views

Organizing Your Finances

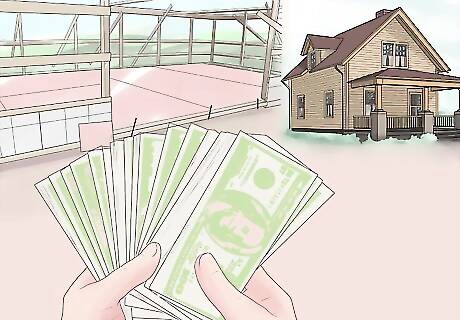

Diversify your finances in all areas of your life. Diversification is not only the key to building wealth, it's also the key to sustaining the wealth that you have. Ensure that your money is well diversified across a broad spectrum of investment classes including stocks, bonds, mutual funds, real estate, and cash. Different areas of the market will respond differently to the same event, so if you have invested in both stocks and bonds, for instance, your stocks may take a hit in a market swing, but you may compensate for the loss by a positive movement in the bond market. Keep in mind that your risk objective may be different than when you were building wealth. You may now find capital preservation (keeping what you have) becoming more important than the risk that comes along with more aggressive (risky) investments. Understand the risk-return tradeoff. This principle states that the higher the risk you take with an investment, the higher the potential return. Determine your risk tolerance (how much you can safely afford to lose if the investment fails, how much time you have to recover from a potential loss) and talk to your financial adviser about how to balance your investments so that you get some return, but you don't risk financial ruin in the process. Keep liquidity in mind. Liquidity refers to how quickly and easily an asset or security can be turned into another asset. Cash is extremely liquid, while something like real estate is not. Although you can build a great deal of wealth "on paper" using real estate, you'll also find that it takes time to sell your real estate properties and convert them to cash. If you think you'll ever need cash from your assets in a hurry, it's best not to park too much of that cash into real estate. Learn more about diversification by reading How to Reduce Financial Risk.

Invest in new opportunities. You shouldn't stop trying to build wealth just because you're rich. Some of the richest people in the world are still making investments (check out any episode of Shark Tank for evidence of that). Now that you're rich, it's time to make money work for you instead of you working for money. Find business opportunities that you can invest in to build on the wealth that you have. Become an angel investor. When you're an angel investor, you'll have the opportunity to invest in startups. You could become a part of the next Uber or Amazon. This is also a way to "invest with your values" by investing in particular companies you believe in and supporting them in a more direct way.

Make your money last. Live on your income, not your liquidation of assets, or keep your spending within what is considered a safe zone. Many experts suggest keeping your spending under 4–6% of your liquid net worth each year. Avoid liquidating your assets just to buy luxury items, otherwise you'll be a consumer who loses money and not an investor who earns money. Spending money on things that do not retain value or have no sentimental value is not a good way to make your money last.

Develop a budget. Yes, even if you're rich, you're going to need to live on a budget. This is for two reasons. For starters, a budget is just as important for you if you're rich as it is for someone of lesser means, because it's easy to fall victim to the "bottomless pit" mindset. That's when you perceive that you have an infinite supply of money. As a result, you're more likely to burn through it and lose it. If you maintain a budget, you'll be in a better position to preserve your wealth. A budget is a good idea for everybody. A budget forces you to itemize your spending and practice discipline with your hard-earned wealth.

Avoid conspicuous consumption. If you are showing off your wealth by purchasing a variety of luxury goods, it might be a good idea to think about whether you are doing this for genuine reasons or if you are doing so to prove something to others. You are more likely to preserve your wealth and feel fulfilled by not spending in this way.

Set up a trust. If you'd like to preserve your wealth for future generations, consider establishing a financial trust that will prevent spendthrift descendants from squandering away the money that you'd like to pass on to them. Anthony Fittizzi, managing director and wealth strategist at U.S. Trust, tells his clients that a trust places safeguards around how beneficiaries can access and spend the money that's been left to them. You can also dictate how your money is spent in the future when you set up a trust. That's a great way to ensure that your wealth preservation strategies continue throughout future generations. You may set up a stipulation that the money in the trust can only be used for educational purposes, for instance, or that it will be dispensed in set a yearly or monthly sum. Be aware that once you place your assets in a trust, they are no longer considered to be your assets.

Getting the Right Advice

Seek guidance and support to manage your wealth. This is especially important if it has been recently or rapidly acquired, as such as shift typically means new challenges and concerns, rather than the elimination of stress around finances. Speak with the above experts and you'll be on the right track.

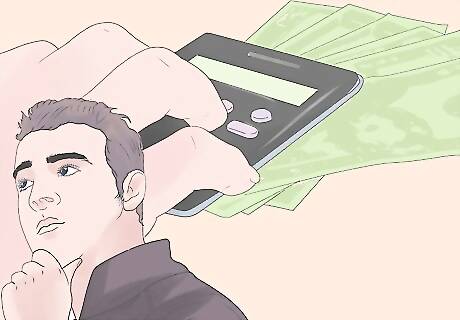

Talk to a financial advisor. Even though you're rich, you'll find that there are financial advisor who have a great deal of input about how you can manage your money in such a way that you'll preserve the wealth you worked hard to earn. Financial advisers help you create a financial plan as well as manage your investments. They help you set goals and use your money in the ways that bring you satisfaction. This person takes the holistic approach to help you wrap your arms around everything in your financial life. Your financial adviser can also help you find and be the "quarterback" for your other advisors (tax professional, estate attorney, etc.).

Hire a tax advisor. You might think that you know everything you need to know about the IRS tax code, but the fact of the matter is that it's tens of thousands of pages long and it's not likely you'll follow all of its intricacies. Working with a tax professional can not only help you keep on top of your tax situation, but can also help you with ongoing strategies to reduce your tax bill each year.

Hire an estate planning attorney. This is the person who can help you establish a will and trust as well as other important documents. Proper estate planning can result in your wishes being carried out beyond your lifetime as well as save taxes on your estate.

Developing the Right Mindset

Take your emotions out of wealth preservation. Many people who have wealth suddenly become terrified that they're going to lose it all due to an economic setback or some other unfortunate occurrence. Remember when you evaluate alternative investment options to not get caught up in the hype but to always look at the opportunity from a financial standpoint. Avoid following the "herd." Just because everybody else is investing in gold or the stock of XYZ Corporation doesn't mean that those are good investments. When you're evaluating a business deal, look beyond the personality of the person who's proposing the deal and strictly evaluate the merits of the deal on the financials. It's easy to fall in love with a personality, but it won't necessarily make you any money. Focus on what's important in life. If you're able to spend additional time with your family or give back to the community — doing so may help bring perspective and peace of mind. The old adage that money doesn't buy happiness will be apparent to you when you're wealthy. To truly be rich, you'll want to have friends, family, and a good quality of life, not simply a huge stockpile of assets.

Give back to society. Now that you have money, do something good with some of it and you'll find that the laws of the universe work marvelously in your favor. One of the best ways to preserve your wealth is to be generous with the money that you have (and not just because of the tax break!). There is a reason why rich families have their own foundations (for example, the Rockefeller Foundation). That's because they understand the importance of giving.

Comments

0 comment