views

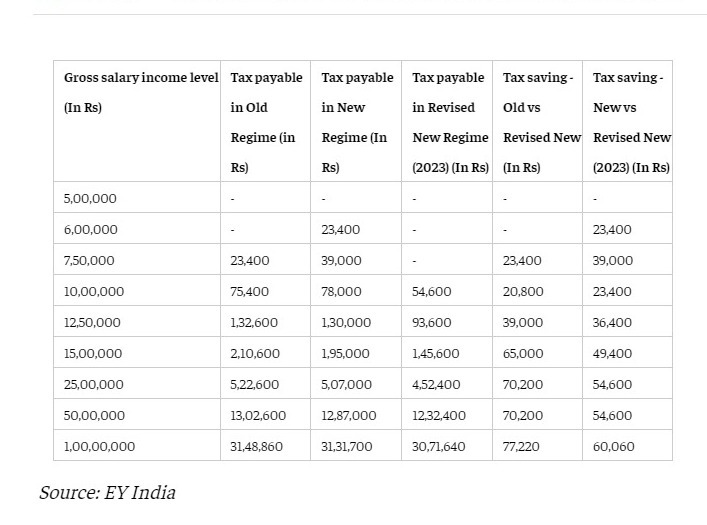

Budget 2023: While presenting the Union Budget on February 1, finance minister Nirmala Sitharaman announced changes in the new regime of personal income tax.

The government proposed to increase the income tax rebate limit from Rs 5 lakh to Rs 7 lakh in new tax regime.

The rebate for the resident individual under the new regime has been raised to Rs 7 lakh.

Standard deduction of Rs 50,000 to salaried individuals, and deduction from family pension up to Rs 15,000, is currently allowed only under the old regime. It is also proposed to allow these two deductions under the new regime.

Now, the maximum income tax rate has been reduced to about 39 per cent from 42.7% after a reduction in the highest surcharge to 25 per cent from 37 per cent.

Any individual willing to be taxed under this new regime can opt to be taxed under the old regime.

However, as soon as the income tax rebate was increased to Rs 7 lakh, the next question was how to save tax beyond this income, when you are just above this, supposedly Rs 8 lakh or Rs 10 lakh salary.

For salaried people, standard deduction of Rs 50,000 is permitted, which means, they will not pay tax at Rs 7.5 lakh salary.

“If taxpayers claim deductions and exemption less than Rs 3.75 lakh annually, it would be advised to opt for the new income tax regime and pay less tax than they give in the old regime, according to a PTI report quoting a senior finance ministry official.

If you are earning Rs 10 lakh in a year, your total tax liability, including 4 per cent higher education cess (HEC), under the old tax regime will be about Rs 78,000, without any deductions claim. However, under the new tax regime, your tax liability will be Rs 54,600.

How to save income tax on your salary?

Taxpayers with an annual income of up to Rs 7 lakh will save Rs 33,800 in taxes after the finance minister increased the rebate under the new income tax regime.

However, the old tax regime that comes with exemptions on certain investments and expenditures will remain attractive for taxpayers who pay house rent or have a home loan.

Vishal Raheja, MD, InvestoXpert.com, suggests once you know how much tax you must pay, you must make a plan to reduce your tax liability by taking advantage of tax deductions allowed by the applicable provisions of the Income Tax Act.

Here are a few pointers relating to the same as suggested by Raheja. However, be sure to speak with a tax expert to receive the suitable guidance on tax-saving investments tailored to your specific need.

-Invest in Tax Savings Opportunities -Investing in vehicles like the Public Provident Fund (PPF), Equity Linked Savings Scheme (ELSS), National Savings Certificate (NSC), Senior Citizen Savings Scheme (SCSS), etc. is the most obvious option to reduce taxes. These investments not only enable tax reduction but also wealth accumulation.

-Utilize Section 80C Benefits Several deductions from your taxable income are available under Section 80C of the Income Tax Act. Investments in PPF, ELSS, NSC, SCSS, life insurance premiums, and certain specified contributions to certain designated funds are among the most popular deductions under Section 80C.

-Obtain Tax Deductions on Home Loans – If you have a home loan, you may be eligible for tax deductions for both the interest and principal payments made on the loan.

-Benefit from Tax Deductions for Education Loans – If you have taken out an education loan, you may be eligible for tax deductions for both the interest paid and the principal repaid on the loan.

-Benefit from Tax Savings on Retirement Savings – You can benefit from tax breaks on both your contributions and the maturity proceeds if you make payments to a pension fund like the National Pension System (NPS).

-Utilize Tax Benefits for Medical Insurance – The premiums for medical insurance policies are tax deductible.

-Benefit from Tax Deductions for Medical Insurance – The premiums for medical insurance policies are eligible for tax deductions.

“Though without any savings, investments and deductions, the new tax regime seems beneficial; the old tax regime can be attractive if you make use of savings, investments and deductions,” an independent tax professional told news18.com.

Moreover, overhauling the income tax structure is expected to add more money in the hands of the middle-class taxpayers and positively impact spending capacity and savings.

Read all the Latest Business News here

Comments

0 comment