views

Mumbai/Delhi: If India's cellular revolution is a boon to consumers, it has become a nightmare for operators that is likely to get worse before it gets better.

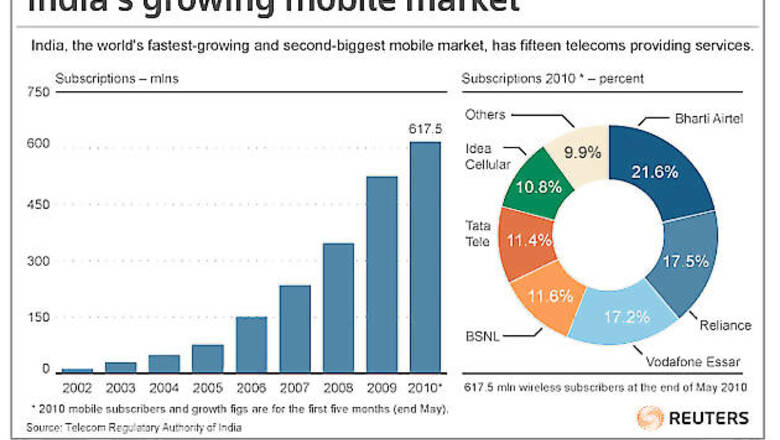

Consolidation in the 15-player market, which is the world's second-largest with more than 600 million users and growing by 16 million a month, looks at least a year away unless rules change.

Just-completed auctions for 3G and broadband airwaves cost far more than expected. They also reintroduced an unpredictable 900-pound gorilla to the market in Mukesh Ambani's Reliance Industries, India's biggest listed firm, which bought the only company to win country-wide broadband wireless spectrum.

With newer entrants backed by foreign players such as Telenor, Sistema and Etisalat ramping up service, rock-bottom tariffs continue to fall, to the detriment of market leaders Bharti Airtel, Reliance Communications and Vodafone's Indian unit.

"With 12 players in the circle it would be too bullish to expect that 12 players will behave rationally," said Vsevolod Rozanov, president and CEO of Sistema Shyam Teleservices, the Russian firm's Indian subsidiary, whose ongoing rollout will be bolstered by a $ 600 million investment by the Russian government.

"Of course price erosion will continue," he said.

The stress is showing, and not just on investors who have seen share prices fall by more than half from peaks for Bharti and Idea Cellular, and 76 percent for Reliance Comm.

"If anything, a lot of these telecom operators may get in some source of funding overseas and their ability to compete in the near term only increases rather than decreases," said Prateek Agrawal, head of equities at Bharti Axa Mutual Fund in Mumbai.

Both Bharti and Vodafone lashed out over a recent regulatory proposal to price additional 2G spectrum based on 3G prices. Vodafone, India's largest foreign investor, booked a 2.3 billion pound ($ 3.5 billion) charge against its India business.

Bharti, 32 percent owned by Singapore Telecommunications, reported its first quarterly profit drop in three years and is hedging its India exposure with its recent $ 9 billion purchase of Zain's Africa operations.

Consolidation would improve the landscape for carriers, but rules prohibit them from selling out within three years of receiving licenses, which means the class of 2008 must stay in the game at least until next year. Eventually, industry watchers expect the sector to be culled to six or seven players.

Reliance Comm is selling its tower arm in a deal that will cut its debt by more than half but is still trying to unload a 26 percent stake to a wary global market. Only Etisalat of Abu Dhabi has expressed interest. Other would-be investors - MTN, AT&T and Vivendi - have shot down reports based on unnamed sources saying they were talking to Reliance Comm.

The promise

This should have been a golden age for carriers in an Indian market where mobile penetration only recently crossed 50 percent and lags only China by number of mobile users.

A key difference: China has just three operators.

The problem for Indian carriers is regulatory, some argue: India allowed too many players when it issued more licences in 2008 to newcomers who in turn sold stakes to foreign players.

Auctions for 3G and broadband spectrum that netted the government $ 21.6 billion may have made the situation worse by adding to costs and bringing in more players. Carriers who sought pan-India 3G coverage were thwarted by the high cost.

So far, operators have managed to find capital, with local banks stumping up funding for 3G licences. Carriers and their investors hope that with increased use of data services and rising incomes, operators will some day earn far more per user in a market with call rates now as low as 0.4 U.S. cents a minute.

Bharti, Reliance Comm, Idea and Vodafone Essar saw combined average revenue per user (ARPU) fall 30 percent to 185 rupees ($ 4) a month in the March quarter from a year earlier, according to Nomura. China Mobile, the dominant player in its market, generated ARPU of 70 yuan ($ 10.30) in the same quarter.

Seth Freeman, CEO of EM Capital Management in California, said investors need a long time horizon. "The phone companies are actually a giant distribution channel for products and services, and generate revenue from products and services that they have not really begun exploiting yet," he said.

Enter Mukesh Ambani

Less clear is the effect broadband wireless technology will have on competition, including for voice service. In a country where broadband penetration is below one line per 100 people, the potential is vast. China, by comparison, has 130 million broadband connections, or roughly 10 percent of its population.

U.S. chipmaker Qualcomm Inc was among those winning broadband spectrum in India, making a bet on the prospects for long-term evolution (LTE) technology in the country.

"You clearly will see over the next two years the wireless data business come into a lot more prominence," said Macquarie analyst Shubham Majumder. "A lot of incremental valuations will be driven by how data uptake is happening for the large incumbent telcos," he said.

The return to telecoms of Mukesh Ambani, the world's fourth-richest man, is the wild card. His Reliance Industries (RIL) conglomerate was free to return to telecoms after he and his long-estranged brother, Anil, ended a pact last month that forbade them from competing on the other's turf.

Anil Ambani controls Reliance Comm, after the two brothers split up the family business empire five years ago.

"Given RIL's access to cash, its prior experience in the Indian telecoms sector and ability to navigate the minefield of Indian regulations, we believe the company could significantly disrupt the Indian wireless space," Credit Suisse analysts wrote.

That's the last thing incumbent operators want to hear.

Comments

0 comment