views

X

Expert Source

Kent LeeCareer & Executive Coach

Expert Interview. 2 April 2020.

Many elements of resume format and style are the same on a bank job resume as on any other type of resume. However, you want to emphasize different skill sets that are most relevant to working in a bank. We’ve put together this list of tips for writing a great resume that you can feel confident using to apply for banking jobs!

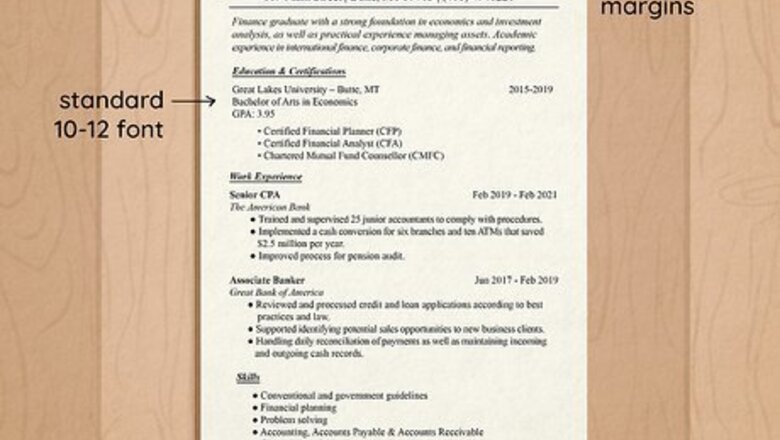

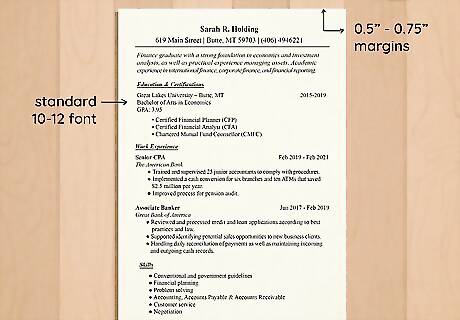

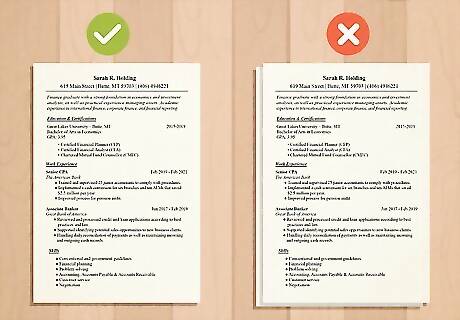

Stick to standard formatting.

It’s best not to decrease font size or margins to squeeze things in. Stick to 0.5- or 0.75-inch margins and size 11 font for the body of your resume. If you absolutely can’t fit everything on the page, decrease the size of the font to size 10, but keep the margins the same so it’s easier for people to skim your resume. People reviewing your resume only spend an average of 30 seconds looking it at. If the page is too crowded, they might not see all the important info that you want to highlight.

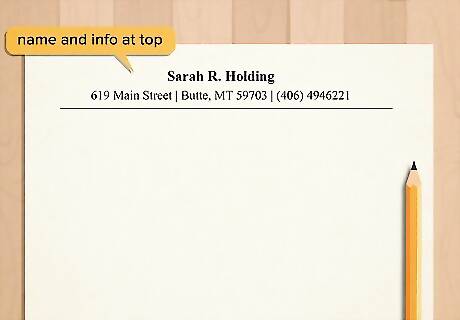

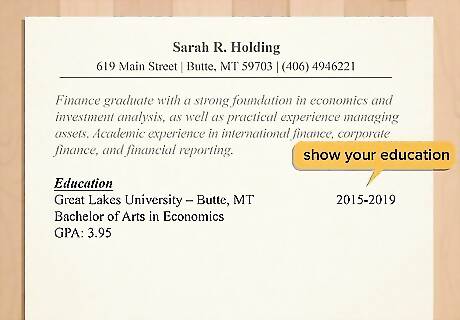

Put your name and contact information at the top.

Center your full name at the very top of the resume in size 20 to 24 font. Below it, in size 11 or 12 font, type your up-to-date contact information, including your phone number, your email address, and your home address. Feel free to give your resume a unique look by selecting a fun font for your name. Just make sure it’s easy to read and looks professional. Stay away from calligraphy-style fonts or cartoony fonts, for example.

