views

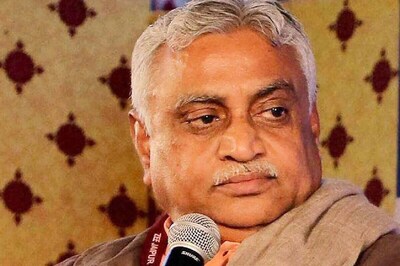

New Delhi: Finance Minister Pranab Mukherjee will present the Union Budget 2010-11 in Parliament on Friday.

Mukherjee is faced with a classic Catch-22 situation - how to sustain stimulus-aided growth while ushering in fiscal consolidation.

The Economic Survey 2009-10 presented on Thursday favoured the gradual rollback of stimulus measures that were introduced following the global economic meltdown in late 2008.

But with industry looking to the Union Government for continued support, Union Budget 2010 could well be a balancing act.

The price rise worries are also weighing down on the Finance Minister.

So Mukherjee is unlikely to resort to large scale, across-the-board rollback of stimulus.

There could be selective increase in excise duty in some sectors and service taxes are likely to go up. The Budget could partly reverse the six per cent cut in excise rate and service tax could go back up by two per cent. Both were reduced as part of the stimulus package.

There could be disinvestment in PSUs like Coal India, Hindustan Copper, SAIL, BSNL to raise funds.

With the emphasis on developing social indicators, Mukherjee could give more money for expenditure on education, health and rural support.

The allocation to flagship programmes like Bharat Nirman and Jawaharlal Nehru National Urban Renewal Mission could also see an increase.

For the tax-payers, too, there could be some good news as the Finance Minister is likely to increase the savings limit under Section 80C and. The exemption limit on medical expenses could also be increased.

Comments

0 comment