views

Establishing Your Non-Profit

Check if your name is available. Your organization’s name cannot already be used by another corporation. It also can’t be too similar. Search the business name database at the Secretary of State’s website. You should also download and submit a free Name Availability Inquiry Letter, which is available here: http://www.sos.ca.gov/business-programs/business-entities/name-availability/#checking. Also check whether your name has been trademarked. You can search the federal trademark database.

Reserve your name. You can download a Name Reservation Request Form from the Secretary of State’s website. Complete the form and submit it to the address provided on the form. The reservation is good for 60 days and costs $10.

Select the initial Board of Directors. You must have at least one director when you incorporate. Generally, the IRS is looking for between three and 25 directors. The directors should share the organization’s vision and have relevant experience. Also look for board members who have strong ties to the community. They can help bring your organization to the attention of other non-profits. Ideally, your board should be diverse in terms of occupation, background, gender, age, and race. The more perspectives you have, the more thoughtful your decision-making will be.

Prepare your Articles of Incorporation. You can download Form ARTS-PB-501(c) from the Secretary of State’s website. These are fill-in-the-blank forms that contain the language necessary to establish a non-profit. Your articles will contain the following information: Your non-profit’s name. Your initial street address and mailing address. Your California agent’s name and street address. This person will receive service of process in case you are sued. This statement: “This corporation is a nonprofit public benefit corporation and is not organized for the private gain of any person. It is organized under the Nonprofit Public Benefit Corporation Law for [public or charitable] purposes.” A statement of purpose that satisfies the IRS requirements. Federal tax-exempt status is reserved for organizations that operate for a charitable, religious, scientific, literary, or educational purpose. A statement that your non-profit won’t engage in prohibited legislative or political activity. A provision dedicating your organization’s assets to another non-profit in case you dissolve.

Draft your bylaws. Your bylaws are the internal operating manual for your organization. You don’t need to file them with the state. However, you should keep them at your principal office. Your bylaws should include the following: Basic information, such as your corporate name, principal office, and other offices. Your organization’s purpose and any limitations. For example, you should limit political activity to retain your non-profit status. An explanation of what happens to the assets if the organization dissolves. A description of how people can become members of the organization and their voting rights, if any. Information about directors and officers, such as the number and qualifications, as well as how meetings may be called and conducted. Also explain how directors and officers can be removed. A conflict of interest policy. An indemnification provision for directors, officers, and agents. You indemnify them when you agree to pay their expenses if they get sued. Your policies on keeping corporate records and the corporate seal.

Incorporating Your Non-Profit

File your Articles of Incorporation with the state. Make a copy for your records and then mail them to the Sacramento address on the form. You cannot file your Articles of Incorporation online at this time. Include your filing fee along with the forms. As of 2017, the fee is $30. Make your check or money order payable to “Secretary of State.” You can also drop off your copies to the office in Sacramento. You will have to pay an extra $15 fee. Articles dropped off in person will be given priority over those submitted through the mail.

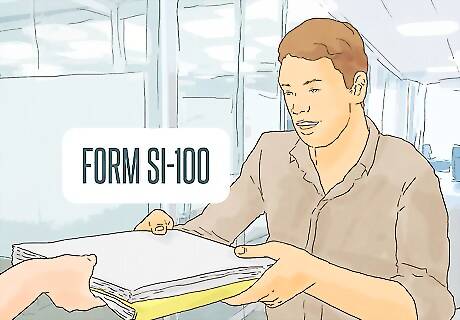

Submit a statement of information. You must file Form SI-100 with the California Secretary of State within 90 days of filing your Articles of Incorporation. The form is available from the Secretary of State’s website. It costs $20 to file.

Hold a meeting of your Board of Directors. At the first meeting, you should act on the following issues: Approve the bylaws. Elect directors, if none are named in your Articles of Incorporation. Appoint officers. Set your accounting period and tax year. Approve applying for federal and state tax-exempt status. Approve any initial transactions, such as opening a bank account or reimbursing start-up expenses. Approve compensation for the executive director (if you have one).

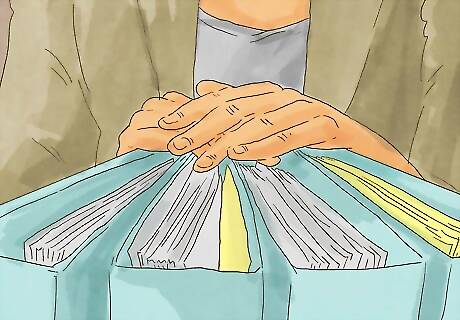

Create a corporate records binder. This binder will hold important documents, such as your bylaws, Articles of Incorporation, and meeting minutes. You can use a three-ring binder and store it at your principal office.

Register with the Attorney General. File Form CT-1 with the Attorney General’s Registry of Charitable Trusts. The form is available from the Attorney General’s website: https://oag.ca.gov/charities/forms. You should submit your Articles of Incorporation and bylaws with the initial filing. Once you receive federal tax-exempt status, you should file your federal determination letter with the Attorney General, along with a copy of your federal application.

Applying for Tax Exemptions

Obtain an Employer Identification Number (EIN). An EIN is your non-profit’s tax ID. You will need it if you have employees and if you want to open a bank account. You can request the number from the IRS website at https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online.

Apply for federal tax-exempt status. Download Form 1023 from the IRS website. If you’re a smaller non-profit, then you can file Form 1023-EZ, with an IRS filing fee of $275. The shorter form is reserved for non-profits that expect to have less than $50,000 in gross receipts each year and total assets under $250,000, with other limitations as well. As of 2018, the filing fee for Form 1023 is $600 for most organizations. See the instructions for the precise amount. It takes the IRS about 3-4 months to process this application. However, it could take longer if you leave out information. Look over the form carefully and consult with an attorney if necessary.

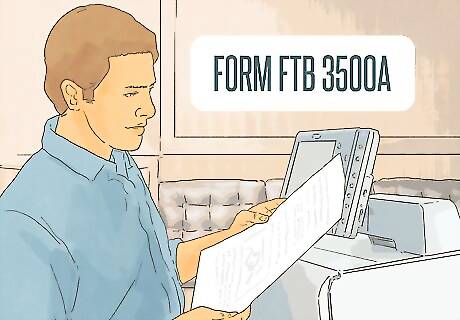

Apply for your California tax exemption. Apply for California non-profit status after receiving your federal tax exemption. Download FTB 3500A, Submission of Exemption Request, from the California Franchise Tax Board. Submit the form along with a copy of your federal determination letter. There is no fee. If you haven’t yet received federal tax-exempt status, you must file FTB 3500 and pay a $25 application fee. If possible, you should wait until you receive your federal determination.

Comments

0 comment