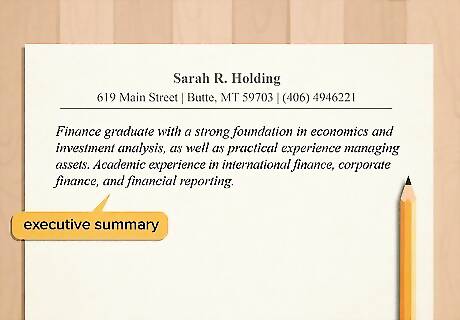

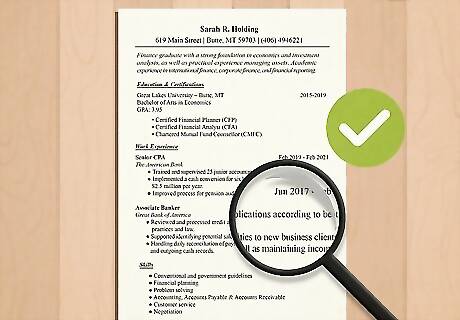

Write an executive summary below your contact info.

This summarizes the experience and skills that you can bring to the job. Keep the statement short and to the point, no more than 2 sentences long. Avoid generic phrases like “detail oriented.” Instead, be specific and say something like: “Experience with recording transactions and managing the accounts of over 100 subscribing customers.” An example of an executive summary is: Finance graduate with a strong foundation in economics and investment analysis, as well as practical experience managing assets. Academic experience in international finance, corporate finance, and financial reporting.

Include a section for your education.

This section lets you highlight your relevant finance-related education. Label the section “Education,” then list the institutions you attended, the degrees you received, your GPA, and any awards you won. Put this section after your executive summary if you are still in university or recently graduated, or put it underneath your work experience if you’ve already been working for a while. It is not typically necessary to include high school education, unless you are just beginning your career or it was the only degree you received. If your college GPA is not as high as you would like, you can include with it your major-specific GPA or with your 3rd and 4th year GPAs. If these are much higher, it shows either that you improved considerably over time or that your general GPA does not adequately convey how adept you are at your specific career.

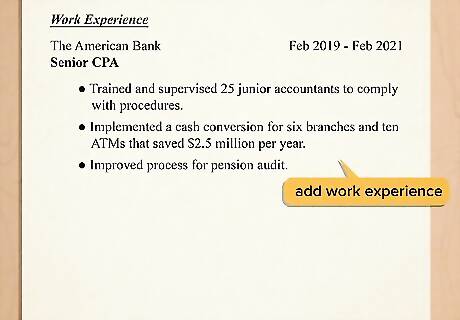

Add your relevant work experience.

This section highlights your finance-related employment history. Title the section something like “Professional Experience.” Under the title, list relevant jobs that you have held along with internships or other unpaid work. For example, Don’t include every job you have ever performed and don’t list anything that isn’t relevant. Include the name of your employer, when you worked for them, and the location of the job. After providing basic information about a job, describe your experience there in bullet points. When doing so, focus on particular accomplishments that demonstrate your ability to meet the qualifications of the job you are applying for. Even if you haven’t worked in finance before, other jobs can still be relevant to working in a bank. For instance, if you were a cashier at a retail store, you handled money and dealt with customers, which is exactly what bank tellers do!

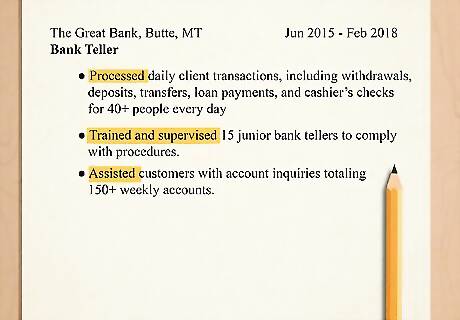

Use active verbs to describe tasks you've performed.

Action verbs provide instant information to resume reviewers. Words like “Wrote,” “organized,” “managed,” “supervised,” and “designed” are ideal. Avoid more vague verbs like “obtained,” “achieved,” and “accomplished,” which don't indicate what skills you employed to reach your goals. For example, use active verbs to describe your experience and responsibilities while you worked at a past job. You might write something like “Supervised a team of 10 sales reps.” Or, “Managed a portfolio of 7 commercial clients.”

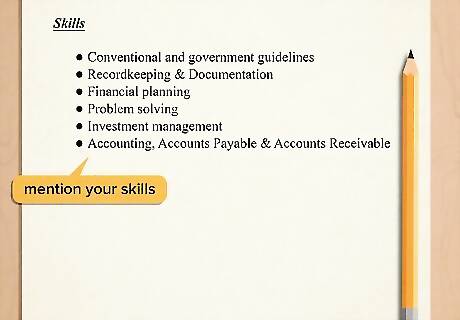

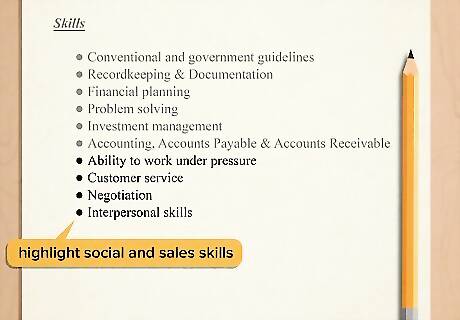

List any other applicable skills.

