views

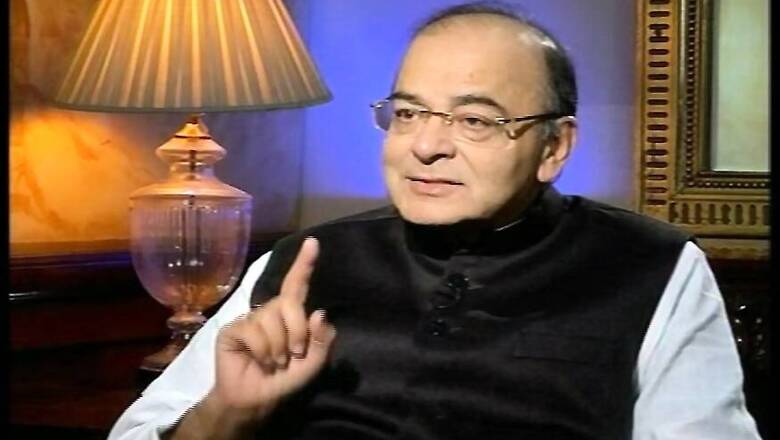

New Delhi: Politicians complaining about the demonetisation of the Rs 500 and Rs 1,000 currency notes are exposing themselves, Union Finance Minister told CNN-News18's Marya Shakil and Sapna Das in an exclusive interview on Thursday. He also assured the depositors that they need not fear anything.

Here is the full transcript of his interview:

Marya: Long queues outside ATMs and banks, would you like to assure the people of this country that there is no finance crunch or there is no cash crunch?

A: There is absolutely no cash crunch. There is substantial amount of currency which is replaceable, which has already been printed by the Reserve Bank of India (RBI). It has been printed over several months. What is the residuary required is also being printed by the day. So, you have a 1,25,000 branches of banks, you have all post offices, you have banking correspondents, and from midnight a large number of ATMs will start functioning.

Now the ATMs have to be tuned to the Rs 2000 note, so far they are tuned to those of Rs 100 and the scrapped notes. So, today the old noted notes are over. In the first instalment, Rs 100 will be available at the ATMs, you have to keep replenishing those notes. So, initially it was not unexpected that there will be some teething troubles, there will be long queues in the first few days. However I think over the next 2-3 weeks the extent of currency which is replacement will be hugely in the entire circulation and nobody has any reason to panic.

It is not necessary for people to go and start exchanging on day one. If you go on day one, you will obviously find a large rush. You can deposit your cash in the bank and most people in this country are honest; they have nominal amounts of cash available with them. Those who are going to deposit nominal amounts of cash, obviously, there is going to be no liability attached to them. We have to assume that everybody keeps certain amount of cash because of legitimate needs. That cash it is not illegitimate. Once you deposit it, you can keep spending as per your spending habits.

Once the entire replacement is done over the next couple of weeks, I think it will be business as usual and then the long-term advantages of this will be felt.

Sapna: You mentioned it will be business as usual once this process is over. Are we expecting people to really come forward and deposit their cash for exchange in large amounts? What would it be like if that really doesn't happen then what would be the implications, would that much money be lost?

A: No economy in the world, nowhere, except in India is the cash in circulation 12 percent of your GDP. You have almost around Rs 17 lakh crore of cash circulating in the market, a lot of it maybe static, lying just stacked. Most countries in the world don't have more than 4 percent of your GDP in cash. Therefore in order to make India cashless or at least less cash oriented you will need to squeeze the amounts of cash available within the system. In 1978 the high denominational currency was 2 percent, it was Rs 80 crore.

I would tell my friends in the Congress party, they said in 1978 this did not happen. It was Rs 80 crore, today it is Rs 14 lakh crore, the high denominational currency. So, the impact of Rs 14 lakh crore can't be the same as the impact of Rs 80 crore in 1978. Therefore this Rs 14 lakh crore is replaced by people by how much? That I can't predict today.

