views

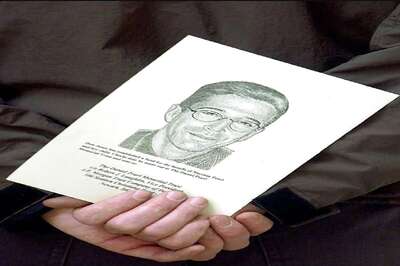

Uday Kotak, a renowned name in Indian banking, recently talked about the current state of Indian markets, dismissing concerns about them being in a bubble zone despite apprehensions over soaring valuations. Speaking at a conference organised by the Securities and Exchange Board of India (SEBI), Uday Kotak, who is the founder and non-executive director of Kotak Mahindra Bank, offered reassurances that while there may be some initial excitement regarding the market, it remains within manageable limits.

His remarks come after SEBI Chairperson Madhabi Puri Buch’s recent statement, where she highlighted a boom in small-cap and mid-cap stocks, hinting at the need for regulatory intervention to prevent the formation of bubbles that could potentially harm investors.

Addressing Buch’s concerns, Kotak spoke about the importance of monitoring market dynamics closely. He asserted that current safeguards and regulatory mechanisms are robust enough to prevent the market from entering a severe bubble zone. Kotak acknowledged the possibility of an ‘initial surge’ in the market. He even suggested that it might appear a bit shallow but he maintained that the situation is under control.

Uday Kotak also spoke about the need for effective management and monitoring to ensure sustained capital formation in the future. He supported greater clarity in taxation policies regarding equities and bonds to aid investors in making informed decisions and to promote the right asset allocation based on individual preferences.

Furthermore, Kotak proposed making the Indian rupee the preferred currency for global trade over the US dollar, suggesting a strategic 10-year plan to achieve this objective.

Kotak’s remarks offer a measured perspective on the current state of Indian markets, downplaying concerns of an imminent bubble while advocating for prudent regulatory oversight and strategic planning to sustain capital formation and promote economic growth.

Comments

0 comment