Potential employers often look to hire people with specific concrete abilities. The skills you list can include a combination of “hard” skills, like specific quantitative techniques and computer programming abilities, and “soft” skills, which typically refer to your ability to deal with people. Make sure to highlight any type of financial software or other tools you know how to use as well as any customer service skills. Some examples of skills to include are: communication, financial analysis, retirement investing, collaboration, management, and client relations.

Highlight social abilities and salesmanship.

Banking jobs, especially teller positions, are very client and sales oriented. To accomplish this, make sure to list and describe any service sector jobs you worked in that required extensive customer interaction as well as any sales jobs. For example, if you worked in a clothing store and made commission, highlight that role. Working in a bank often requires you to interact with customers all day and make them feel comfortable, as well as sell them services like mortgages and loans.

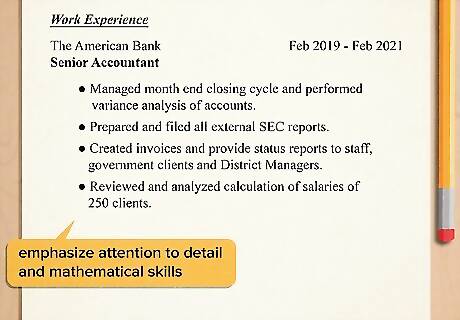

Emphasize attention to detail and mathematical ability.

Any bank job requires you to be detail-oriented and good with numbers. List experience and skills that demonstrate your capacity to perform basic mathematical processes. For example, if you were treasurer for a club or organization at your university, list that on your resume. Highlight any academic awards that are suggestive of mathematical ability. If any of your prior jobs required the counting of money or other mathematical skills, describe these in detail. List instances in which you followed stringent workplace rules precisely, proofread text, managed large databases, or in any other way reviewed the work of a coworker to verify accuracy.

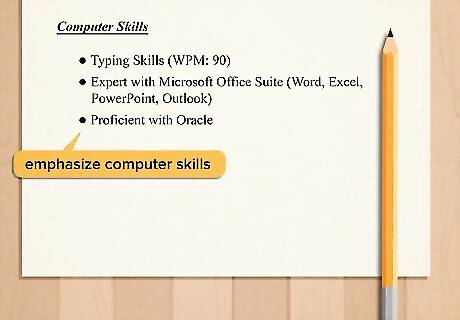

Spotlight your computer literacy.

Bank employees make extensive use of computers to record transactions. List programs you know how to use, especially if they’re finance-related, to prove that you have been able to master technical programs in the past. For example, highlight how you used Excel to put together financial reports in your college courses. Make sure to list any formal credentials you might have earned for specific software programs.

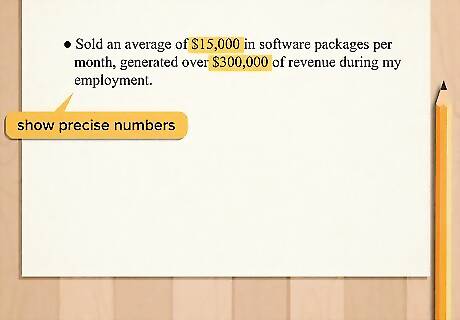

Show achievements using numbers.

Employers want to know precisely what you’ve achieved. Be specific and list precise numbers as frequently as possible. For example, if you previously worked in a sales role, include the dollar amount in sales you made monthly or yearly and what sort of revenue you produced for the company you worked for overall. For instance, in your work experience section, underneath the title of your role, the company, and the location, you might write something like: “Sold an average of $15,000 in software packages per month, generated over $300,000 of revenue during my employment.”

Limit your resume to 1 page.

Resume reviewers want a concise summary of your experience. If you run out of space, remove the least important information, such as older jobs that aren’t particularly relevant to working in a bank. Look for ways to shorten things like job descriptions by removing unnecessary words or reworking sentences. There are lots of free 1-page resume templates online and in Microsoft Office that you can use to help you fit all your info on a single page.

Proofread your resume when you finish it.

Errors prevent you from getting moved along in the hiring process. Run spell check after you finish writing your resume to catch obvious errors. Then, proofread everything 2-3 times to catch other mistakes. For example, be on the lookout for words that are spelled correctly, but are the wrong choice of word, such as “complaint” and “compliant.” Get a friend or a family member to give your resume a look as well as they might notice mistakes that you missed.

Comments

0 comment