views

New Delhi: Overseas firms including Dutch pension fund manager APG and US buyout group Warburg Pincus are looking to invest in India's warehouses, hoping to cash in on demand for modern and efficient storage space from booming online retailers.

With more Indian consumers shopping online, the country's $110 billion logistics and warehousing sector is stretched.

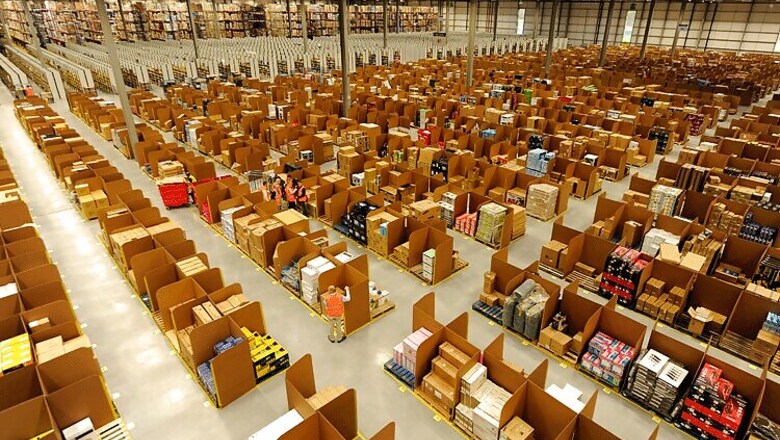

Existing spaces, known as "godowns" - low-rise sheds with poor ventilation and only a shutter to ward off heat and dust - are too old and cramped for firms like retail giant Amazon.com and Indian rival Flipkart.

Goods frequently get soiled, or spoil.

By contrast, e-tailers need to move goods around swiftly with minimal damage. They demand fire sprinkler systems, climate control, levelled loading bays and paved roads to warehouses.

Simply adding this in can lift rents by up to 20 per cent, according to real estate firm JLL.

"We have got enough people running around with bags of money, and not that many assets," said Ben Salmon, head of Singapore-based Assetz Property Group that has raised $50 million from Asian investors to buy warehouses in India.

Rekindled demand is good news for India's property developers, many of whom are saddled with high debt and struggling with sluggish residential sales. Office leasing is slower than during the peak years between 2009 and 2011.

E-commerce in India, meanwhile, is booming: the market is expected to grow to $220 billion in terms of value of goods sold by 2025, up from an expected $11 billion this year, according to Bank of America Merrill Lynch.

To satisfy that, supply of modern warehouses in India is set to more than double by 2020 to 200 million square feet, JLL estimates, fuelled by online retailers. They took up over 20 percent of the space added in the first half of 2015.

As demand pushes up rents, which are as low as 156 rupees ($2.34) a square foot a year in some city outskirts, investors can earn total annual returns of 15-20 per cent, analysts estimate.

By comparison, average annual returns on industrial assets in the UK are expected to be 9 percent over the next five years, a report from real estate firm Colliers International shows.

ROOM TO MOVE

In the dusty wastelands south of New Delhi, large, steel-framed, modern warehouses with ventilation and 24-hour security are mushrooming on what was once farmland, as logistics firms and retailers line up to serve the capital.

Amazon is among them, its large, modern, red and white warehouse many times the size of a cluster of nearby godowns, ranging in size from a family garage to a basketball court.

Amazon India has leased 20 fulfilment centres - warehouses where it stores goods and packs and sorts orders - in the last 18 months from multiple landlords. Still, it needs bigger, modern spaces closer to customers; the average size it leases today is 200,000 square feet.

The sector has attracted more than $1.5 billion in private equity funds since 2011, according to data tracker Venture Intelligence, and more is afoot.

Warburg and developer Embassy Group plan to jointly invest $250 million to build, lease and operate a portfolio of up to 20 million square feet of warehouses over the next 5-7 years, said Anshul Singhal, CEO of the joint venture, Embassy Industrial Parks.

APG is also looking for a local partner it can invest with to build logistics parks in India, said Sachin Doshi, the head of its private real estate investments in Asia Pacific.

Of course, there are basic challenges, investors say; for one, acquiring land where ownership cannot be disputed.

To sidestep this and cash in quickly, developers like Assetz are betting on buying larger existing warehouses and refitting them, rather than building from scratch.

After investing the first tranche, Assetz plans to raise another $100 million next year, giving it enough money to buy 10 million square feet of warehouses, said Salmon.

Comments

0 comment