views

Checking Someone’s Background as a Private Citizen

Start with an online search. Many sites provide background searches either cheaply or for free. Keep in mind, though, that internet searches might return inaccurate or outright false information. Make sure to verify all the information you find. When using a search engine, put quotation marks around the name of the person you’re researching. This ensures that the engine looks for the entire name instead of breaking it up. You want "John Smith," not "John Brown" and "Jim Smith." Include extra identifying information to make sure you find the right person: "Bill Gates" Microsoft.

Search the public records. Information about arrests, convictions, and incarcerations is part of the public record. You can often access relevant documents through governmental websites for courts and police departments. Note that while many counties provide online databases, some still store public records in hard copy. If you can't find records online, contact the county courthouse to find out how to get access the public archives. You may have to pay a small fee to make photocopies of the documents you want to take with you. Remember to search documents in all states where your subject has lived, and to search county and city websites as well.

Be willing to put in the work. If you rely on public records for your research, you'll have to invest a great deal of time to get a complete background picture. Even checking the courts in every county where the subject has ever lived isn't enough! You also have to look at every county where he's potentially had a run-in with the law — even if he's never lived there! This can be time consuming and difficult.

Ask for information directly from the person. Many records (credit reports, school records, military records, etc. ) are off limits without the subject's permission. To get such information, you might try asking the person you're researching to provide it. While nobody has to give you access to their records, you can take a refusal into consideration when making decisions. For example, if you're considering a potential new roommate, you want to make sure they pay bills on time. Ask for a copy of his or her credit report before making your decision. If the person doesn't provide the information you need, you can choose not to move forward with the arrangement.

Hire a professional. Private citizens can hire any legal service to run a background check. Search the internet for “background check service” to find local companies in your area. Research the company well before contracting its services to make sure it's a reliable, reputable firm — not a scam. Read online reviews to see whether customers are generally satisfied with their results. Private companies and citizens can't access all the records law enforcement agencies can. As such, the information gathered by private agencies may not be as reliable. Beware of scam artists! Don't do business with companies that charge too much below or above the industry standard. Compare prices with other companies in the area who provide similar services.

Checking Someone’s Background as an Employer

Consider screening potential employees. Many government positions or other jobs with a security clearance require background checks. Private sector employers don't have to run a background check on potential hires, but it's a good idea to cover your bases. No matter how honest someone seems in an interview, your new employee's actions may hurt someone. If you didn't perform a background check on that employee, your company might be liable for negligent hiring. A background check can help insulate your company from such risk. Most states demand criminal background checks on people who work with children, the elderly or people with disabilities.

Follow the laws regulating background checks. You can ask potential employees about their backgrounds, but it's illegal to target members of protected classes. You cannot conduct a background search based on someone's race, sex, nationality, age, disability, or religion. For example, running background checks only on Muslim or African American applicants would violate equal opportunity laws. So, too, would "people under 30" or "men." You might run background checks on everyone who applies to work for you. But, taking action on that information only for members of protected classes is illegal.

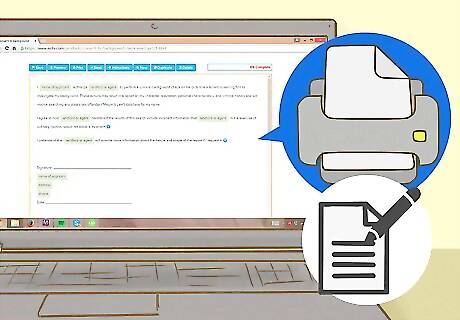

Have employees sign a consent form. Employers must ask current or potential employees for permission to conduct background checks. Even in industries with mandatory checks, new employees must sign a consent form. This will not only give you permission to proceed, it will also protect you from claims of invasion of privacy.

Understand what an official Consumer Reporting Agency (CRA) is. If you are an employer using an outside agency to conduct a background check, federal law requires you to use a registered CRA. Under the Fair Credit Reporting Act, a CRA must follow strict standards for data protection and offer dispute resolution. There are many different types of CRAs to fit your needs. For example, a CRA might focus on credit, insurance, employment, or rental history. Research CRAs carefully before contracting services. Because there is such a wide variety, you need to ask about specific services to make sure they fit your needs.

Consider hiring an Employment Screening Company. This is a popular category of CRA that provides a special credit report called an “Employment Report.” The document lists everything on a person's actual credit report aside from their credit score. This includes payment history, prior addresses, and prior employers. Normal credit reports affect the subject's credit score. A request for an “Employment Report,” though, has no effect on it. Most CRAs don't list credit scores because asking (without reason) is illegal in some states. A good reason to request an employee's credit score might be if the person would be handling your money.

Go in depth with an "Investigative Consumer Report." This type of report includes interviews with an employee’s neighbors, co-workers, and friends. This can give you a picture of the subject’s reputation in the community and personal characteristics. Only some CRAs provide this service, so ask about it specifically.

