views

Adding Your Teen as a User

Choose a card with a low credit limit. If your teen loses control and racks up huge bills, you are on the hook for them. Your credit score may also take a hit. Accordingly, you may want to add your teen to a credit card that has a low limit. If none of your cards have low limits, ask your bank if you can get a card with one. For example, you might have a credit limit of $30,000 on one card. Your bank might be willing to split this up into two cards—one with a $25,000 limit and a second with a $5,000 limit. You’ll add your teen to the card with the lower limit.

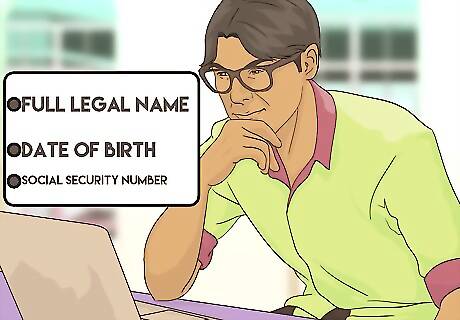

Gather required information about your teen. You’ll need to give your bank your teen’s personal information so that they can be added as a user. Gather the following: full legal name date of birth Social Security Number

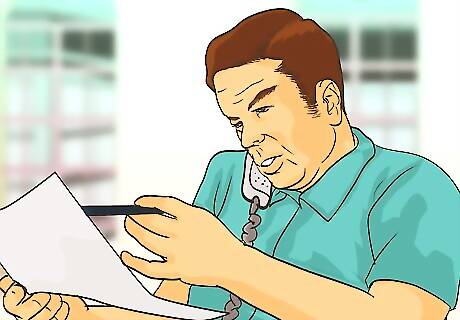

Contact your bank. Often, you can add a user over the phone by calling your bank. You might also be able to add them online if you use online banking. The exact process will differ, depending on your bank. With a Chase credit card, for example, you can log onto your online account. Then go to the “Access Manager” overview page and select “Add New User.”

Limit your teen’s transactions. On the Chase credit card, you can choose to limit the transactions that they can make. You can also identify what transaction types they can make and set transaction limits. Check to see if your credit card has a similar option. You might also consider getting alerts for any large purchases. For example, you could be alerted for any purchase over $100.

Setting Ground Rules

Teach your child about budgeting. Before you even give your teen a card, you should teach them about the value of budgeting their money. You don’t want your teen to view the credit card as a source of easy cash to blow on luxuries. One good technique is to give your children three envelopes. Label them “Save,” “Spend,” and “Share.” If they get an allowance or work a job, they can divide their money and store it in each envelope. If your teen is older (or has more money), you can open a savings account with them. This is a good way to emphasize the importance of saving.

Give your child a list of approved purchases. You might need to specify what things your teen can use the credit card for. A cab ride home if their car breaks down? Sure. But what if they decide to go to a movie at the last minute when all of their cash is home? You should tell your child what they can buy and can’t buy with the card. Write out a list, if necessary, and email it to them so they can consult the list on their smart phone. You might want to give your teen more flexibility. However, you should discuss generally when it is appropriate to use credit and when they should use their cash.

Discuss repayment. If you want your teen you reimburse you for any purchase they make, then you should talk about this upfront. Tell them when you will need to be paid and how they can pay you (e.g., in cash). To help instill financial discipline, you can require payment in full on the day your credit card statement arrives at your house.

Teach your teen how to protect their financial identity. Another problem you have to worry about is identity theft. If someone steals your child’s credit card, they can use it to make purchases. Teach your teen the basics of protecting their credit cards: Don’t leave the card lying around. Don’t lend the card or your credit card numbers to someone else. Avoid giving the number to someone over the phone unless you called them. Watch the card during any transaction. Ideally, you should take it back as soon as the cashier swipes it. Don’t sign a receipt that has a blank line on it. Save your receipts.

Review your bill. All authorized users get their own credit card. However, the bill still comes to you as the primary cardholder. Make sure to review your bill to confirm that your teen has used the card according to your rules. Make a note of any purchase that looks suspicious. You should ask your teen what the purchase was and why they made it.

Discipline appropriately. If your child overspends, you should respond in an appropriate manner—preferably one that instills important financial lessons to your child. Don’t simply ground your child. Instead, consider the following: Have them get a part-time job or do chores around the house and contribute to paying off their debt. Ask them to return the item to the store for a refund.

Remove your teen from the card, if necessary. Should your teen run into trouble using the card, you should seriously consider removing them and pursuing other options. Generally, removing an authorized user is easy. Call your bank up and ask that your teen be removed. Some banks might require that you complete a form or submit a request in writing. Check with your bank.

Considering Other Options

Use a prepaid debit card. Instead of giving your child a credit card, give them a prepaid debit card. You can either load money onto the card or have your teen spend their own money loading it. Once the money runs out, the card is declined. Remember not to opt into overdraft protection with your debit card. If you do, then you’ll end up paying overdraft fees if your child overspends. Of course, without overdraft protection the card will be declined if overdrawn. You might be worried that the card won’t work in an emergency—especially if your child blows all of the balance on luxuries. It’s probably best to start out with a debit card while your teen still lives with you. That way, they can call you in case of emergencies. If your teen is going off to college, then you might want to stick with a credit card.

Get a secured credit card. This is like a debit card. In exchange for a deposit, the bank extends a line of credit. Generally, secured credit cards come with low limits, around $300-500. This might be a perfect choice for a teen. You might be able to get a secured card with a bank you already have a regular credit card with. Call customer service and explain your situation. Discuss whether you can get a secured credit card and add your teen as an authorized user.

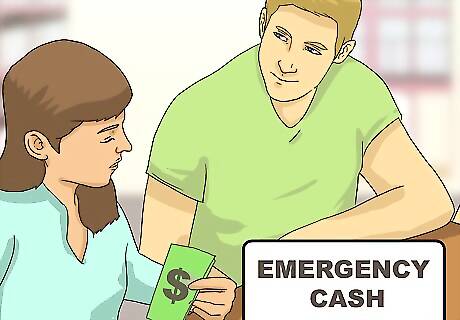

Give your teen emergency cash. Cash works in just as many emergencies as a credit card. If you’re worried your child will suddenly need money, you can have them carry a money clip with extra cash. Of course, cash is also very easy to spend, and you’ll have no record of what the money was spent on.

Comments

0 comment