views

Warehouse leasing or transactions across primary eight markets of India was recorded at ~23 mn sq ft in H1 FY 2024 (April – September 2023). 53% of these transactions occurred in Grade A spaces during the current analysis period, said a new report.

Also Read: India’s Real Estate Outlook Brightens, Home Prices To Rise In 6 Months: Report

Knight Frank India’s report titled ‘India Warehousing Market Report – H1 FY 2024’ added that while occupier sentiments continue to be strong, traction in the warehousing market has taken a pause in the first half of FY 2024 (April to September 2023).

Transactions during H1 FY 2024

The 23 mn sq ft transacted in H1 FY 2024 represents a 10% drop in transacted volume compared to half-yearly volumes in FY 2023 (10% less than half the volume transacted in FY 2023).

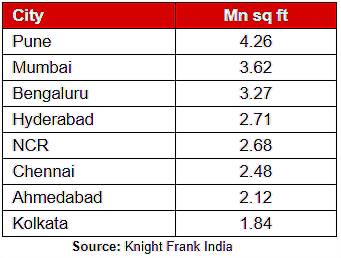

Transaction activity was well distributed across markets. Pune, the leading market, accounted for 19% of the total warehousing volume, driven primarily by the automotive industry.

Mumbai was the second most prolific market, representing 16% of the total warehousing area transacted during the period, with the 3PL (third-party logistics) sector as a significant contributor.

Warehousing Rent

Pune is the most expensive warehousing rental market in the country (amongst the reviewed eight cities) with average rents for grade A warehouses at Rs 25.9/sq ft/month. Followed by Kolkata with rental rate of Rs 23.6/sq ft/month and Mumbai at Rs 23.4/sq ft/month.

While occupier traction seems to have taken a pause in the current analysis period, rent growth across markets has been relatively healthy in H1 FY 2024 (30th September 2023) compared to levels existing at the end of FY 2023 (31st March 2023).

Pune and Chennai at 4% and Ahmedabad with a 3% growth in six months were markets with the most growth in H1 FY 2024.

Shishir Baijal, chairman & MD, Knight Frank India said, “As the 3PL sector playing a pivotal role in the market and the manufacturing sector exhibiting substantial growth over the past two years, the overall demand from occupiers has remained remarkably resilient, even considering the e-commerce sector’s cautious approach during this period. While the global economic and geopolitical landscape is expected to exert some influence on the Indian market, it is noteworthy that the nation’s relatively robust fiscal position and resilient economy are well poised to support the stability and growth potential of the warehousing market in the remainder of fiscal year 2024.”

Industry-wise transactions:

Manufacturing Sector constitutes nearly half of the transacted volumes

Continuing their strong showing in FY 2023, the volume transacted by the manufacturing sector companies exceeded that of the 3PL sector in H1 FY 2024.

Manufacturing sector companies such as those from the automotive, energy and chemicals space constituted a substantial 47% of the total transacted volume during the period.

The report added that India has benefited from the sustained move towards decentralisation of manufacturing capacity from China, with global manufacturing giants such as Apple, Samsung, Foxconn and TSMC increasing their manufacturing base in the country.

Second to the manufacturing sector, 3PL sector companies comprised 30% of the volume while the other sectors had single digit shares.

E-commerce sector volumes had languished since the beginning of 2022 as aggressive expansion during the pandemic created excess capacities that are still being utilised. With the focus increasingly shifting toward profitability, e-commerce companies have concentrated on curbing costs as well as speculative expansion.

Comments

0 comment