Cash has several attendant problems, it can be used for corruption, it can be used for bribery, it can be used for crime, cash is involved in drugs, cash is involved in terrorism, it is involved in gun running and so on. Obviously people who have used cash for crime purposes are not foolhardy enough to try and risk and bring the cash back into the system because there will be questions asked.

Now those with crores of cash lying stacked can't claim the advantage that a nominal, honest person has. So, between a person who deposits Rs 2 lakh and a person who deposits Rs 2 crore the difference is obvious. To the Rs 2 lakh person you can't ask any questions because that is within the exempted limit but the Rs 2 crore person will have a tax liability attached to him and ,therefore, he will have to answer the questions. So, how much of this Rs 14 lakh crore comes back, how much of it gets extinguished, some would certainly get extinguished.

In 1978, I have looked at the statistics, out of Rs 80 crore, 25 percent got extinguished and therefore that percentage was reasonably high. Therefore we will have to keep our fingers crossed and see how much gets extinguished this time.

Marya: Talking about the criticisms that are coming your way, particularly by various political parties; it almost looks like that this decision has split the political class down the middle. While there are the likes of Naveen Patnaik, Nitish Kumar who have welcomed and supported you, there is also a Mamata Banerjee who has called it draconian; Rahul Gandhi has criticised it and criticism is also coming from Uttar Pradesh parties, such as Mulayam Singh Yadav and Mayawati, who have dismissed it and criticised it. How do you look at these reactions?

A: The polarisation is between the people of India on one side and some politicians on the other, this is the disconnect. Every Indian's life is going to be impacted by this decision because everyone has some element of cash. Every Indian is having to go to the bank to either exchange or deposit. Every Indian is going to have to change his habits.

Today, there are people who say I had a few Rs 100 notes and I have very little left or I have nothing left. Then his next comment is I still think it is a good decision, it will help the country. So, people are willing to suffer a little inconvenience because they realise that this is a decision which in the long run favours honesty, it favours integrity of the economy and individuals and therefore they are willing to suffer the consequences of this.

The politicians who are choosing to oppose it are ending up exposing themselves. People are not complaining, you haven’t seen demonstrations. Even today the queues outside the banks have been orderly, banks are still working trying to discharge their responsibility and people are standing for two hours and three hours at various banks.

Now there are some mischievous elements, for instance, a false rumour has been spread that the lockers are going to be digitised. That is factually incorrect, there is no such proposal at all.

I have been explaining to people, and I will take this opportunity to explain to you. And you cover the economy so you should realise and seriously analyse what the pattern of the Prime Minister and government's thinking was. Anybody who logically analysed it and followed it should have predicted this decision. What was the first step the government took?

Jan Dhan accounts. Instead of 58 percent, 100 percent Indian families should be connected to the banks. So, we first connected the families to the banks. To people with zero amount in the bank, we gave bank accounts. We gave those people a debit card. So, even if you had a zero balance in the bank account, you had a debit card in your pocket. Our next decision, people with money abroad, please come clean. If you don't, we will prosecute you. So, we started prosecuting them.

Our next decision, if there are benami, fake transactions, cancel them. Our next decision, if you have domestic black money please declare it or there will be serious consequences. In the last few months there has been a rumour that the government is going tough as far as the revenue department is concerned on black money and therefore it is no longer safe.

So, we were logically moving in this direction. The natural culmination of this is, if India has to grow into a developed country, if our banking system has to have sufficient monies in order to support industry, trade and business which is in the larger interest of businesses, if our formal GDP has to expand, therefore the parallel economy also becomes a part of the GDP, if GDP has to become cleaner, if tax revenues are to go up there is no point saying I am pro-poor.

The Congress party leaders say that we are pro-poor but then we will make sure the taxes are not collected which go to serve the poor. After all if I have a couple of lakhs extra in the governments kitty, I am going to spend that on the rural areas. So, the Uttar Pradesh political parties if they are genuinely pro-Dalit and pro-poor, must realise that the state must have more revenue and this proposal brings greater revenue to the people which can be invested in the poor of this country.

