views

X

Trustworthy Source

US Consumer Financial Protection Bureau

U.S. government agency for protecting consumers in the financial sector

Go to source

Explaining Your Situation

Figure out a realistic offer before beginning your letter. As with any negotiation, you don’t want your settlement offer to be so low that the creditor refuses to even consider it, but also no higher than it needs to be in order for them to accept it. Generally speaking, don’t go under 25% or above 50% of the total amount you owe—30% is usually a good starting point. And never offer more than you can actually afford! For example, if you owe $10,000 USD, consider making an initial offer of $3,000 USD. Thoroughly examine your current income and household expenses in order to figure out what amount of settlement offer you can make. Debt settlements are usually lump-sum offers (paying the agreed-upon amount all at once to satisfy the debt). You can definitely try making a settlement payment plan—for instance, cutting a monthly debt payment from $1,000 to $500 USD—but this has lower odds of success.

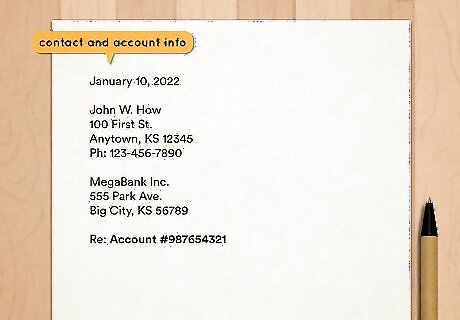

Start the letter with detailed contact and account info. Settlement proposals, along with all the correspondence that follow them, are legal documents—so it’s really important to get all the details right. Contact your creditor’s customer service department, if needed, to get the right info. Include the date, your name and contact information, the creditor’s info, and then your relevant account number for the debt: January 10, 2022 [blank line] John W. How 100 First St. Anytown, KS 12345 Ph: 123-456-7890 [blank line] MegaBank Inc. 555 Park Ave. Big City, KS 56789 [blank line] Re: Account #987654321 [blank line]

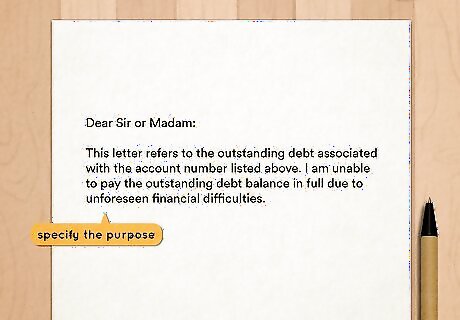

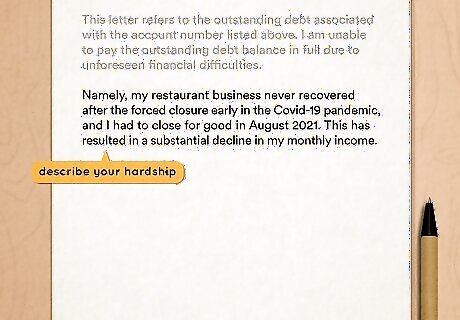

State right away that you’re unable to pay the debt. Other than including a “Dear Sir or Madam,” don’t worry about adding any pleasantries here. Instead, treat this like the legal document it is and immediately specify the purpose of the letter: Dear Sir or Madam: [blank line] This letter refers to the outstanding debt associated with the account number listed above. I am unable to pay the outstanding debt balance in full due to unforeseen financial difficulties. [continues below]

Describe your hardship in clear but not overly-specific detail. It’s important to show that you’re facing a legitimate hardship here—one that prevents you from paying the debt as anticipated. Describe the situation in broad terms, however, avoiding unnecessary details that could be used in legal proceedings if your settlement attempt doesn’t succeed. For example: [continued from above] Namely, my restaurant business never recovered after the forced closure early in the Covid-19 pandemic, and I had to close for good in August 2021. This has resulted in a substantial decline in my monthly income. [blank line before next paragraph]

Setting Your Offer Terms

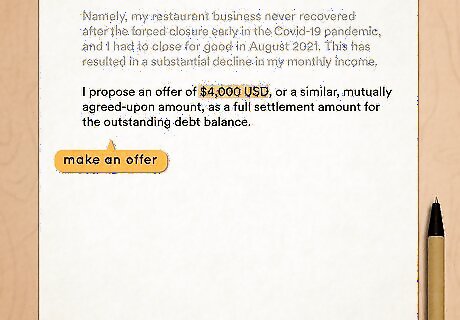

Make a specific payment offer to begin paragraph two. Assuming you’re making a lump-sum settlement offer, include the precise amount. It’s also a good idea to use the phrase “full settlement amount.” If you’re trying to reduce your current payments, be equally specific about the details. In either case, also open the door (slightly) for potential negotiations: I propose an offer of $4,000 USD, or a similar, mutually agreed-upon amount, as a full settlement amount for the outstanding debt balance. [continues below]

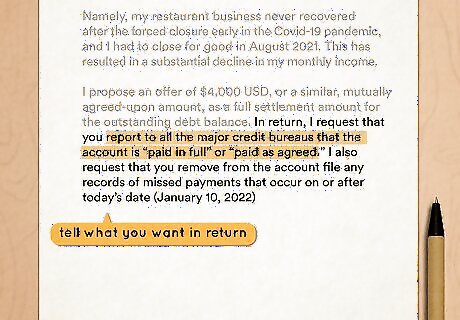

Spell out what you want the creditor to do in return. Most importantly, request that the creditor report the debt as “paid in full” or “paid as agreed” rather than “settled” (or similar) to credit bureaus—this looks much better on your credit report. You can also ask the creditor to remove records of past missed payments from your file (and therefore your credit report), but there’s not a good chance of them agreeing to this. Make sure your request is specific: [continued from above] In return, I request that you report to all the major credit bureaus that the account is “paid in full” or “paid as agreed.” I also request that you remove from the account file any records of missed payments that occur on or after today’s date (January 10, 2022).

