views

Locating Your Account Number

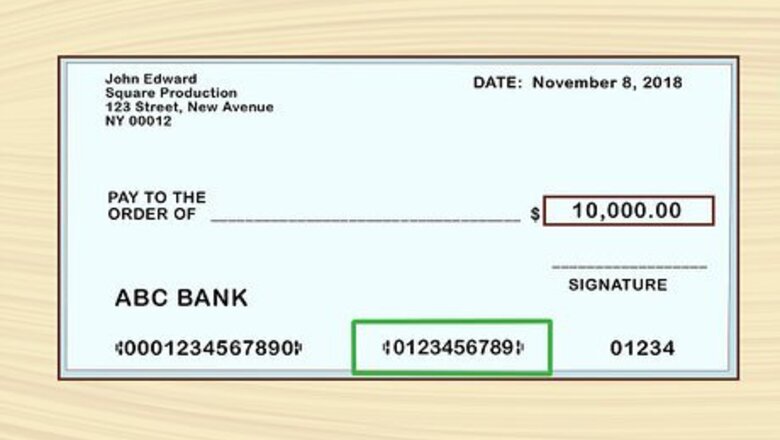

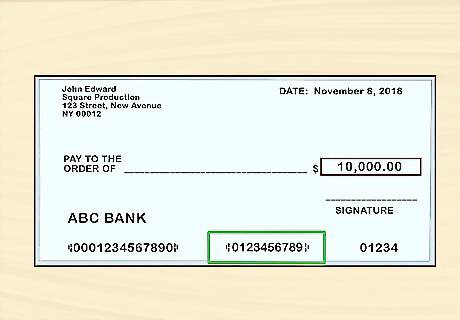

Find the 2nd series of numbers on the bottom of a check if you have one. The first series of numbers printed on the left-hand side of the bottom of a check is the bank’s 9-digit routing number. The second series of numbers, usually 10-12 digits, is your account number. The third and shortest series of numbers printed at the bottom is the check number. The number will be bracketed by a pair of identical symbols. For instance, the number may look like this: “⑆0123456789⑆”

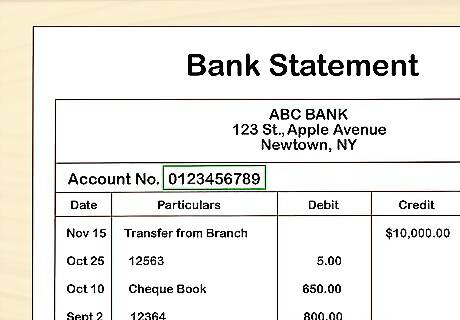

View a digital or paper bank statement if they’re easily accessible. Your account number will be printed on each bank statement you receive, whether it arrived in your inbox online or in your mailbox as a paper statement. Find a recent bank statement and look for a 10-12 digit number labeled “Account Number.” It’s usually located at the top of the document on either the right- or left-hand side.

Use a mobile banking website or app to find the number online. Navigate to your bank’s website on a computer or open up their mobile app on your phone or tablet. Sign in and click on the tab to view a summary of your account. Usually, the account number will be listed on this page. If it’s not, search through the website or use the “Help” function to find it.

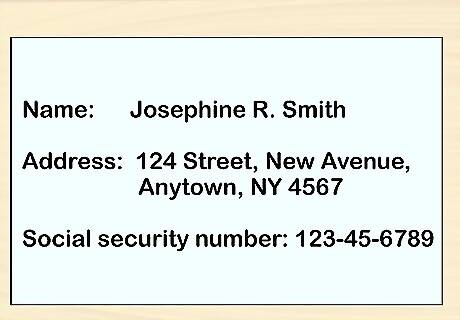

Contact your bank if all else fails. Call the number on the back of your credit or debit card or look up their customer service number online. You’ll likely have to provide your name, address, and social security number so they can verify your identity. Then, they’ll tell you your account number. If you write the number down, be sure to store it in a safe place, like your wallet or a filing cabinet.

Keeping Your Account Number Safe

Use a secure Internet connection to access your accounts online. Though you may be tempted to check your bank account in a coffee shop, store, or train station, you really shouldn’t. Using an unsecure wireless connection can put you at risk for identity theft. Only access your accounts online or through a mobile app when you have access to a secure Internet connection.

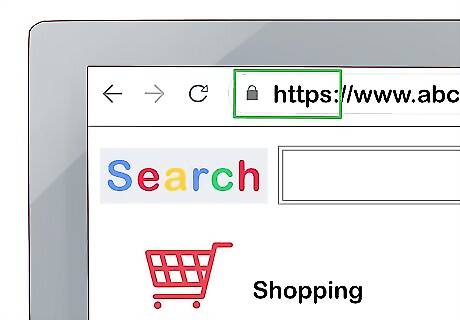

Provide your account number only on secure websites. If you need to provide your account number online to pay bills or transfer funds, make sure the website is secure. The website address should begin with “https” as the “s” stands for “secure.” You should also look for an icon of a lock and/or the word “Secure” in the top left corner of the address bar before providing your account number. If none of these things are present, don’t enter your account number as your information may not be kept confidential. You should not need to provide your account number for online shopping, so be wary of sites that ask you to.

Keep track of your checks and bank statements. Don’t leave your checkbook or bank statements lying around your home or car. Instead, open and view the statements when they arrive, then store them and any other papers with your account information on them in a safe place, such as a filing cabinet. Also, keep your checkbook in a secure location. Don’t forget to shred, rather than simply recycle or toss out, old checks and bank statements to keep others from learning your account information.

Monitor your account regularly for fraud. It’s important to look through the bank statements for your checking and savings accounts on a regular basis. Make sure you’ve been charged appropriately for all purchases. If you see any charges that you haven’t authorized, contact your bank immediately for more information.

Comments

0 comment