Therefore the advantages of this decision are so many that logically moving to a cleaner economy and I think some parties may be disturbed because elections are going to become cheaper and money is going to have a lesser role in elections.

Marya: The point is also being made by Mayawati and Mulayam Singh Yadav that perhaps BJP has managed in some way and that what Arvind Kejriwal in his message said, he used the word 'setting kari hai'.

A: I don't think his comments are serious enough to merit a response, because he speaks without evidence on any subject, but as far as political parties who are criticising it, there are only two parties whose reactions I am disappointed with. I expected Congress to have a more serious stand on the subject. I must say in all fairness that Mr Chidambaram's stance was more nuanced than his party's, but the Congress has a terrible track record.

When in power they have never taken a single step in the direction of checking black money. If you can recollect any steps that they took then please remind me. They didn’t take any step, but the two parties I am totally disappointed with one is the Left.

It is money and dirty money which is the cause of all evil. I thought the Marxists should have jumped up and supported this idea, but the Marxists want a cash economy to persist and I think the shrinking base of the Indian Marxists is because they have lost connection. This is completely contrarian to the Left ideology, the positions which the Left parties have taken, particularly the CPM has taken.

Obviously, second, just as Naveen Patnaik, Nitish Kumar have supported the government’s move, I had expected Mamata Banerjee to be on their side, given her entire track record notwithstanding my differences with her. Now to say that some inconvenience is caused, well inconveniences are caused when you charge income tax, inconvenience will be caused when you charge goods and services tax (GST), because a state without taxation is a very convenient state, but the long-term advantages of these are going to be too many.

Marya: The criticism of it being economic emergency, some kind of economic emergency?

A: What is an economic emergency? Transacting dishonestly, transacting in black money is the normal case and checking black money is emergency? These politicians have turned the logic upside down. Look at the kind of arguments which are being given, every fake argument is being given. Like, how will parties give shagun in a wedding, this is a wedding season, but wedding is a very pure institution why taint it with black money.

You can give it by cheque, if you have to give a Rs 1,000 or Rs 1,100 please do it by cheque, why do you want to do it by cash. That option is open or how will the farmer keep his money. A farmer is not liable to pay tax, so it is safer if he keeps it in bank and he will get some interest on it also. Now people come up and say what will the temples do, well why in the name of god should there be black money. So better the temple should have a bank account and deposit the money in the bank.

Marya: Mr Chidambaram has said introduction of Rs 2,000 note is a puzzle, that also a question that lot of people want an answer for. He also says that if new income or wealth is unaccounted will it not be hidden into Rs 2,000 note?

A: Let me be very clear, I don’t blame him for raising this question. The Congress, as I said, including his tenure was a do nothing government. They did not take a single step in this direction. Now, look at what we are doing, we have a legislation like the GST, because it is a more efficient system which will ensure tax compliance.

Through tax measures, PAN cards, where you spent on luxury items, that 1 percent excise on gold. We are trying to check the user of black money and while you are taking all these other steps the foreign black money law, the IDS scheme etc, you are now creating a system where people have no option but to deal in white.

There still will be people who will find ways of generating black money, but is it not my responsibility. As the government and the responsibility of India as a state to squeeze the opportunities of generation or just because there will be problems in future also - so let’s close our eyes and all live in a world of black money. Is this an argument which is expected from a political party which has ruled India for decades.

Sapna: Keeping the momentum on in terms of tracking down and curbing black money, there are lots of other recommendations the SIT just elevated, a very major step has just been taken so do you think that other recommendations also benefit.

A: I don’t see the SIT as an adversarial institution. The UPA government did, they did not constitute it.

Sapna: The banning cash transaction above Rs 3 lakh for example.

