views

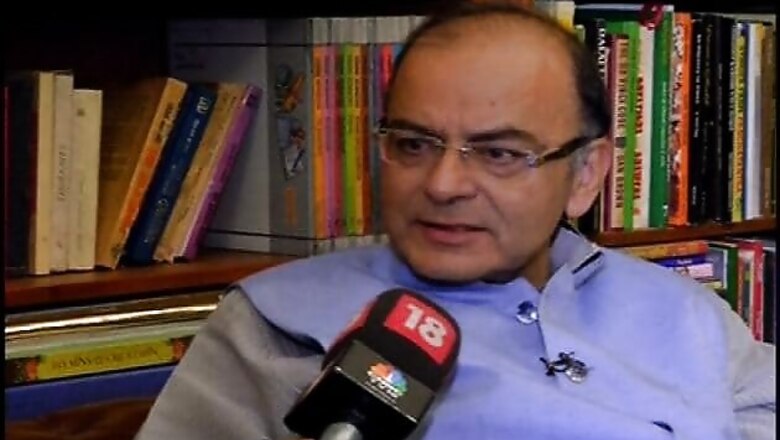

New Delhi: The government will not take away any 'significant' power of the RBI and a clarification on the central bank's role in the regulation of bond market will be provided in April, Finance Minister Arun Jaitley said.

In his first full year Budget, Jaitley had on February 28 proposed to shift the powers to regulate trading in government bonds from RBI to capital market regulator Sebi.

"RBI is a time tested institution and therefore government has full confidence in the ability of the RBI and therefore the question of taking away any significant power of the RBI doesn't arise," he said.

Asked about the Budget proposal, Jaitley said a clarification on RBI's power to regulate will be provided during the debate on Finance Bill 2015 when Parliament reconvenes on April 20.

"Whatever steps we take will be in consultation with the the RBI. The RBI Governor has been in touch with me," he said.

Earlier in the day, RBI Deputy Governor SS Mundra said the regulation and issuance of government securities (G-Secs) have implications on monetary policy.

"I think, the (RBI) Governor had told about it that the timing (of issuance of G-Secs) and all related issues need to be examined," Mundra told reporters.

Under the present system of regulations, the money markets are controlled by the RBI, but mutual funds, who are major players in the money market, are regulated by Sebi.

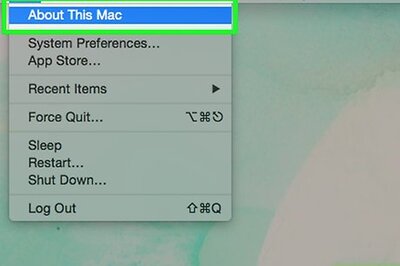

The Finance Bill seeks amend in sections 45U and 45W of the RBI Act to enable this shift. The proposed amendment to section 45W says, "any direction issued by the Reserve Bank, in respect of security, under chapter III D of the RBI Act, shall stand repealed."

This means that the RBI will cease to regulate government bonds and other money market instruments. These powers were given to the central bank after amending the RBI Act in FY06, to enable it to ensure financial stability.

Both these proposals are part of the Financial Sector Legislative Reforms Commission prepared by N Srikrishna and submitted in March 2013.

Comments

0 comment