views

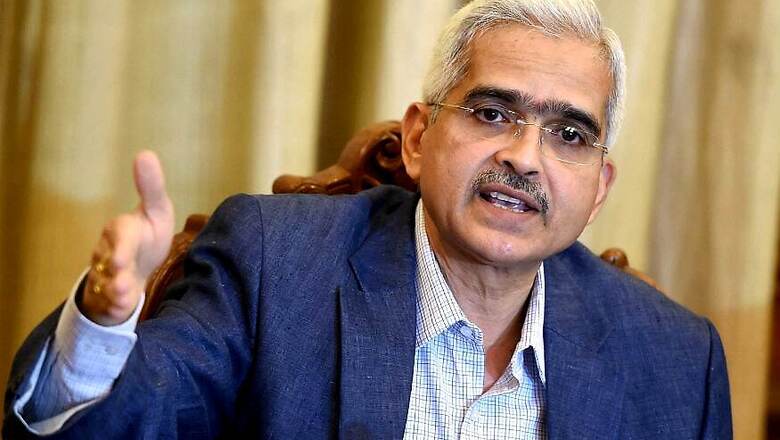

In a move widely anticipated, the monetary policy committee (MPC) of the Reserve Bank of India (RBI) cut the repo rate by 25 basis points to 5.75%. This is the third consecutive rate cut by the MPC, hinting at its clear intent to revive sluggish economic activity in the country. After Shaktikanta Das took over as RBI governor in December 2018, the MPC has reduced policy rate by 75 basis points. But besides the rate cut, RBI also talked about growth, inflation, liquidity, bad loans and electronic money transfer. Here are the 10 key announcements made by RBI today:

1) Rates

After the 25 bps repo rate cut, the reverse repo rate now stands adjusted to 5.5%, while the marginal standing facility (MSF) rate and the bank rate gets adjusted to 6%.

2) Policy stance

The MPC changed the policy stance to ‘accommodative’ from ‘neutral’. RBI says a change in stance to ‘accomodative’ means that a rate increase is off the table for now.

All six members of the MPC unanimously decided to reduce the policy repo rate by 25 basis and change the stance of monetary policy

3) Growth

The MPC cut its gross domestic product (GDP) growth forecast for FY20 to 7% from its earlier projection of 7.2%.

4) Inflation

RBI’s MPC now sees consumer price index (CPI) inflation at 3-3.1% in the first half of FY20 and at 3.4-3.7% in the second half of FY20. In April, RBI had said it expects CPI inflation at 2.9-3% in the first half of FY20 and 3.5-3.8% in the second half.

5) NPAs

RBI will issue a revised circular on bad loan recognition within the next three-four days, replacing the 12 February circular that was struck down by the apex court.

On 2 April, the Supreme Court had declared as "ultra vires" the February circular that mandated banks to label even a day’s default as non-performing asset (NPA).

6) RTGS, NEFT charges

RBI decided to abolish all charges levied on Real-Time Gross Settlement (RTGS) and National Electronic Funds Transfer (NEFT) transactions. It has also asked banks to pass this benefit to their customers within a week.

7) ATM charges

RBI has also decided to set up a committee to review the charges levied on the usage of ATMs as widely demanded.

8) On-tap licensing for small finance banks

RBI said it is considering ‘on tap’ licensing for small finance banks and would issue draft guidelines on the licensing of such banks by the end of August 2019. An ‘on-tap’ facility would mean RBI will accept applications and grant license for such banks throughout the year.

9) Liquidity

Addressing liquidity concerns in the system, RBI said it has decided to set up an internal working group which will submit its report by July this year.

As announced earlier this year, RBI would also an auction on 13 June to purchase government securities under open market operations (OMO) for Rs 15,000 crore to infuse durable liquidity.

10) Leverage ratio for banks

RBI sets minimum leverage ratio at 4% for systemically important banks and 3.5% for all other banks to maintain financial stability in the country. RBI’s stipulation is higher than the minimum leverage ratio of 3% as prescribed by Basel Committee on Banking Supervision.

The instructions on leverage ratio will be issued before the end of June 2019.

Comments

0 comment