A: The SIT has been coming up with recommendations from time to time. Our officers go and interact with them. There are a very large number of ideas which we accept. There are some ideas which may complicate matters, so we refer it back to them. But as a whole, the overall approach of the SIT is commendable. They have been recommending actions in various fields and SIT experience has been of a huge assistance to the government.

I must acknowledge both the honourable judges and the team available with them, have made some very positive suggestions and therefore suggestions like PAN cards etc all came from the SIT.

Now it creates some kind of irritation when you have to disclose your PAN card number and you can no longer buy an expensive item by just without paying tax. It creates an inconvenience but that’s a legitimate inconvenience the state is entitled to create.

Sapna: Going forward do we expect more recommendations to be put into place in a phased manner?

A: Well, we will have to see what recommendations they make and we will have to consider them accordingly.

Marya: The decision to bring back Rs 500 note and Rs 1,000 the criticism is that why did you remove them in the first place?

A: I will tell you a lot of the present currency is now available as black money, some is available as a crime money and therefore it is necessary that this money gets into the banking system. The tainted part will get eliminated, the legitimate part will get into the banking system, some will get into the banking system after paying tax and some won’t come at all and therefore coupled with other steps future generation will be made a little more difficult. There still will be some generation, but it will be made difficult.

Now the RBI considered this matter and considered the various design because they are the expert body on this and keeping inflation in mind and conveniences in mind the RBI original proposal was to have a Rs 5,000 and Rs 10,000 note to be brought back. Now the government, for the good reasons, did not agree to that and finally we worked out an arrangement that the current replacement will be Rs 500 and Rs 2,000.

Marya: The criticism is also that lot of people are converting their black money into gold, so that’s why the prices of gold are going up, do you think it is a new form of illegal assets that it can create?

A: It can happen for some days. The quantum of gold available is also restricted. It is not indefinitely available, it is not produced in India and eventually the man who sells gold will also have to learn how to use that money. Because what will he do with the crores of rupees that he generates from selling gold, because he can’t deposit it in the bank, he will have to use that money in some way; and, therefore, once the user of that money also becomes difficult I think this trade won’t have a disincentive of sorts.

Sapna: Can we also expect some kind of a relief for the small taxpayer, especially the salaried taxpayer?

A: I can only tell you today the Government of India functions on a deficit of almost Rs 4-5 lakh crore. We borrow money in order to survive, therefore, when I am borrowing money where do I give relief from. If my taxation income goes up and I have a surplus in my pocket, then obviously one of the ideas is that you expand that base of taxation by making taxes more reasonable - so tax evasion, tax non-compliance will always lead to higher rates of taxation and once you make the rates more reasonable if you can afford to do that then compliances are also greater.

Sapna: The expectation probably is in terms of the exemption limit, the threshold limit, you had done that, you had taken a major step in your first Budget. So, probably there are expectations on that front. Adding one more question here, slightly on the other side of the coin, in terms of the corporate tax rates again this is going to be the third Budget. We already have a roadmap in place to bring down the headline rates to 25 percent.

A: I have already announced that and in the last Budget I did bring it down to 29 percent. For newer manufacturing investment it became 25 percent and therefore the direction that I have indicated towards 25 percent is a direction which we are going to maintain. In fact eliminate the exemptions and bring the rates down, that is the policy of the government.

Marya: Is there a roadmap post this? The SIT was setup in the first cabinet decision, is there something more that is coming.

A: A road for reform never ends. I can tell you the government will not take any adventurous decisions like the kind mentioned in the social media. There is no reason to panic and therefore as far as farmers are concerned, small depositors are concerned who will deposit small quantum, they have nothing to fear. However certainly there is a tax law and if you are going to deposit crore of rupees, as I have said ,this is not an immunity scheme, the tax law will take its effect.

Sapna: Can we also expect the IT law to be tightened further on that front in terms of the penalty provision probably the tax rates?

A: That's the budget matter which I can't really discuss at this stage.

Comments

0 comment