views

Luxury housing sales continued to top the charts post the pandemic – particularly in Mumbai Metropolitan Region or MMR, where prices in this segment had dropped during the first wave. Latest Anarock data shows a 24% yearly decline in MMR’s unsold stock of homes priced >Rs 2.5 Cr.

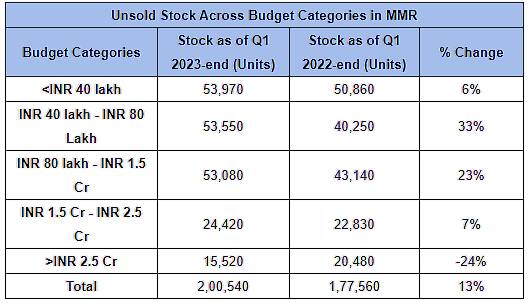

At Q1 2022-end, MMR’s unsold stock in this category stood at approx. 20,480 units; this dropped to approx. 15,520 units by Q1 2023-end. At pre-Covid Q1 2019-end, MMR’s luxury stock was approx. 23,130 units.

Also Read: Delhi NCR Holds 99,690 Unsold Residential Units, Highest Among Top 8 Cities: Report

According to Anarock, overall unsold housing stock across all budget categories in MMR saw a yearly rise of 13% – from approx. 1,77,560 units by Q1 2022-end to approx. 2,00,540 units by Q1 2023-end.

The luxury segment was the only one to see a 24% decline in the period. Unsold stock of mid-segment homes (priced Rs 40 – 80 lakh) in MMR saw the highest rise of 33% in the year – from approx. 40,245 units by Q1 2022-end to approx. 53,550 units by Q1 2023-end.

Meanwhile, in another report by PropTiger, it was revealed that the real estate market in Delhi NCR witnessed a healthy surge in supply of new residential units, 5,209 launches by various developers in the first three months of 2023, marking a remarkable 189 percent quarter-on-quarter growth. However, the unsold stock as of March 2023 in Delhi NCR was 99,690 units, reflecting a 66 months of inventory overhang while the all India inventory overhang was 34 months.

According to Anarock data, MMR’s inventory of homes priced Rs 80 Lakh to Rs 1.5 Cr rose by 23% in the period – from approx. 43,140 units by Q1 2022-end to approx. 53,080 units by Q1 2023-end – while inventory of homes priced between Rs 1.5 Cr to Rs 2.5 Cr saw a 7% jump. The stock of affordable homes (priced within Rs 40 lakh) jumped up by 6% in MMR – from approx. 50,860 units in Q1 2022 to approx. 53,970 units in Q1 2023.

“Luxury homes are driving housing sales across most cities since the first Covid-19 wave,” said Anuj Puri, Chairman – Anarock Group.

“The quest for more space – one of the defining characteristics of luxury homes – fuels most of this demand, which has helped developers to clear significant chunks of their unsold luxury stock. Data also reveals a 1% decline in the overall unsold stock of luxury homes priced >Rs 2.5 Cr across all top 7 cities; however, MMR saw a 24% yearly decline in its unsold luxury stock. In fact, the current luxury stock of approx. 15,520 units is the lowest the city has held in this category in a long time,” Puri added.

Furthermore, despite increased new supply in the top 7 cities in Q1 2023, overall unsold stock across all budget categories remained static in the period. It was approx. 6.28 lakh units by Q1 2022-end and stood at approx. 6.27 lakh units as on Q1 2023-end.

Comments

0 comment