views

In the fourth floor of a dark grey building near the western end of Residency Road in Bangalore, the air is thick with energy. Employees scurry around as if their watches run at a different pace.

In a room dominated by a picture of RK Laxman’s common man, the one-time mascot of low cost airline Air Deccan, there is a meeting in progress. But everyone is standing and the conversation takes place in bullet points rather than in full sentences.

In a floor above, Jude Fonseka from Sri Lanka, who has seen his share of action during his 22 years at FedEx, says he only heard of start-up stories at his former employer. Now, he is living it.

At the centre of all this excitement is a man whose name is associated with serial entrepreneurship in India. The man is Captain Gopinath, who took India’s airline industry inexorably down the path of low-fare travel.

In the corridors of his temporary headquarters, Gopinath gives shape to his latest idea, to launch an express cargo company, Deccan 360, through stories. Of how things will change - from the way we eat apples to the way we get our laptops repaired.

Gopinath’s new venture is about expanding express cargo to more locations, small towns, small industrial clusters, far flung farms. If you are a manufacturer, he will supply your raw materials when you want it - and deliver the finished goods to your customers.

He wants to kill time and distance. And he plans to service it all from one hub: Nagpur, Maharashtra.

Gopinath, CEO Fonseka and their team are in the process of setting up the basic infrastructure to do this. On the day of its launch, expected in late October, the cargo airline will connect 17 airports and 24 cities with three Airbus A310s and seven smaller ATR 42 turboprops.

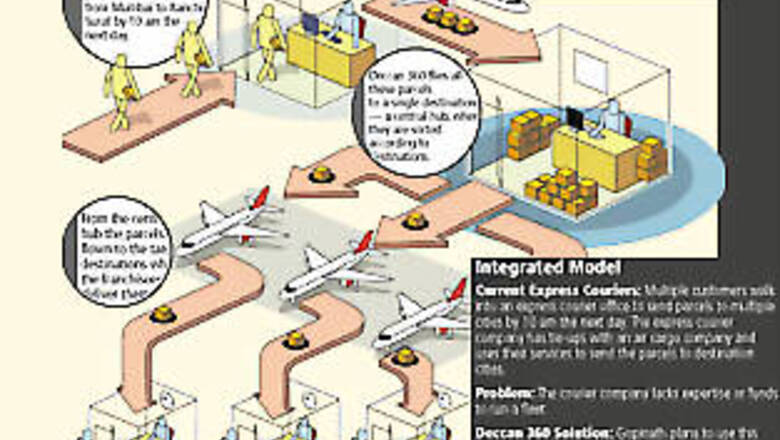

His vision for the future is grand: Each night, flights from different parts of the country, with parcels from every nook and corner, will leave for Nagpur, located about the centre of the country.

All these pieces will be consolidated and sorted. Before dawn, these flights will go back to the cities they came from and deliver the goods. The road transport, door delivery and collections will be done by franchisees. The Deccan 360 Web site proclaims this to be Captain Gopinath’s new revolution. But, is it?

The hub and spoke model isn’t new. FedEx has used it successfully for ages. “But, it’s new for India. The other players haven’t tried this model here,” says Narayanan Ramaswamy, executive director at KPMG Advisory Services.

“Also, the scale he is looking at, the integrated model that he is planning; I would certainly call it revolutionary for India.” he says.

PAGE_BREAK

Game Changer

Revolution is what Gopinath does best. When he launched his low-cost airline in 2003, critics scoffed. Millions of aspirational Indians didn’t. Air travel, for long a mode of travel for the elite, used to carry 8-10 million passengers a year in India; today the number stands at 70 million passengers.

But what about Air Deccan itself? At its peak, it was adding one plane a month, flying 700,000 passengers a month across 67 cities. It was also bleeding money, so badly that it had to be sold. Air Deccan, the airline that spawned the air travel revolution, did not survive on its own to harvest the fruit.

Will Deccan 360 fly the same route?

“India is at the brink of an air express revolution. If you look at the US and European markets, currently, the air express segment constitutes about 50 – 60 percent of total air cargo market. Once the economy reaches a certain stage in its growth phase, air express becomes viable and necessary,” says Arun Narayanan of Frost & Sullivan.

Deccan 360 could well be the nudge that triggers the revolution.

Today, express courier (overnight deliveries of packages) is restricted to the top six cities in the country.

Expansion happens only when the market expands. Blue Dart, the biggest player in the express cargo segment, follows this strategy.

The company owned by German logistics major DHL, controls 43 percent of the market. It uses Blue Dart Aviation, India’s only successful freighter airline, for air support.

