views

Many of us are aware about mutual funds as investors, through television commercials or from someone who has invested in them. However, some find it difficult to navigate due to different types of funds available in the market.

In simple words, in mutual fund, money is pooled in by a large number of investors. This fund is managed by a professional fund manager. The money is invested in equities, bonds, money market instruments and/or other securities.

India has seen a rise in retail mutual fund investors over the last couple of years. Many first-time investors have jumped into the sea of funds to find the right one for them. However, due to the availability of multiple options, they tend to get confused to understand the difference between mutual funds.

As per market regulator SEBI, mutual fund schemes are classified as under five broad categories, namely;

1. Equity Schemes

2. Debt Schemes

3. Hybrid Schemes

4. Solution Oriented Schemes – For Retirement and Children

5. Other Schemes – Index Funds & ETFs and Fund of Funds

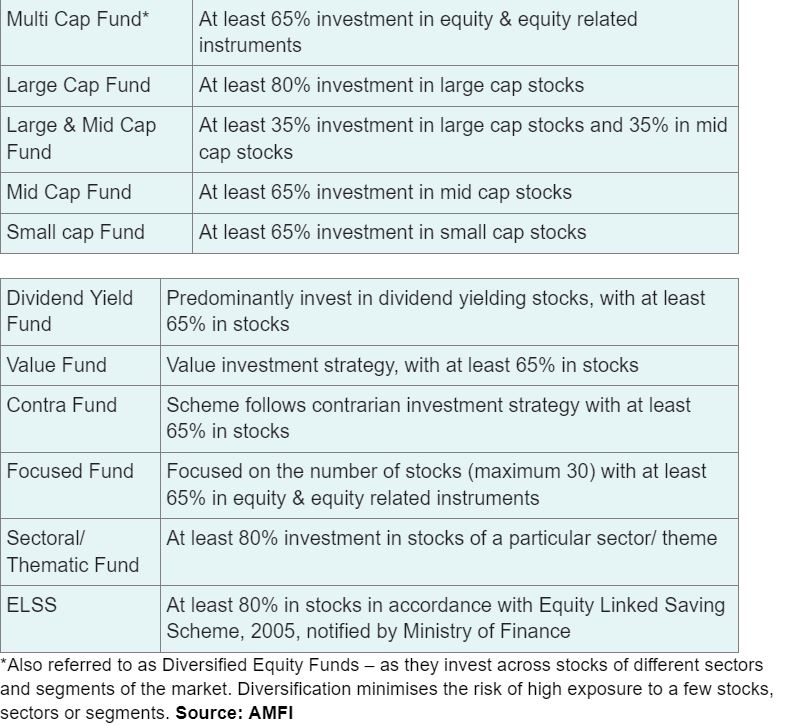

1. Equity Schemes

SEBI has defined Large, Mid and Small cap stocks under the Equity Schemes category.

The Association of Mutual Funds in India has also laid out clear definitions of each SEBI-classified scheme of mutual funds.

Also Read: SIP Or Lump sum? Factors You Should Consider Before Investing

An equity scheme primarily invests in equities and equity related instruments. It seeks long term growth but could be volatile in the short term.

This is suitable for investors with a higher risk appetite and longer investment horizon.

2. Debt Schemes

A debt fund (also known as income fund) is a fund that invests primarily in bonds or other debt securities. Debt funds invest in short and long-term securities issued by government, public financial institutions, and companies. For example, Treasury bills, Government Securities, Debentures, Commercial paper, Certificates of Deposit and others.

Debt schemes invest in various fixed income instruments such as Short-Term Plans, Long-Term Bonds, Monthly Income Plans, Fixed Maturity Plans (FMPs), Gilt Funds and Liquid Funds among others.

3. Hybrid Schemes

Hybrid Scheme funds (Balanced Funds) is a mix of bonds and stocks, thereby bridging the gap between equity funds and debt funds. SEBI has classified Hybrid funds into 7 sub-categories as follows, Conservative Hybrid Fund, Balanced Hybrid Fund, Aggressive Hybrid Fund, Dynamic Asset Allocation or Balanced Advantage Fund, Multi Asset Allocation Fund, Arbitrage Fund and Equity Savings.

These funds invest in a mix of equities and debt securities. They seek to find a ‘balance’ between growth and income by investing in both equity and debt.

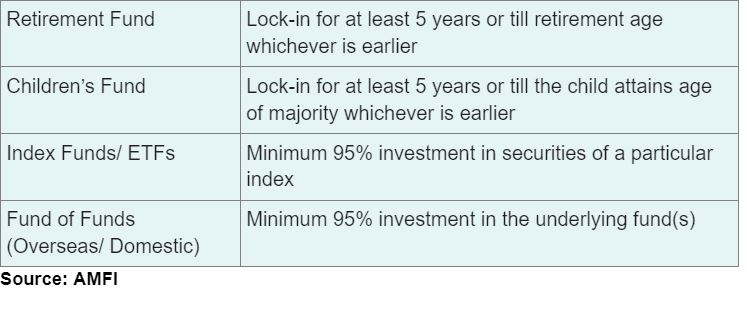

4. Solution Oriented Schemes – For Retirement and Children

5. Other Schemes – Index Funds, ETFs and Fund of Funds

a) Index Funds- This creates a portfolio that mirrors a market index.

– The securities included in the portfolio and their weights are the same as that in the index

– The fund manager does not rebalance the portfolio based on their view of the market or sector

– Index funds are passively managed, which means that the fund manager makes only minor, periodic adjustments to keep the fund in line with its index. Hence, an Index fund offers the same return and risk represented by the index it tracks.

– The fees that an index fund can charge is capped at 1.5%

b) Exchange Traded Funds (ETFs)- It is a marketable security that tracks an index, a commodity, bonds, or a basket of assets like an index fund.

- ETFs are listed on stock exchanges.

- Unlike regular mutual funds, an ETF trades like a common stock on a stock exchange. The traded price of an ETF changes throughout the day like any other stock, as it is bought and sold on the stock exchange.

- ETF Units are compulsorily held in Demat mode

- ETFs are passively managed, which means that the fund manager makes only minor, periodic adjustments to keep the fund in line with its index

- Because an ETF tracks an index without trying to outperform it, it incurs lower administrative costs than actively managed portfolios.

- Rather than investing in an ‘active’ fund managed by a fund manager, when one buys units of an ETF one is harnessing the power of the market itself.

c) Fund of Funds (FoF)- Mutual fund schemes that invest in the units of other schemes of the same mutual fund or other mutual funds.

- The schemes selected for investment will be based on the investment objective of the FoF

- The FoF has two levels of expenses: that of the scheme whose units the FoF invests in and the expense of the FoF itself.

Investors must note that there are sub-categorisation of the above mentioned funds based on the utility and the investment demand. Importantly, mutual fund schemes are not guaranteed or assured return products and past performance does not guarantee future performance of any mutual fund scheme.

As AMFI has stated that a mutual fund scheme is Not a Deposit product and is not an obligation of, or guaranteed, or insured by the mutual fund or its Asset Management Company. Therefore, investors are advised to read all related documents carefully before investing.

Read all the Latest Business News here

Comments

0 comment