views

All of a sudden, the entire soundtrack has changed. Global music streaming services, which were adopting a wait and watch strategy all this while, have made a beeline for the Indian market. Global giant Spotify had barely landed on our shores to take on the likes of Apple Music, JioSaavn, Amazon Music, Gaana, Hungama and Google Play Music to name a few, that Google pulled a proverbial rabbit out of the hat and announced the launch of the YouTube Music service in India. Choice is more vibrant than ever for users.

The reception has been quite welcoming, nevertheless. Spotify noted that it clocked 1 million users in India in just the first week of its launch. The company doesn’t usually give out subscriber base numbers for such short intervals in global markets, which could mean this clearly was an achievement. Globally, Spotify has 207 million active users, of which 96 million are paying for Spotify Premium. Spotify attributes the increasing popularity of streaming services in India to a variety of factors. “India is a huge market and we believe we debuted at the right time, given the size and health of the music industry, the growing creator ecosystem, the increasing smartphone penetration, and evolving consumer segments,” says Amarjit Singh Batra, Managing Director, Spotify India, while speaking with News18.

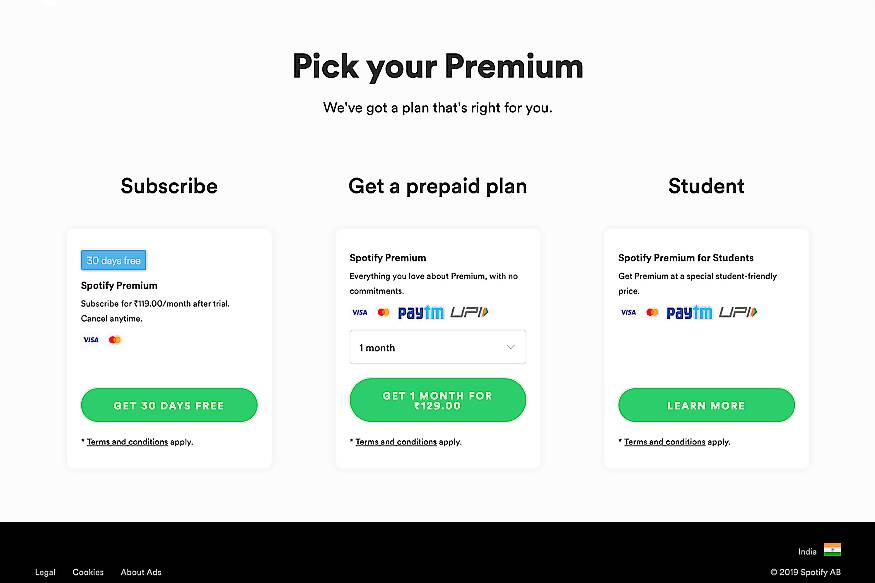

Spotify Premium is priced at Rs 119 per month for full access to all the premium features in the app, though you can opt to remain on the free subscription tier post the 30-day free trial, and bear with some advertising in the midst of the music playback. At present, Spotify is the only international player to offer differing duration Premium options as well—Rs 13 for 1 day and Rs 39 for a week, Rs 389 for 3 months, Rs 719 for 6 months and Rs 1189 for an year.

Competition is tough. There are Indian players in addition to the global giants, vying for a chunk of the ever-largening pie. “We have 4 major Indian players and around 90% of the consumption happens on these platforms. Amongst these platforms, content provided through labels is almost similar and all players have tried to work towards differentiating their services from one another on the basis of app interface, AI enabled recommendations, original content etc,” says Neeraj Roy, Founder & CEO, Hungama Digital Media while speaking with News18. Hungama Music currently has 42 million monthly users.

Do Indians like to pay for music streaming? Contrary to the general perception, things are changing. And hence so many players vying for a chunk of the pie. “Though the Indian music streaming industry is still in its early days where nearly 1% of audio streamers pay for music, there is definitely a growing section of users who are seeing the value in subscriptions. While it is a popular notion that Indian consumers shy away from paid content, we believe the market is maturing and ready to transition from a price conscious to a value for money mindset,” says Spotify’s Batra. Convenience is a factor, and so is the more affordable internet, particularly on mobile. According to the latest numbers by research firm Deloitte in February, India has about 150 million subscribers for music streaming services—of which about 14 percent either use a service bundled with their mobile plan or have signed up for Amazon Prime which includes the Amazon Music streaming service. The International Federation of the Phonographic Industry (IFPI), the digital revenues, including from music streaming subscriptions in India, was around $130.7 billion. The IFPI survey suggests Indians spend 21-and-a-half hours a week listening to music, which is significantly more than the global average of 17.8 hours and 95% of internet users in India consume music through on-demand streaming. A report by FICCI and EY released this month suggests that the online music streaming space could be worth Rs 19.2 billion by the year 2021. “Currently, there are about 300 million consumers in India streaming content. The market is expected to touch about 700 million consumers in the next few years,” says Roy.