The last one year has been very challenging as demand has shrunk. Anil Khanna, MD, Blue Dart says, “Up until 2007, the industry grew at 17 percent per annum. The figures have slowed down in the next two years.”

The slowdown also nixed plans by other larger players to enter the air-cargo space. One such venture Quikjet, was to be launched by Singapore based private equity fund Cardinal, with IL&FS, IDFC and Tata Capital, in April last year.

The project has been delayed. Even during the boom, other start ups in this space like First Flight, couldn’t get airborne.

But, Gopinath believes the market is ready and waiting to be tapped.

His favourite, oft-repeated story is about an incident in 2005, when an Air Deccan plane was grounded in Calcutta.

An engine had to be flown in from abroad.

With every passing hour, he was losing money, and his reputation was getting battered.

He wanted to airlift an engine from Delhi to Kolkata, but there was no way he could do that, because no airline had that kind of cargo-space.

It took six days before he could finally bring in the engine via Singapore, through a foreign freighter. Gopinath says there are many - in small towns, as well industrial clusters who would be ready to pay for a reliable delivery.

Typically, in air cargo segment, walk-in customers account for 10 percent of the business, big customers such as Nokia account for 20 percent, and the rest are mostly small and medium enterprises. Deccan 360 hopes to tap the last market.

Palani Shanmugam, who has been running a cargo for over 20 years, believes there is demand for express cargo even among his existing clients in Coimbatore and Tirupur.

A year ago, when he read about Gopinath’s venture in a trade journal, he contacted them.

He is among the 60 franchisees on board the Deccan 360 venture. “In Coimbatore, people know of Deccan. All you have to do is to offer good service and reasonable price,” he says.

Even if there is a market, can he pull off something on such a huge scale? Gopinath likens it to being a telecom company. It can’t enter the market offering connectivity to just two places. It has to be big. And that is the biggest problem.

PAGE_BREAK

An executive from a firm that has attempted air cargo says, “Deccan 360’s plans for creating a hub-and-spoke distribution model appears far too ambitious to implement in the timeframe that Gopinath claims he will. Moreover setting up an integrated distribution network in an infrastructure-starved operating environment such as ours will not be easy. It took Blue Dart almost a decade to integrate and perfect their air-surface network.”

An army colleague describes Gopinath as the ‘Energizer Bunny’ who marches to the beat of his own drum. He is often described as a hands-on person, interested in details. For a start up, that’s a great quality. In Deccan 360, he has assembled an eight member team, led by Fonseka.

Management guru Ram Charan advises the team. “He has guided some of our key discussions. At one point, there was a debate on whether to go in for a franchisee model or not. His inputs helped us a lot in coming to a decision,” says Fonseka.

Low Cost Culture

Gopinath has invested close to Rs 35 crore in an IT system, that’s designed to help the company reduce costs. For example, the system will make sure that a franchisee pays upfront, before even the airway bill is generated.

“We’ve built a system where we can integrate the billing into their (franchisee) billing so we can export into their accounting software,” Gopinath said. This helps in working capital management, and saves on manpower too. But, most importantly, his experience in running a low cost airline will help significantly in air operations.

Gopinath might have learnt the trick of instilling low cost culture within one organisation.

But, Deccan 360 will have to do that for franchisees. Will that not be tough? Gopinath says it’s the opposite. The franchisee model takes capital expenditure off the books of Deccan 360. Blue Dart employs 6,000 people within India, Gopinath has a team of 200 people - he plans to expand that to not more than 400 people. He just has to train the entrepreneur and the entrepreneur will train the people he recruits at his own cost.

But all his grand plans could derail if he fails to convince investors. Mohan Kumar says that the company will have to invest Rs. 500-600 crore in its Nagpur hub in the next five to six years. Last year it tried to raise money, but the financial crisis brought it to a halt.

“Merrill Lynch was talking to us but they did not know their bottom was burning,” says Gopinath. Then he decided to put in his own money, build the infrastructure, launch the service and then seek money for expansion.

Deccan 360 is talking to investors again. Nothing has been concluded yet.

“The investors with no exposure to logistics don’t even get what we are trying to do. But, the ones who know logistics are responding better,” says Gopinath.

It’s a complex project where he has to get a lot of things right. Manage air operations with an infrastructure that’s not designed to handle volumes, connect the IT systems to the franchisees, customers, hub and its own offices - and software on site, in real time can throw surprises.

The company is yet to announce the final date. It’s likely to be in the middle of October, but some franchisees feel he should postpone till after Diwali.

“It’s like a daughter’s wedding. To fix a date is very hard,” Gopinath says. Or like giving birth, to a super-sized kid, we think.

Comments

0 comment