Work within legal time restrictions. Under federal law, CRAs generally won't reveal civil lawsuits or judgments, arrest accounts out for collection, or paid tax liens over 7 years old. You likely won't learn about bankruptcies that occurred over 10 years ago, either. But you can request that history beyond 7 years be included in your report if your state allows it. A few states have stricter regulations that protect even criminal records older than 7 years. Even though arrest records are public records, some states don't allow them to be used in hiring decisions.

Use public records legally. There are some public records you can't take into consideration in the hiring process. For example, Workers' Compensation claims often become public records. Using these records in a hiring decision could be illegal under the Americans with Disabilities Act (ADA). You also can't consider prior bankruptcy in most decisions unless it's relevant to the position. Official criminal records ("Rap Sheets") aren't always public records. Some states allow access only for special cases, like law enforcement and childcare facilities. This doesn't mean private investigation companies can't compile their own lists. They can still search for individual convictions and arrests in the public records.

Contact past employers. Legally, they're allowed to say anything truthful about your potential new hire’s past performance. But, to avoid lawsuits, most companies won't do much more than say that your potential new hire worked there. If you get honest, detailed feedback, use it to evaluate your potential hire, but don't go into the hiring process relying on thorough feedback.

Search online profiles. Personal blogs, Facebook and Twitter accounts, and much, much more are all waiting for you to find them. A person's online presence can speak volumes about their personal and professional life. If potential hires keep their information private, ask for permission to access the information.

Speak to your new hire directly. There are many pieces of information that reporting agencies are not allowed to provide. But, there's often nothing stopping you from directly asking your potential new hire for answers. For instance, "Have you EVER been arrested?" is an acceptable question even though CRAs can only report on the past seven years of criminal history. Be aware that asking these questions early in the application process might expose you to liability. You can't exclude every applicant who answers “yes.” Allow them to provide an explanation, and take it into consideration before making your decision.

Checking Someone’s Background as a Landlord

Gather the facts. The most important information for a landlord is a potential renter's credit history. To check that, you need the prospective tenant's name, address, date of birth, and SSN (or another tax I.D. number). At the same time, gather general information like current employment and wages, cars, work hours, past landlords or employment, etc. You might also ask about any arrests, convictions, or incarcerations. If you run background checks on potential tenants, you should run them on ALL potential tenants. Cherry-picking the people you want to research opens you up to discrimination lawsuits.

Have the potential tenant sign a consent form. Under the Fair Credit Reporting Act, you cannot run a credit check on someone without their written permission. Print and present this release separately from other application documents. Make sure applicants are fully aware they are signing a consent form, not just another application form.

Collect a fee. Credit checks cost money. Most states let you collect a reasonable fee to cover the cost of running a check. (Some require you pay it as part of your operating costs.) If the applicant pays for the credit check, make sure they understand what you'll be doing with that money. Also make clear that it's not a refundable deposit. You may want to give applicants a discount on the fee so you don’t scare them away from even applying to rent with you.

Get approved to run checks. Not just anyone can run credit checks. You will likely have to get approved by the credit bureau or Credit Reporting Agency (CRA) as a landlord. Provide them with proof of your identity and that you own a rental unit. The CRA may even send an inspector to your property for a site inspection.

Request a check. You can get a credit check directly from one of the three major credit bureaus (Equifax, Transunion, or Experian). You can also contract with a third-party CRA. CRAs often give you the option to add a “Criminal Background Check” and an “Eviction Report” to the “Credit Report” for a fee. But in most cases, you won't need anything beyond a credit check.

Analyze the Credit Report. It will show late payments on car loans, educational loans, credit cards, medical bills, and many other debts. As a landlord, you're looking for a debt load too high to manage with the applicant’s income. Remember that a credit report will only have information from the past seven years (or, ten years for some things). Some reports will also contain a "FICO" Score ranging from 300 to 900. The higher the score, the better. Anything above the mid-600s is usually thought to be low-risk. If you reject an applicant due to information on the Credit Report, you should give an “Adverse Action” notice. This letter should provide contact information for the agency you used to get that report. The tenant can choose to dispute the information the agency provided. Applicants can receive a free copy of the Credit Report from that agency so long as they dispute the information within 60 days.

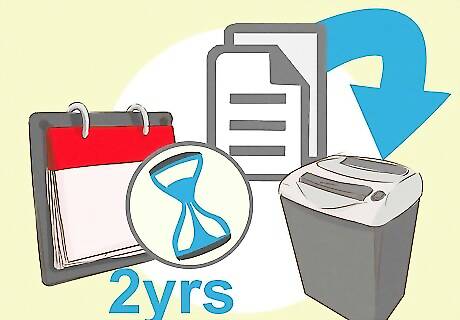

Dispose of the report. You are not legally allowed to keep a copy of an applicant’s Credit Report after you have no more legitimate use for it. However, you should keep them for at least 2 years because applicants can file a fair housing claim against you within 2 years of claimed discrimination. Note that some states allow a fair housing claim to be filed past the two years, in which case you should keep the reports longer.

Comments

0 comment