In terms of the pricing, most of these services are priced between Rs 99 and Rs 120 per month, and that really won’t be a factor when it comes to you picking the one favorite music streaming app.

The biggest surprise has perhaps been the launch of YouTube Music this month, which is also a part of Google’s YouTube Premium subscription plan (you can subscribe to YouTube Premium or just the YouTube Music app) and will play alongside the Google Play Music app for the time being. “As the Indian music streaming market gets more mature, there will be more demand for a premium service. YouTube Music Premium gives music fans a subscription offering that is built just for music, rather than bundling music with additional benefits like YouTube Originals and features in the main app,” says Pawan Agarwal, Head of Music Content Partnerships (India & South Asia), YouTube, in an interaction with News18.

There are two ways to get access to YouTube Music. You can either sign up for YouTube Music at Rs 99 per month, or subscribe to the YouTube Premium package for Rs 129 per month which gives you access to ad-free YouTube viewing and Originals, as well as YouTube Music. For the moment though, a YouTube Music Premium member will also get subscription access to Google Play Music, and existing Google Play Music subscribers will get a YouTube Music Premium membership as well.

But this does pose a slight complication—what happens to the Google Play Music app? “Subscribers of Google Play Music will get YouTube Music Premium membership as part of their subscription each month. And for them nothing will change -- they will still be able to access all of their purchased music, uploads and playlists in Google Play Music,” says Agarwal. However, Google does confirm that they eventually plan to replace Google Play Music with YouTube Music, but not before certain criteria are met by the new app—this includes the feature to let users upload their your own music to their online library, play music locally stored on Android devices and easily transfer the library and preferences from Play Music to YouTube Music.

While the likes of JioSaavn, Gaana and Spotify have an ad-supported free subscription, Apple Music, Amazon Music and YouTube Music don’t. Does having an ad-supported free subscription tier help in retaining subscribers for longer? Users who don’t mind the extra advertising that comes their way or aren’t exactly very picky about the sound quality either, will not have to pay a monthly subscription to stream their favourite music. “The free ad-supported tier on music apps allows the users to sample the content and experience the platform. In the process, users are also exposed to the benefits they would get as premium subscribers,” says Hungama’s Roy. However, he believes that in the end, it is content that truly dictates customer retention. “Ultimately, what keeps a user on any platform is the experience, whether it is ease of use, the content, or the general engagement and relatability they feel towards a brand. We are the most popular music app in the world, and nearly 55% of our users are on the free tier,” says Spotify’s Batra. For India, Spotify has further localised the free tier, which they call ‘free on demand’ and gives users access to any song they want to listen to, as many times as they want and have access to the same playlist features that Spotify Premium subscribers. To that effect, it is a close call between the competition. Apple Music leads the way with a library of around 45 million songs, while the coming together of Saavn and Jio Music in December means they also offer around the same number of songs to their users. Spotify currently has about 40 million songs on its platform, while Amazon Music clocks in with upwards of 30 million songs.

Is the more affordable 3G/4G data on mobile phones as well as the better home broadband connections responsible for people streaming more? “India’s data usage on mobile is now at par with developed markets at 8 GB per month per subscriber,” says YouTube’s Agarwal. The Hungama Music Sound of Fame Report 2018 indicates that as many as 30 million GB worth of data was streamed in 2018, and the number of streams increased by three times in comparison with the consumption trends of the years 2017. That is perhaps the clearest indicator of the changing user preferences—most users now want the convenience of instant music streaming, as opposed to perhaps scouring the depths of the internet for hours to find and download the music they want to listen to. However, the trend isn’t the same all over the country. “Downloading songs for offline listening is a useful tool for those who live in areas of patchy connectivity or commute often. Over the last year, we witnessed a 29x increase in the number of songs downloaded. Users who do not face connectivity issues continue to stream using mobile internet or Wi-Fi,” says Hungama’s Roy.

This is perhaps just the start of the bloody battles in the music streaming space. The next few months could very well be classified as the experimentation stage, where users weigh their options and see which streaming platform works best for them. Differentiation will play a major role, and that’s where the ecosystem could play a major role. Apple Music has the advantage of a potentially captive audience who already use iOS and macOS products such as the iPhone and the MacBook respectively. Amazon Music has the Echo assistant powered Alexa smart speakers. Spotify perhaps has the checklist ticked off best, with an app for almost every platform including Android TVs, and the Spotify Connect which lets you stream music with a single tap to any Wi-Fi enabled speaker, television, cast device, game consoles and smart watches. And this sort of uniqueness will only become all too common, as platform close in on each other, at least on the features sheet.

Comments

0 comment