views

New Delhi: The first quarter’s GDP growth numbers suggest another year of 8 per cent growth following the last year’s growth of 8.4 per cent.

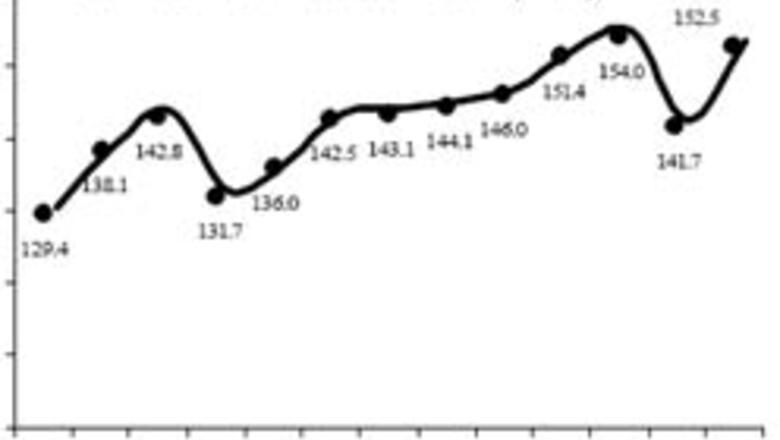

The optimism on the output front is also echoed in the rise in the Business Confidence Index (BCI) that was observed in National Council for Applied Economic Research’s (NCAER) survey of Business Expectations conducted in September-October 2006.

The rise in BCI was also mirrored in the increase in the Political Confidence Index. Both these indices had declined sharply in the previous quarter, with the fall apparently triggered by the crash of stock prices towards the end of the first quarter in 2006.

The accelerated pace of economic activity is reflected in several indicators. The industrial output performance for the first five months of the current financial year is better than in the same period last year.

Growth of the Index of Industrial Production (IIP) for April-August 2006 is more than 10 per cent as compared to 8.7 per cent last year.

The financial performance of the corporate sector in the current year’s first quarter has exceeded the performance in first quarter of 2005-06.

In the services sector, the telecommunication revolution has continued. Growth in new subscriptions, rise in non-food credit, growth of the civil aviation sector, performance of the railways indicate that the momentum of the service sector growth will be maintained.

In the case of construction the pace of growth appears to have slowed but this may well be transitory given the current emphasis on infrastructure development.

The rainfall during the current monsoon season has turned out to be slightly better than last year from the perspective of foodgrain production. There are, however, several regions in which rainfall was well below the long-term average for the season. Some of the regions where the rainfall was below normal include the northwestern states of Punjab and Haryana where the irrigation coverage is extensive.

The high rate of economic growth has benefited from favourable global capital flows and demand conditions.

PAGE_BREAK

The merchandise exports have increased by 23 per cent in the first half of the current year.

The FDI inflows in the first quarter at $1.7 billion suggest that last years’ mark of $7.8 billion is likely to be exceeded this year.

The high fuel prices suffered throughout the last year appear to be softening but the fact that major economies of the world are expected to see continuation of economic growth trend implies that demand pressure on energy supplies will remain.

But the prices of sensitive items such as foodgrain and energy have increased at a much higher rate in the first six months of the year.

The policy interest rates, the repo and reverse repo rates, had increased in the first quarter by 50 basis points in the context of rising interest rates globally and the concerns over rising inflation rate.

There was also a concern that the consumer credit is rising at unprecedented rates and there is a need to ensure better quality of credit at such pace of expansion. The rise in interest rates has been a cause of concern in the context of the adverse impact of higher interest rates on investment spending.

In the mid-year review of the monetary policy, RBI has increased the repo rate by 25 basis points raising it to 7.25 per cent while keeping the bank rate, reverse repo rate and CRR unchanged. The increase in repo rate raises the cost of short-term funds to the banks.

However, whether this is passed on to lending rates would depend on a host of other factors such as availability of liquid funds from other sources. It may also lead the banks to use funds more efficiently.

The revised projections for 2006-07 indicate a higher current account deficit of 2.1 per cent of GDP and lower gross fiscal deficit of the Centre at 3.7 per cent of GDP. The inflation rate is projected at 5 per cent.

Comments

0 comment