you, not the date the previous owner died. In column (c), write the date the sale of the property was completed in month-day-year format. In column (d), write the total amount you sold the property for. In column (e), write your total basis in the property. This is the FMV of the property on the date of death plus any expenses you incurred making improvements to the property. For column (h), subtract column (e) from column (d). This number is your gain or loss on the property. Write a loss as a negative number.

Add any other long-term capital gains or losses you have. If you have any other long-term capital transactions, include the same information about those on the lines below the information about the sale of your inherited property. For sale of long-term investment properties reported to you on a Form 1099-B, you'll need to complete a separate Form 8949. If you have short-term capital transactions you need to report, you can fill those in on Part I of the same form.

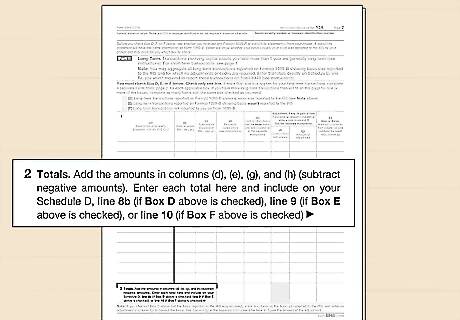

Total the amounts in your proceeds, basis, and gain or loss columns. If the sale of your inherited property is the only long-term capital transaction you're reporting, simply copy the numbers from the first line to the line labeled "2" at the bottom of the table. Make sure you're putting each number in the correct column. Since you checked Box (F) at the top of Part II, you'll copy these numbers into line 10 of your Schedule D.

Completing Schedule D

Download Schedule D for the correct tax year. If you're doing your taxes by hand, get a copy of Schedule D at https://www.irs.gov/forms-pubs/about-schedule-d-form-1040. You may also want to print the instructions and read those before you start. The IRS updates the page every year. However, you should still double-check the year in the upper right-hand corner and make sure it's the same as the year for which you're filing taxes.

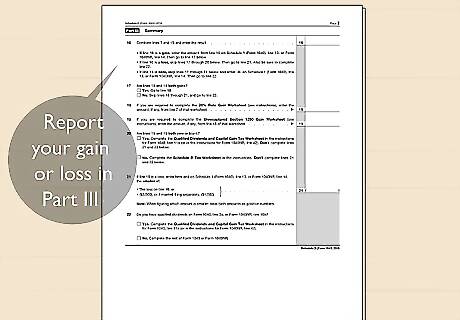

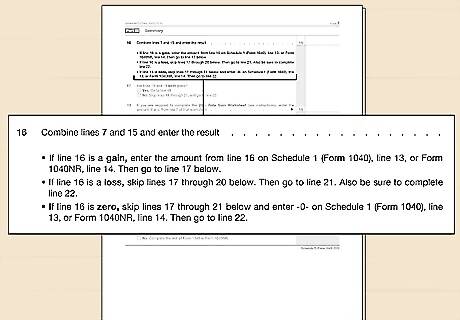

Enter your totals from Form 8949 in Part II of Schedule D. Skip down to Part II (unless you have separate short-term capital transactions to report) and copy the totals on your Form 8949 into the correct columns on line 10. Lines 11 – 14 likely won't apply to you, particularly if the sale of your inherited property is the only capital transaction you have to report. Read them over and if none of them mention anything familiar, you can leave them blank. On line 15, write the total capital gain or loss in Column (h). If you have negative numbers and positive numbers, subtract the negative numbers from the positive numbers.Tip: Rounding off cents to whole dollars will make it easier for you to complete the form and the necessary calculations.

Report your gain or loss in Part III of Schedule D. Combine any short-term gain or loss with your long-term gain or loss. If the line is a gain, you'll have additional worksheets to complete. Follow the instructions on the form. Any necessary worksheets will be included in the instructions for Schedule D.Tip: Although you don't have to turn in your worksheets when you file your taxes, you should still keep them along with all your other tax records.

Copy your net gain or loss from Schedule D to the appropriate line on your tax return. Schedule D will tell you exactly which line on your Form 1040 to write your net gain or loss. Make sure you copy this amount exactly. As of 2019, net capital gain on a long-term asset is taxed at 5% if you are in the lowest 2 tax brackets or 15% if you're in the higher 2 tax brackets.

Comments

0 comment