views

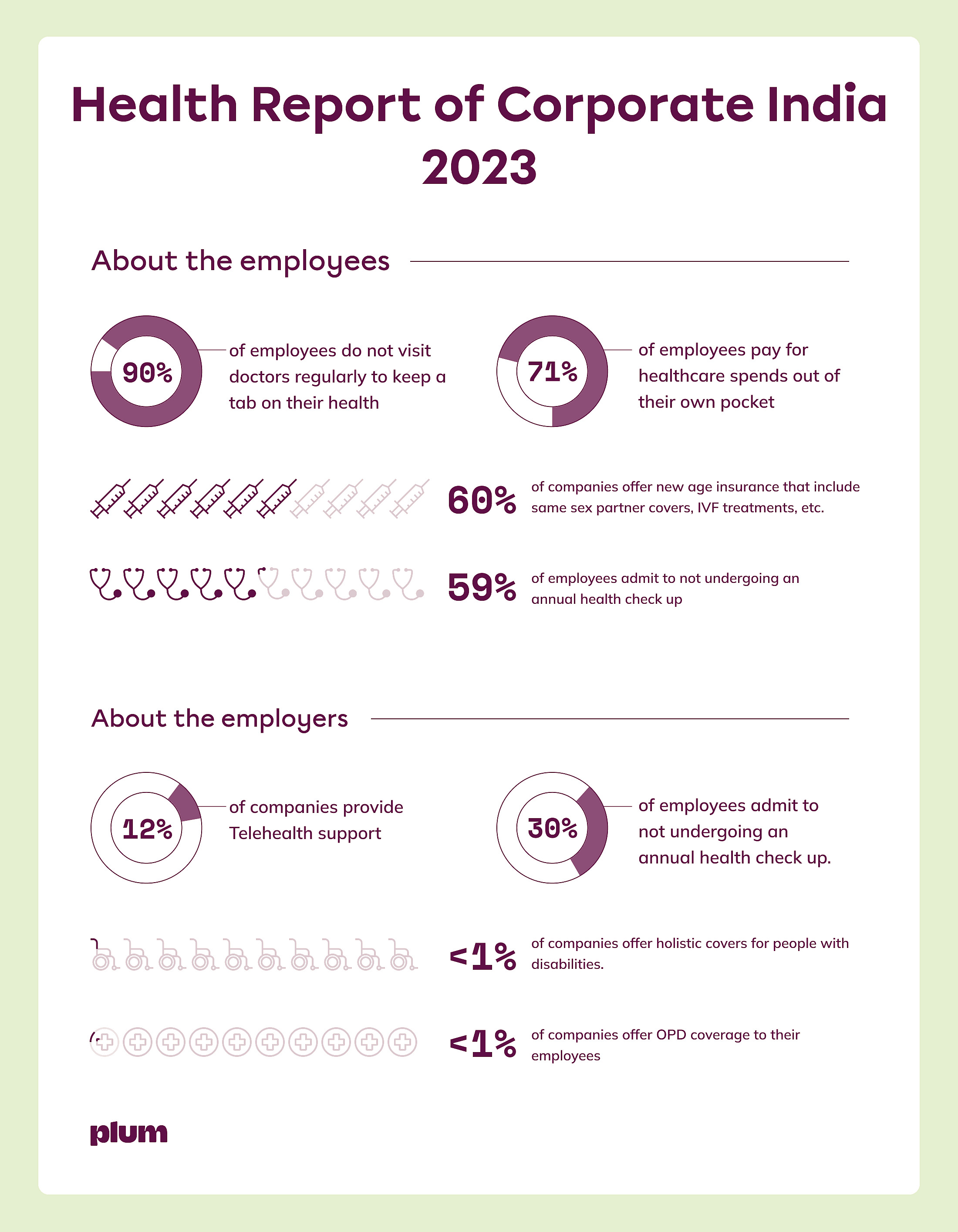

Less than 30% employees participate in company sponsored wellbeing initiatives with 71% bearing last mile healthcare expenses out of pocket (which roughly averages to 5% of the annual income). A mere 8% avail discounted medicines and less than 1% of employees avail vision check-ups, said a new report.

Plum, the insurtech company providing employee group health insurance and business insurance solutions, has launched the “Health Report of Corporate India 2023”. This study sheds light on employee health and the gap between health benefits offered by employers and availed by employees.

Plum said it surveyed more than 700 corporate employees and took its own telehealth data of over 30,000 consults over a period of six months.

Reasons for low adoption are threefold:.

The age factor: Adoption of employer-sponsored healthcare plans among youth aged 20-30 has been half as compared to employees aged 51 and above. 42% of employees (across age groups) expressed an interest in the availability of ‘flex benefits’, where they get to choose their own healthcare plans.

Chronic illness and comprehensive benefits missing from company healthcare initiatives: 85% of employees with a chronic illness do not feel supported by their employers. Less than 5% of companies offer comprehensive healthcare options to their employees that include insurance, telehealth, and other health benefits.

Not enough healthcare access for loved ones: Nearly 1/3rd (30%) of all telehealth consultations were made in non-metro cities with 55% of them made by employees and 45% of them by their dependents. The most common consultations were for General Physician (24%), Mental Health (18%), and Dermatologist (21%). Yet, only 12% of companies provide telehealth support to their employees.

Saurabh Arora, co-founder and CTO, Plum, said, “An average person spends 90,000 hours working. That’s almost a third of their life. Employee health should be a top priority for organisations, not only from a humanitarian perspective but also as a strategic investment in their workforce. Hence just health insurance is not enough – companies should adopt comprehensive healthcare benefits that accommodate insurance, primary, and preventive care.

Plum’s recommendations to companies:

In addition to providing comprehensive insurance (basic sum insured 5,00,000 including maternity and modern treatment expenses of 1,00,000) it is also important to provide last mile and personalised health benefits that include:

Jayanth Ganapathy, head of healthcare and wellness, Plum, said, “Companies that work with a long term approach to create an impact on health outcomes rather than seeing healthcare as engagement activities will tend to see much better returns on their healthcare investments.”

Comments

0 comment