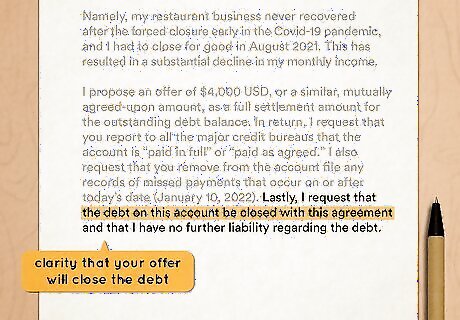

Restate for clarity that your offer will close the debt. As obvious as it is to you—and to the letter reader—that this is your goal, it’s always a good idea to be as crystal clear as possible. Therefore, use a statement like the following to close the second paragraph: [continued from above] Lastly, I request that the debt on this account be closed with this agreement and that I have no further liability regarding the debt. [blank line before next paragraph]

Finalizing the Details

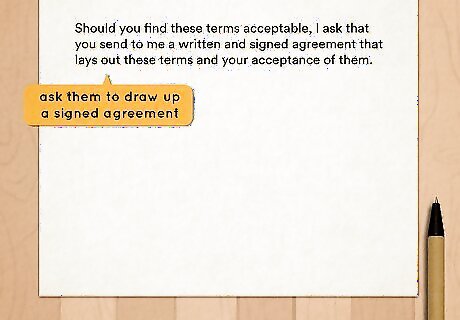

Ask them to draw up a signed agreement if they accept. Unless you want to open the door to negotiation by phone, clarify at the start of the final paragraph that you want to keep everything in writing. Put the ball in their court to draw up the official agreement based on your terms, or (as you alluded to earlier in the letter) to send a written counter-offer for negotiations: Should you find these terms acceptable, I ask that you send to me a written and signed agreement that lays out these terms and your acceptance of them. [continues below]

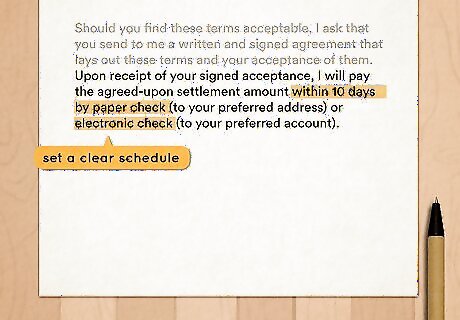

Set a clear schedule for making your payment if they accept. Continue here with the “If you do this, then I’ll do this” pattern of the letter. You’ve established the amount you’ll pay, so now is the time to be precise on the timeframe for your payment. Make the timeframe as short as is reasonably possible for you to handle: [continued from above] Upon receipt of your signed acceptance, I will pay the agreed-upon settlement amount within 10 days by paper check (to your preferred address) or electronic check (to your preferred account). [continues below]

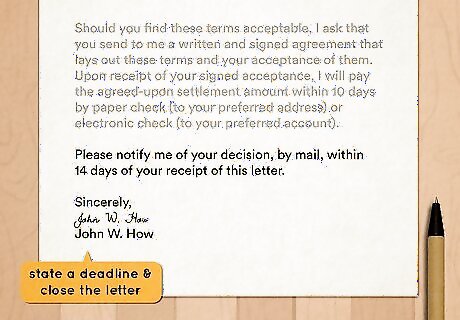

Lay out a specific deadline for them to respond to your letter. Don’t allow the situation to drag on longer than is necessary, since your debt will continue to grow and your negotiating position may worsen. Close the letter by giving them a reasonable timeframe, such as 14 days after receipt of your letter: [continued from above] Please notify me of your decision, by mail, within 14 days of your receipt of this letter. [blank line] Sincerely, [signature of John W. How] John W. How Note: Use Certified Mail so you have confirmation that the creditor received the letter on a specific date.

Anticipate a counter-offer in most cases. If the creditor agrees to your initial terms, it means that they’re either desperate to get something for the debt or that you made too generous of an initial offer. Barring that situation, expect them to send you a counter-offer. When you get it, don’t just look at the money amount—make sure the other details also meet your approval. They might accept all your terms except the lump-sum amount, for instance—they might request $6,000 USD instead of $3,000. If you agree to their terms, ask them to send a written and signed agreement based on those terms. If you disagree, send another letter (similar to your first) with your counter-offer (such as $4,500 USD). Keep going back-and-forth as needed until you reach mutually-acceptable terms. Talk to a credit counselor or an attorney if you’re having trouble deciphering the fine details of the creditor’s counter-offer.

Get everything in writing, even if you negotiate by phone. Especially if you get into a back-and-forth negotiation, it may make sense to do the negotiations by phone in order to speed things along. Even in this case, though, never rely on verbal agreements—insist that everything be put in writing and signed before sending any money. Keep all the documents on file for at least 7 years for legal and tax purposes.

Comments

0 comment